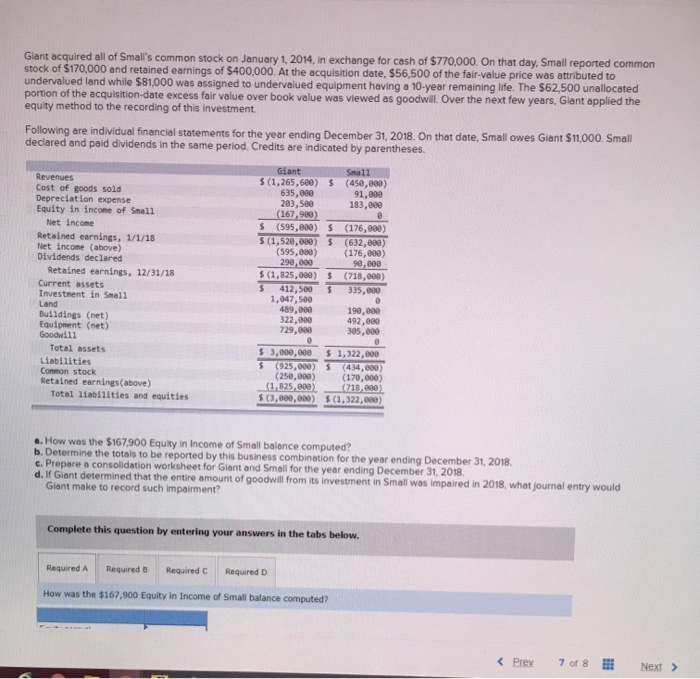

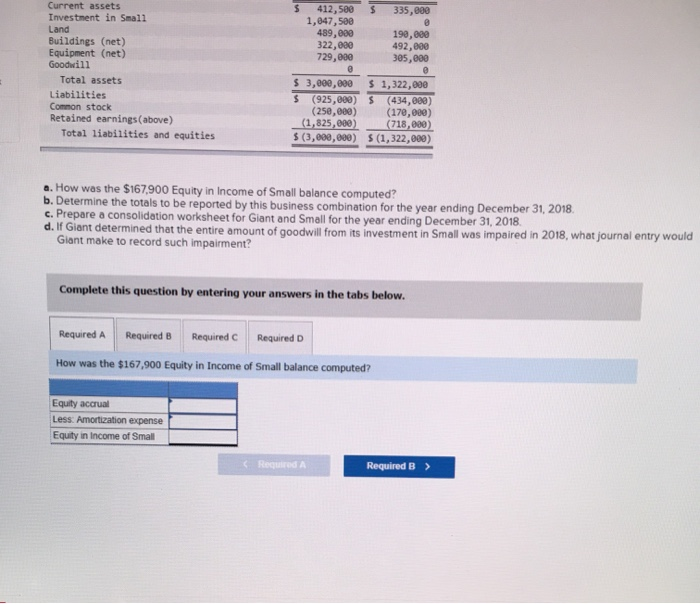

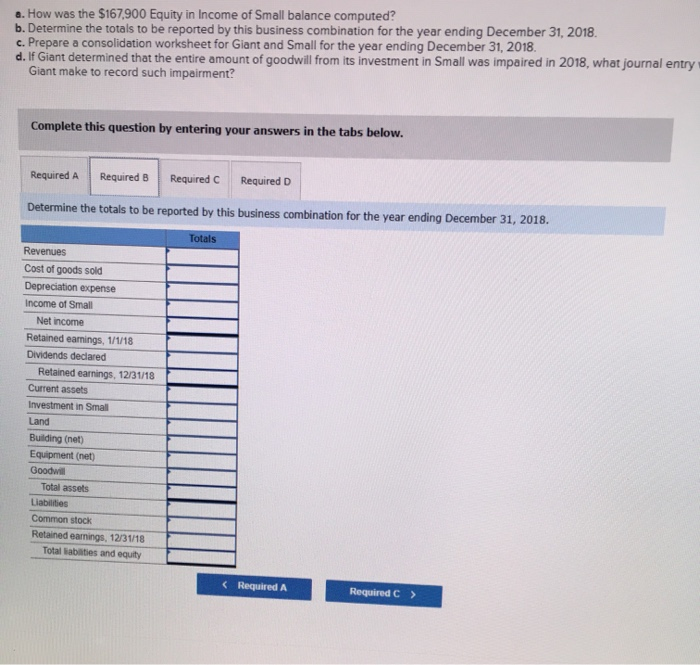

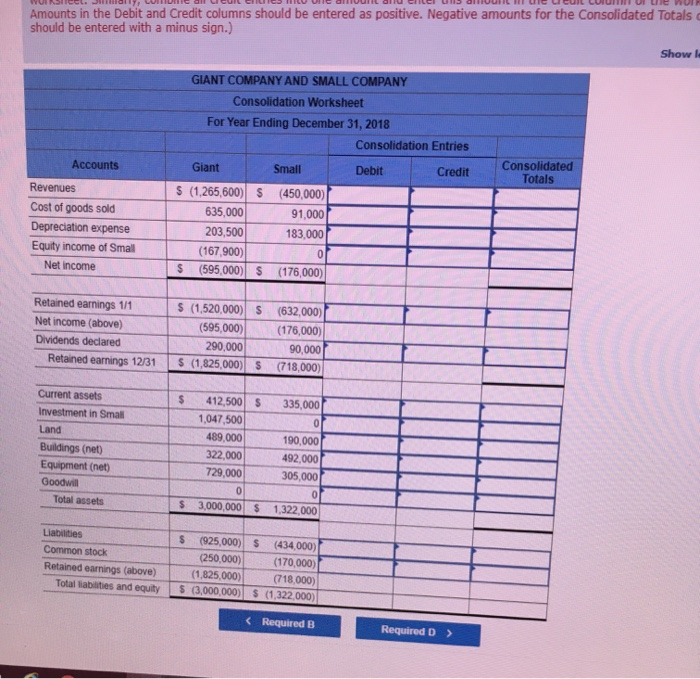

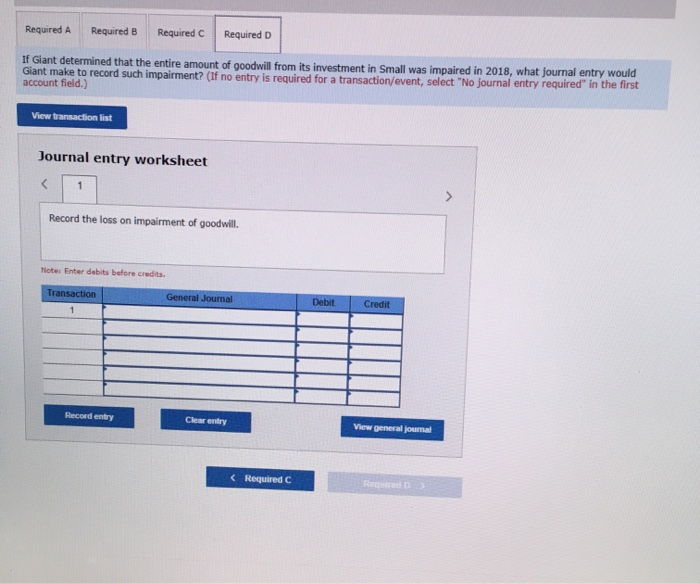

Giant acquired all of Small's common stock on January 1, 2014, in exchange for cash of $770,000. On that day. Small reported common stock of $170,000 and retained earnings of $400,000. At the acquisition date. $56,500 of the fair value price was attributed to undervalued land while $81,000 was assigned to undervalued equipment having a 10-year remaining life. The $62,500 unallocated portion of the acquisition date excess fair value over book value was viewed as goodwil. Over the next few years, Giant applied the equity method to the recording of this investment Following are individual financial statements for the year ending December 31, 2018. On that date, Smallowes Giant $11,000. Small declared and paid dividends in the same period. Credits are indicated by parentheses. $ Small (450,000) 91,000 183,000 $ $ Giant $(1,265,600) 635,000 203,500 (167,900) $ (595,000) $ (1,520,000) (595,000) 290,000 $(1,625,000) $ 412,500 1.047,500 489.00 322,000 729,000 Revenues Cost of goods sold Depreciation expense Equity in income of Small Net Income Retained earnings, 1/1/18 Net Income (above) Dividends declared Retained earnings, 12/31/18 Current assets Investment in Small Land Buildings (net) Equipment (net) Goodwill Total assets Liabilities Common stock Retained earnings(above) Total liabilities and equities (176,000) (632,000) (176.000) 90,000 (718,000) 335,000 $ 190.000 492,000 305,000 $ 3,000,000 $ (925,000) (250,000) (1,825,000). $ (3,000,000) $1,322,000 5 (434,000) (170,000) (718,000) $(1,322,000) a. How was the $167,900 Equity in Income of Small balance computed? b. Determine the totals to be reported by this business combination for the year ending December 31, 2018 c. Prepare a consolidation worksheet