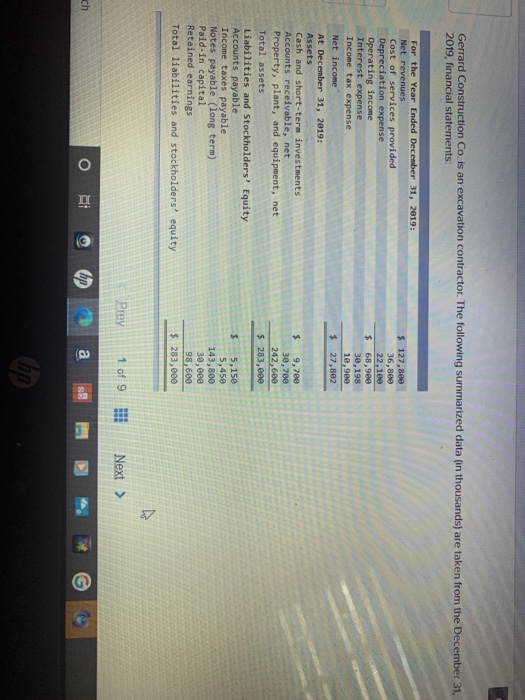

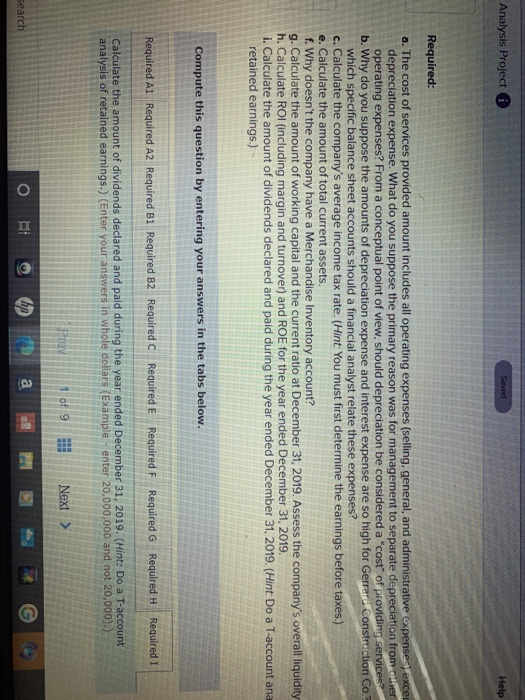

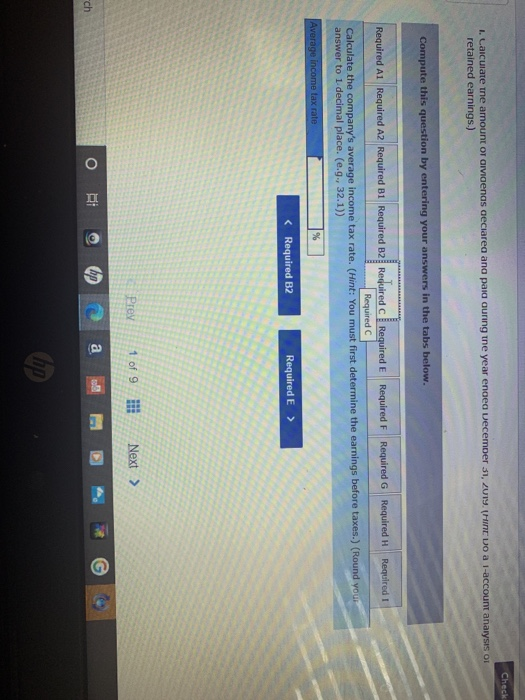

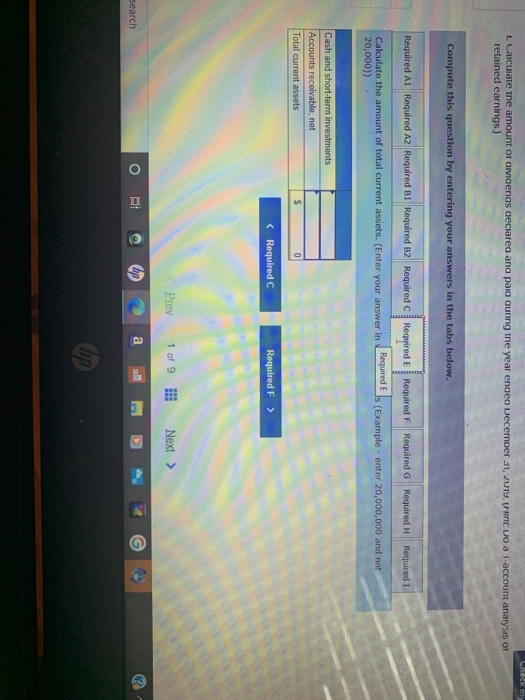

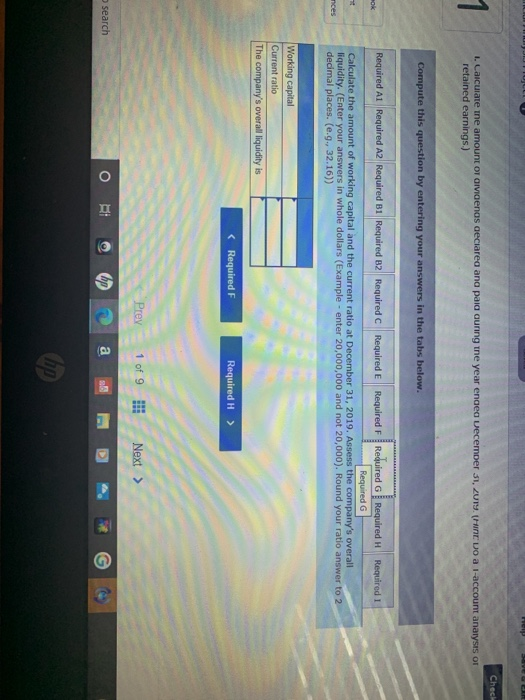

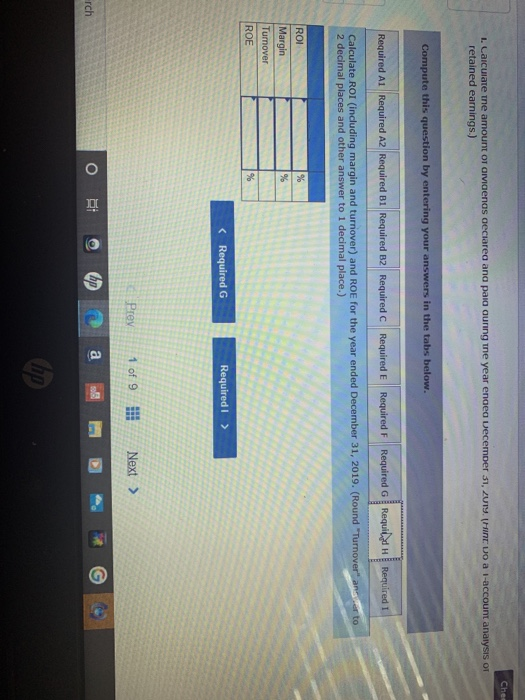

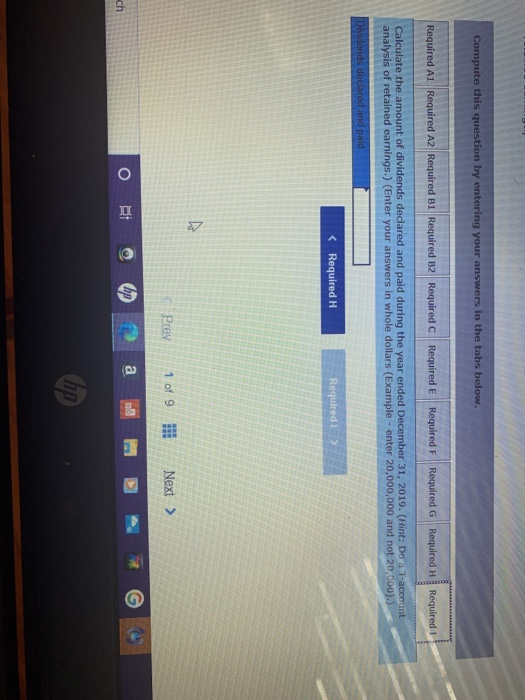

Gerrard Construction Co. is an excavation contractor. The following summarized data (in thousands) are taken from the December 31, 2019, financial statements: $ 127,800 36,800 22,100 $ 68,900 30, 198 10,980 $ 27,892 For the Year Ended December 31, 2019: Net revenues Cost of services provided Depreciation expense Operating income Interest expense Income tax expense Net income At December 31, 2019: Assets Cash and short-term investments Accounts receivable, net Property, plant, and equipment, net Total assets Liabilities and Stockholders' Equity Accounts payable Income taxes payable Notes payable (long term) Paid-in capital Retained earnings Total liabilities and stockholders' equity $ 9,700 30,700 242,600 $ 283,000 $ 5,150 5,45 143,800 30,000 98,600 $ 283,000 Prey 1 of 9 Next > ch 0 C Analysis Project Samed Help Required: a. The cost of services provided amount includes all operating expenses (selling, general, and administrative expenses excer depreciation expense. What do you suppose the primary reason was for management to separate depreciation from her operating expenses? From a conceptual point of view, should depreciation be considered a "cost" of providing services? b. Why do you suppose the amounts of depreciation expense and interest expense are so high for Gerrard Construction Co. which specific balance sheet accounts should a financial analyst relate these expenses? c. Calculate the company's average income tax rate. (Hint: You must first determine the