Answered step by step

Verified Expert Solution

Question

1 Approved Answer

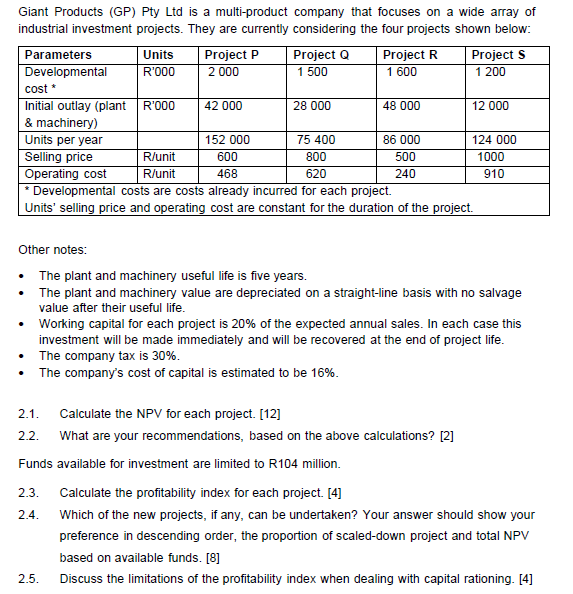

Giant Products (GP) Pty Ltd is a multi-product company that focuses on a wide array of industrial investment projects. They are currently considering the four

Giant Products (GP) Pty Ltd is a multi-product company that focuses on a wide array of industrial investment projects. They are currently considering the four projects shown below: - veveropmental costs are costs aiready incurrea tor eacn project. Units' selling price and operating cost are constant for the duration of the project. Other notes: - The plant and machinery useful life is five years. - The plant and machinery value are depreciated on a straight-line basis with no salvage value after their useful life. - Working capital for each project is 20% of the expected annual sales. In each case this investment will be made immediately and will be recovered at the end of project life. - The company tax is 30%. - The company's cost of capital is estimated to be 16%. 2.1. Calculate the NPV for each project. [12] 2.2. What are your recommendations, based on the above calculations? [2] Funds available for investment are limited to R104 million. 2.3. Calculate the profitability index for each project. [4] 2.4. Which of the new projects, if any, can be undertaken? Your answer should show your preference in descending order, the proportion of scaled-down project and total NPV based on available funds. [8] 2.5. Discuss the limitations of the profitability index when dealing with capital rationing. [4]

Giant Products (GP) Pty Ltd is a multi-product company that focuses on a wide array of industrial investment projects. They are currently considering the four projects shown below: - veveropmental costs are costs aiready incurrea tor eacn project. Units' selling price and operating cost are constant for the duration of the project. Other notes: - The plant and machinery useful life is five years. - The plant and machinery value are depreciated on a straight-line basis with no salvage value after their useful life. - Working capital for each project is 20% of the expected annual sales. In each case this investment will be made immediately and will be recovered at the end of project life. - The company tax is 30%. - The company's cost of capital is estimated to be 16%. 2.1. Calculate the NPV for each project. [12] 2.2. What are your recommendations, based on the above calculations? [2] Funds available for investment are limited to R104 million. 2.3. Calculate the profitability index for each project. [4] 2.4. Which of the new projects, if any, can be undertaken? Your answer should show your preference in descending order, the proportion of scaled-down project and total NPV based on available funds. [8] 2.5. Discuss the limitations of the profitability index when dealing with capital rationing. [4] Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started