Question

Giannacarro, Inc., purchased 100% of the common shares of Arietta for $290,000 on January 1, 20X7. Ariettas balance sheet just before the acquisition was as

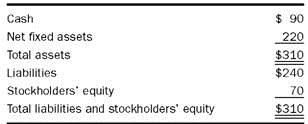

Giannacarro, Inc., purchased 100% of the common shares of Arietta for $290,000 on January 1, 20X7. Arietta’s balance sheet just before the acquisition was as follows ($ in thousands):

The fair market values of Arietta’s assets and liabilities were equal to their book values.

1. Compute the amount of goodwill Giannacarro would recognize on this purchase. Where would this goodwill appear on Giannacarro’s financial statements?

2. Giannacarro’s 20X7 net income from all operations excluding those of Arietta was $100,000. Arietta had a net loss of $5,000. Assume there were no intercompany transactions. Compute consolidated net income for 20X7.

3. Repeat requirement 2 assuming Giannacarro concluded goodwill was impaired by $20,000.

4. How much goodwill appears on the consolidated balance sheet after requirement 3?

Cash $90 Net fixed assets 220 Total assets $310 Liabilities $240 Stockholders' equity 70 Total liabilities and stockholders' equity $310

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Price paid for acquisition 290000 Net assets of Arietta 310000 240000 70000 Goodw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started