earnings before taxes.) e. Calculate the amount of total current assets. f. Why doesn't the company have a Merchandise Inventory account? g. Calculate the amount of working capital and the current ratio at December 31, 2019. Assess the company's overall liquidity h. Calculate ROI (including margin and turnover) and ROE for the year ended December 31, 2019. i. Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (Hint: Do a T-account ana retained earnings.) Compute this question by entering your answers in the tabs below. Required Al Required A2 Required B1 Required B2 Required C Required E Required F Required G Required H Required I Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (Hint: Do a T-account analysis of retained earnings.) (Enter your answers in whole dollars (Example-enter 20,000,000 and not 20,000)) Pour 1 of 9 Next > Search O RI a Check I. Calculate the amount of dividenas declarea and paid during the year ended December 31, 2014. (HINDO a 1-account analysis On retained earnings.) Compute this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Required C. Required E Required F Required G Required H Required Required Calculate the company's average income tax rate. (Hint: You must first determine the earnings before taxes.) (Round your answer to 1 decimal place. (e.g., 32.1)) Average income tax rate % Prey 1 of 9 Next > o ch ir G hip 9 a CHECK m. 1. Calculate the amount or vienas deciarea ana pala auring the year endea December 31, 2019. Uoa -account analysis or retained earnings.) Compute this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Required Required E Required F Required G Required H Required I Calculate the amount of total current assets. (Enter your answer in Required E Js (Example - enter 20,000,000 and not 20,000)) Cash and