Answered step by step

Verified Expert Solution

Question

1 Approved Answer

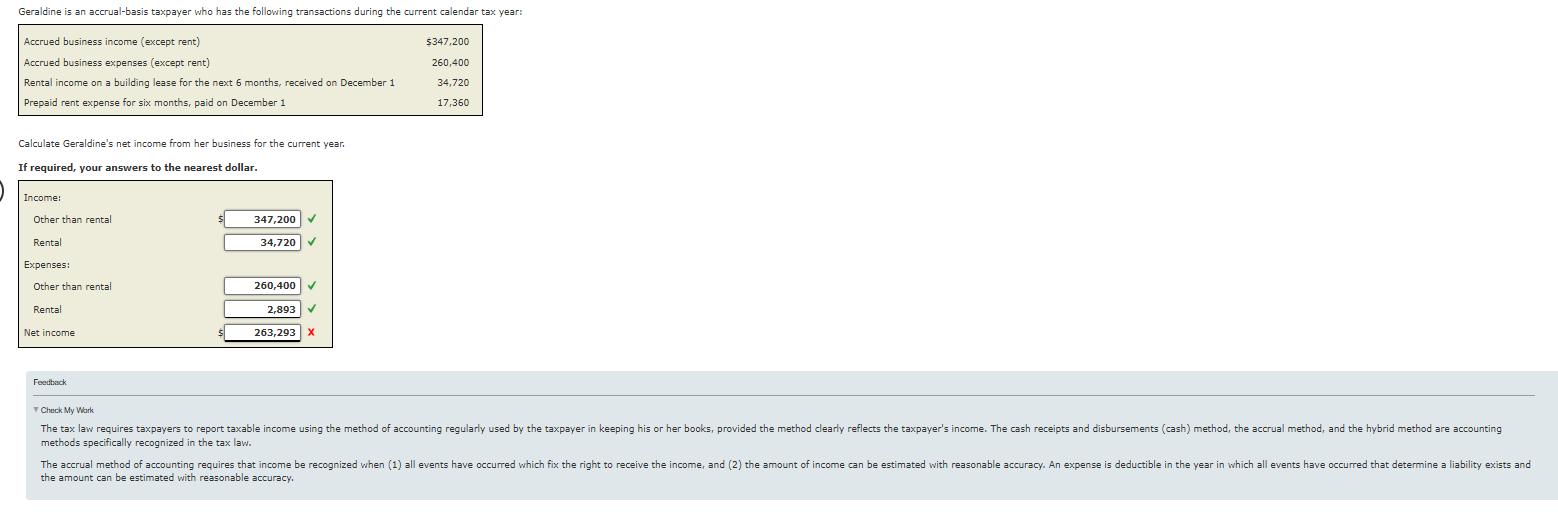

Geraldine is an accrual-basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) $347,200 Accrued business

Geraldine is an accrual-basis taxpayer who has the following transactions during the current calendar tax year: Accrued business income (except rent) $347,200 Accrued business expenses (except rent) 260,400 Rental income on a building lease for the next 6 months, received on December 1 Prepaid rent expense for six months, paid on December 1 34,720 17,360 Calculate Geraldine's net income from her business for the current year. If required, your answers to the nearest dollar. Income: Other than rental Rental 347,200 34,720 Expenses: Other than rental 260,400 Rental 2,893 Net income Feedback 263,293 X Check My Work The tax law requires taxpayers to report taxable income using the method of accounting regularly used by the taxpayer in keeping his or her books, provided the method clearly reflects the taxpayer's income. The cash receipts and disbursements (cash) method, the accrual method, and the hybrid method are accounting methods specifically recognized in the tax law. The accrual method of accounting requires that income be recognized when (1) all events have occurred which fix the right to receive the income, and (2) the amount of income can be estimated with reasonable accuracy. An expense is deductible in the year in which all events have occurred that determine a liability exists and the amount can be estimated with reasonable accuracy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started