Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gerry is a resident of Quebec and has been with the same employer, XYZ company for the last 3 years. Facts: Gerry's gross salary in

Gerry is a resident of Quebec and has been with the same employer, XYZ company for the last 3 years.

Facts:

Gerry's gross salary in 2022: $96,000

ignore non-refundable tax credits for this problem

Using Table A, 2022 tax rates, calculate Gerry's taxes payable

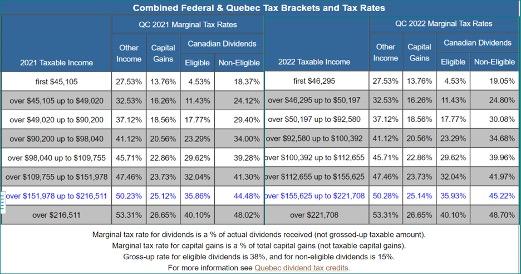

Table A:

Gerry's Taxes Payable

Calculate Gerry's average tax rate and marginal tax rate:

| Tax calculation |

Average tax rate |

|

Marginal tax rate |

|

Combined Federal & Quebec Tax Brackets and Tax Rates QC 2021 Marginal Tax Rates Canadian Dividends Other Capital Income Gains Eligible Non-Eligible 2021 Taxable income first $45, 105 27.53% 13.76% 4.53% 15.26% 11.43% over $45,105 up to $49,020 over $49,020 up to 800,200 over $90,200 up to 598,040 over $98,040 up to $109,755 32.53 % 37.12% 18.50% 17.77% 41.12% 20.56% 23.29% 45.71% 22.86 % 29.62% 32.04% over $109,755 up to 5151.978 47.46% 23.73 % over $151.978 up to $216,511 50.23% 25.12% 35.86% over $216,511 53.31% 26.65% 40.10% QC 2022 Marginal Tax Rates Other Capital Income Gains Canadian Dividends Eligible Non-Eligible 2022 Taxable Income 18,37% first $46,295 27.53% 13.76% 4.53% 32.53% 16.26 % 11.43% 24.12% over $46,295 up to $50,197 29.40% over $50, 197 up to $92,500 34.00% over $92,580 up to $100,392 39.28% over $100,392 up to $112.655 41.30% over $112.655 up to $155,625 44.48% over $155,625 up to $221,708 50.28% 25.14% 35,93% 48.02% over $221,708 53.31% 26.65% 40.10% 37.12% 18.58% 17.77% 41.12 % 20.56% 23.29% 45.71% 22.86% 29.62% 47.46% 23.73% 32.04% Marginal tax rate for dividends is a % of actual dividends received (not grassod-up taxable amount) Marginal tax rate for capital gains is a % of total capital gains (not taxable capital gains). Gross-up rate for eligible dividends is 38%, and for non-algible dividends is 15% For more information see Quebec dividend tax credits. 19.05% 24.80% 30.08% 34.68% 39.96% 41.97% 45.22% 48.70%

Step by Step Solution

★★★★★

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Gerrys taxes payable we need to determine his taxable income and apply the correspondin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started