Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ggplot package These are parts e,f,g,h,i of this question : https://www.chegg.com/homework-help/questions-and-answers/ggplot-please-answer-r-studio-note-needed-data-link-https-githubcom-wampeh1-ecog314spring2-q20106881 R STUDIO ! Please answer by R studio. NOTE : The needed data are

ggplot package

These are parts e,f,g,h,i of this question :

https://www.chegg.com/homework-help/questions-and-answers/ggplot-please-answer-r-studio-note-needed-data-link-https-githubcom-wampeh1-ecog314spring2-q20106881

R STUDIO !

Please answer by R studio.

NOTE : The needed data are in this link:

https://github.com/wampeh1/Ecog314_Spring2017/tree/master/lecture7

This could not be answered without R studio

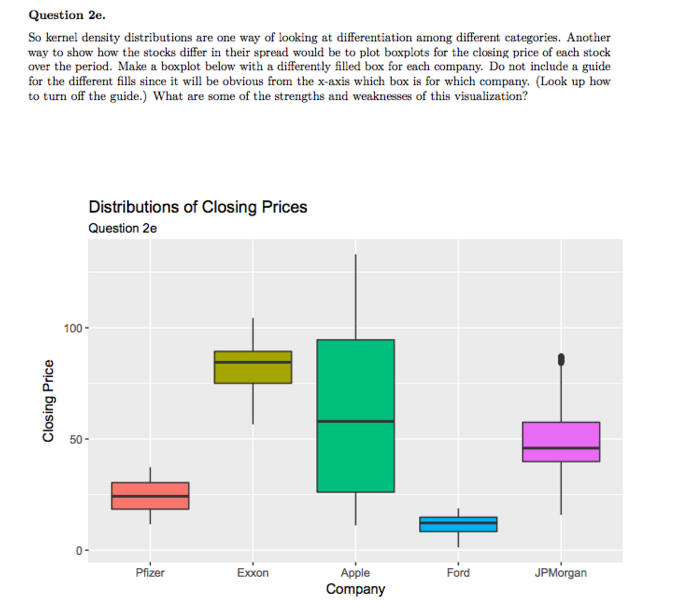

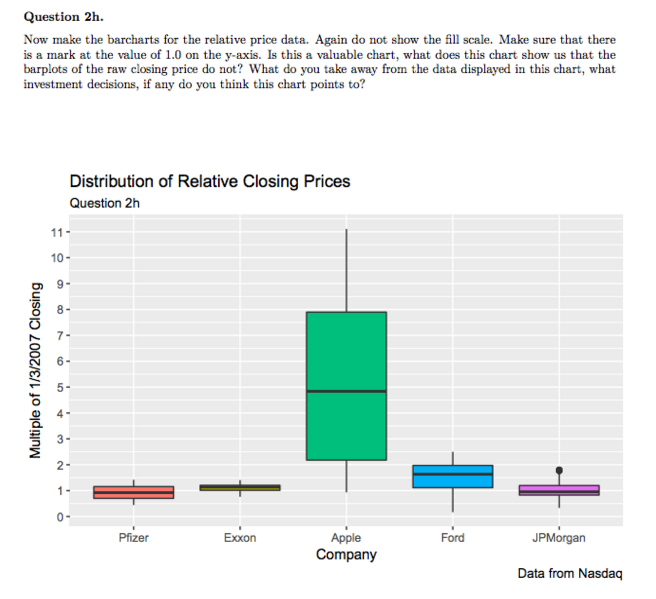

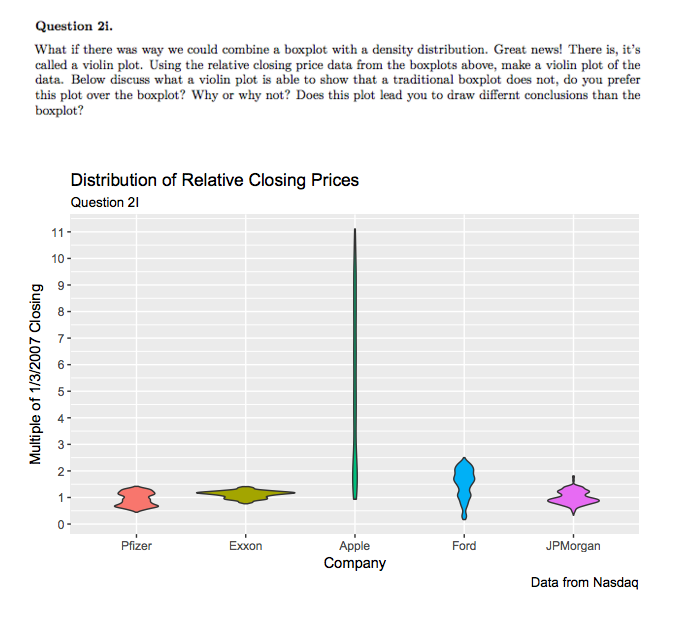

Question 2e. So kernel density distributions are one way of looking at differentiation among different categories. Another way to show how the stocks differ in their spread would be to plot boxplots for the closing price of each stock over the period. Make a boxplot below with a differently filled box for each company. Do not include a guide for the different fills since it will be obvious from the x-axis which box is for which company. (Look up how to turn off the guide.) What are some of the strengths and weaknesses of this visualization? Distributions of Closing Prices Question 2e 100 50- Exxon Apple Ford JPMorgan Pfizer CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started