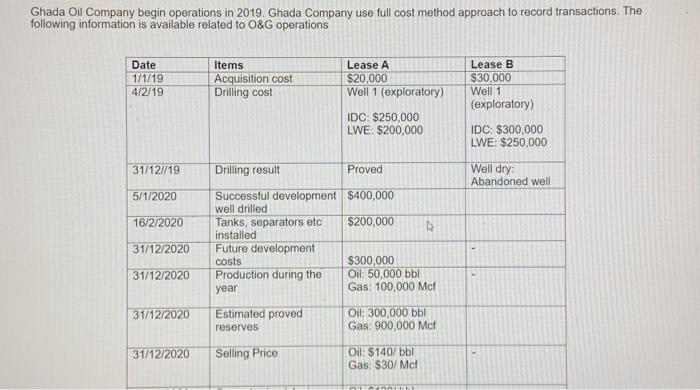

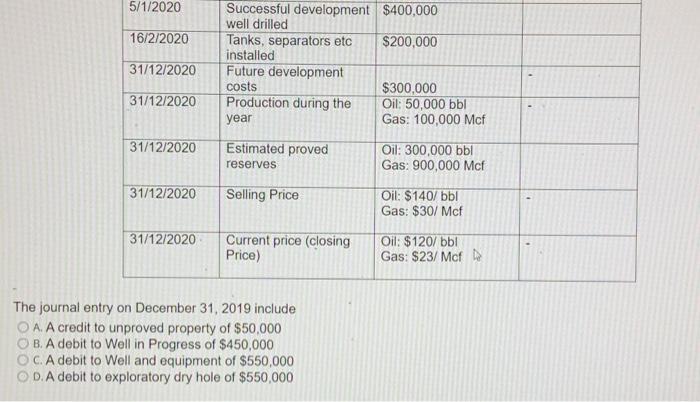

Ghada Oil Company begin operations in 2019. Ghada Company use full cost method approach to record transactions. The following information is available related to O&G operations Date 1/1/19 4/2/19 Items Acquisition cost Drilling cost Lease A $20,000 Well 1 (exploratory) IDC: $250,000 LWE: $200,000 Lease B $30,000 Well 1 (exploratory) IDC: $300,000 LWE: $250,000 31/121/19 Drilling result Proved Well dry: Abandoned well 5/1/2020 16/2/2020 Successful development $400,000 well drilled Tanks, separators etc $200,000 installed Future development costs $300,000 Production during the Oil: 50,000 bbl year Gas: 100,000 Mcf 31/12/2020 31/12/2020 31/12/2020 Estimated proved reserves Oil: 300,000 bbl Gas 900,000 Mct 31/12/2020 Selling Price Oil: $140/bbl Gas: $30/ Met 5/1/2020 16/2/2020 31/12/2020 Successful development $400,000 well drilled Tanks, separators etc $200,000 installed Future development costs $300,000 Production during the Oil: 50,000 bbl year Gas: 100,000 Mcf 31/12/2020 31/12/2020 Estimated proved reserves Oil: 300,000 bbl Gas: 900,000 Mcf 31/12/2020 Selling Price Oil: $140/bb! Gas: $30/ Mct 31/12/2020 Current price (closing Price) Oil: $120/bb! Gas: $23/Mcf The journal entry on December 31, 2019 include O A. A credit to unproved property of $50,000 OB. A debit to Well in Progress of $450,000 OC. A debit to Well and equipment of $550,000 OD. A debit to exploratory dry hole of $550,000 Ghada Oil Company begin operations in 2019. Ghada Company use full cost method approach to record transactions. The following information is available related to O&G operations Date 1/1/19 4/2/19 Items Acquisition cost Drilling cost Lease A $20,000 Well 1 (exploratory) IDC: $250,000 LWE: $200,000 Lease B $30,000 Well 1 (exploratory) IDC: $300,000 LWE: $250,000 31/121/19 Drilling result Proved Well dry: Abandoned well 5/1/2020 16/2/2020 Successful development $400,000 well drilled Tanks, separators etc $200,000 installed Future development costs $300,000 Production during the Oil: 50,000 bbl year Gas: 100,000 Mcf 31/12/2020 31/12/2020 31/12/2020 Estimated proved reserves Oil: 300,000 bbl Gas 900,000 Mct 31/12/2020 Selling Price Oil: $140/bbl Gas: $30/ Met 5/1/2020 16/2/2020 31/12/2020 Successful development $400,000 well drilled Tanks, separators etc $200,000 installed Future development costs $300,000 Production during the Oil: 50,000 bbl year Gas: 100,000 Mcf 31/12/2020 31/12/2020 Estimated proved reserves Oil: 300,000 bbl Gas: 900,000 Mcf 31/12/2020 Selling Price Oil: $140/bb! Gas: $30/ Mct 31/12/2020 Current price (closing Price) Oil: $120/bb! Gas: $23/Mcf The journal entry on December 31, 2019 include O A. A credit to unproved property of $50,000 OB. A debit to Well in Progress of $450,000 OC. A debit to Well and equipment of $550,000 OD. A debit to exploratory dry hole of $550,000