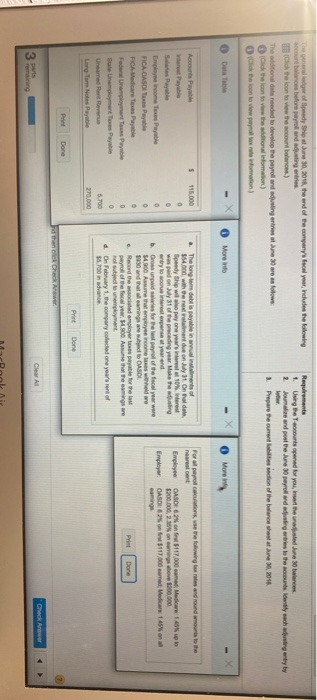

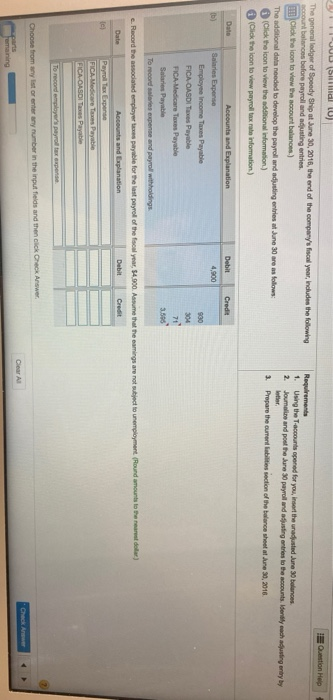

gerger of Speedy plane 30, 2016, the end of the company's fool year, indude the folowing Dances before payroll and adjusting entries Click the loon to view the account balances) The n al dalaneeded to develop the payroll and adjusting entries a n resolow to the icon to view the additional formation) Requirements 1. Using the accounts opened for you are used June 30 balances Journalize and post the June 30 payroll and adjusting entries to the courts. Identity each adjusting entry by Prepare the current section of the whole ne 30, 2016 O More info More info For all payrollc wing ons were Accounts Payable s and round amount to the Employee up to GASDE 62 on first $117.000 and Medicare $200.000,25% on rings above $200,000 CASO 6 5 117,000 and Medicare 145 Employer Employee s Payable CACADI Payetle Fica Medicare Payable Federal Uniarts Payable Senemployment Payable Uhamed Rond Revenue a. The long term dels poble ina intments of $54.000, with the mo m ent due on My 31. On that date Speedy She will pay one years were wonderest was paid on My Store preceding year Make the jung entry to counterlopers year and b. Gospad for Plastproffocal year were 54,900 Asume that employee comes where and that all caring an OASDI. Record the w ilderner les payable for the last payroll of the fiscal year. $900. Assume that the wings are no subject to unemployment d. On February 1, the company collected one year's renter $5.700 in advance Print Done Print Done the CNC Check Arewer MacBook Air Question Help P UD ( dal 1 ) The general ledger of Speedy Ship at June 30, 2016, the end of the company's fiscal year, Indludes the following con balance before payroll and adjusting entines Click the icon to view the account balances The additional dels needed to develop the payroll and adjusting entries at June 30 are as follows: Click the icon to view the additional information) Click the loon to view payroll tax rate information) Requirements 1. Using the accounts opened for you, Insert the rated June 30 belances Joumaline and post the payroll and adjusting entries to the accounts rely each adjusting entry by 3. Prepare the current abilities section of the balance sheet at ne 30, 2016 Debit Credit Accounts and Explanation Sales Expense Employee income Taxes Payable FICA OASDI vs Payable FICA-Medicare Tes Payable Salais Payable To record stories expense and payroll withholdings c. Record the associated employer axes payable for the last payrol of the focal year. $4.000. A m that the rigs are not subject to unemployment (Round amount to b e Choose from any store any number in the input fields and then click Check Answer Check Answer maning