Answered step by step

Verified Expert Solution

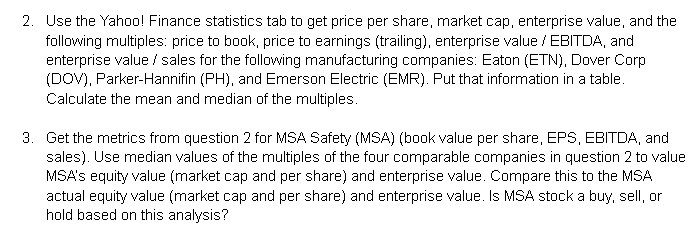

Question

1 Approved Answer

Get the metrics from question 2 for MSA Safety ( MSA ) ( book value per share, EPS, EBITDA, and sales ) . Use median

Get the metrics from question for MSA Safety MSAbook value per share, EPS, EBITDA, and sales Use median values of the multiples of the four comparable companies in question to value MSAs equity value market cap and per share and enterprise value. Compare this to the MSA actual equity value market cap and per share and enterprise value. Is MSA stock a buy, sell, or hold based on this analysis? Use the Yahoo! Finance statistics tab to get price per share, market cap, enterprise value, and the following multiples: price to book, price to earnings trailing enterprise value EBITDA, and enterprise value sales for the following manufacturing companies: Eaton ETN Dover Corp DOV ParkerHannifin mathrmPH and Emerson Electric EMR Put that information in a table. Calculate the mean and median of the multiples.

Get the metrics from question for MSA Safety MSAbook value per share, EPS, EBITDA, and sales Use median values of the multiples of the four comparable companies in question to value MSA's equity value market cap and per share and enterprise value. Compare this to the MSA actual equity value market cap and per share and enterprise value. Is MSA stock a buy, sell, or hold based on this analysis?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started