short-term investments Accounts receivable, net Total current assets $ Prey 1 of 9 Next > search a B G Check 1 I. Calculate ine amount of dividenas declared and paia auring the year endea vecember 31, ZUTY (HINDO a I-account analysis or retained earnings.) Compute this question by entering your answers in the tabs below. ok Required A1 Required A2 Required B1 Required B2 Required C Required e Required f Required G Required H Required 1 Required G Calculate the amount of working capital and the current ratio at December 31, 2019. Assess the company's overall liquidity. (Enter your answers in whole dollars (Example - enter 20,000,000 and not 20,000). Round your ratio answer to 2 decimal places. (e.g., 32.16)) nces Working capital Current ratio The company's overall liquidity is Prey 1 of 9 Next > search a G Ches 1. Calculate the amount of Cividenas declared and paid during the year ended December 31, ZUTY. HE Doa I-account analysis OT retained earnings.) Compute this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Required C Required E Required F Required Requid Required 1 Calculate ROI (including margin and turnover) and ROE for the year ended December 31, 2019. (Round "Turnover" ansato 2 decimal places and other answer to 1 decimal place.) % % ROI Margin Turnover ROE % Prey 1 of 9 Next > O DI Erch 0 op G a Compute this question by entering your answers in the tabs below. Required A1 Required A2 Required B1 Required B2 Required C Required E Required F Required G Required H Required 1 Calculate the amount of dividends declared and paid during the year ended December 31, 2019. (Hint: Do a T-account analysis of retained earnings.) (Enter your answers in whole dollars (Example - enter 20,000,000 and not 20,000).) Dividends declared and paid ch O PRI hip a