for Glant and Small for the year ending December 31, 2018 d. If Giant determined that the entire amount of goodwill from its investment in Small was impaired in 2018, what journal entry would Giant make to record such impairment? Complete this question by entering your answers in the tabs below. Required A Required Required C Required D How was the $167.900 Equity in Income of Small balance computed? S 335,800 198,080 492,000 305,000 Current assets Investment in Small Land Buildings (net) Equipment (net) Goodwill Total assets Liabilities Common stock Retained earnings (above) Total liabilities and equities $ 412,500 1,047,500 489,000 322,000 729,000 @ $ 3,000,000 $ (925,000) (250,000) (1,825,000) $ (3,000,000) $ 1,322,000 $ (434,000) (170,000) (718,000) S (1,322,000) a. How was the $167,900 Equity in Income of Small balance computed? b. Determine the totals to be reported by this business combination for the year ending December 31, 2018 c. Prepare a consolidation worksheet for Giant and Small for the year ending December 31, 2018 d. If Giant determined that the entire amount of goodwill from its investment in Small was impaired in 2018, what journal entry would Giant make to record such impairment? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How was the $167.900 Equity in Income of Small balance computed? Equity accrual Less: Amortization expense Equity in income of Small Required A Required B > a. How was the $167.900 Equity in Income of Small balance computed? b. Determine the totals to be reported by this business combination for the year ending December 31, 2018. c. Prepare a consolidation worksheet for Glant and Small for the year ending December 31, 2018 d. If Giant determined that the entire amount of goodwill from its investment in Small was impaired in 2018, what journal entry Giant make to record such impairment? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Determine the totals to be reported by this business combination for the year ending December 31, 2018. Totals Revenues Cost of goods sold Depreciation expense Income of Small Net income Retained earnings, 1/1/18 Dividends declared Retained earnings, 12/31/18 Current assets Investment in Small Land Building (net) Equipment (net) Goodwill Total assets Liabilities Common stock Retained earnings, 12/31/18 Total Babies and equity Required A Required C > WINSTCEL. J oly UITDI LI CUIL CHUCHU VUIL Ollu llei 15 allUIL CUI CUIL CUIUIUI Lie VOIR Amounts in the Debit and credit columns should be entered as positive. Negative amounts for the Consolidated Totals should be entered with a minus sign.) Show le GIANT COMPANY AND SMALL COMPANY Consolidation Worksheet For Year Ending December 31, 2018 Consolidation Entries Giant Small Debit Credit $ (1,265,600) S (450,000) 635,000 91,000 203,500 183,000 (167,900) op $ (595,000) S (176,000) Accounts Revenues Cost of goods sold Depreciation expense Equity income of Small Net income Consolidated Totals Retained earnings 111 Net income (above) Dividends declared Retained earnings 12/31 S (1,520,000) S (595,000) 290,000 S (1,825,000) S (632,000) | (176,000) 90,000| (718,000) . $ $ 335,000 Current assets Investment in Small Land Buildings (net) Equipment (net) Goodwill Total assets 412,500 1.047,500 489,000 322,000 729,000 0 3,000,000 190,000 492,000 305,000 of 1,322,000 $ Liabilities Common stock Retained earnings (above) Total liabilities and equity $ (925,000) (250,000) (1.825.000) $ (3,000,000) $ (434,000) (170,000) (718,000) $ (1,322,000) Required A Required B Required C Required D If Giant determined that the entire amount of goodwill from its investment in Small was impaired in 2018, what journal entry would Giant make to record such impairment? (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record the loss on impairment of goodwill. Notes Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal