Answered step by step

Verified Expert Solution

Question

1 Approved Answer

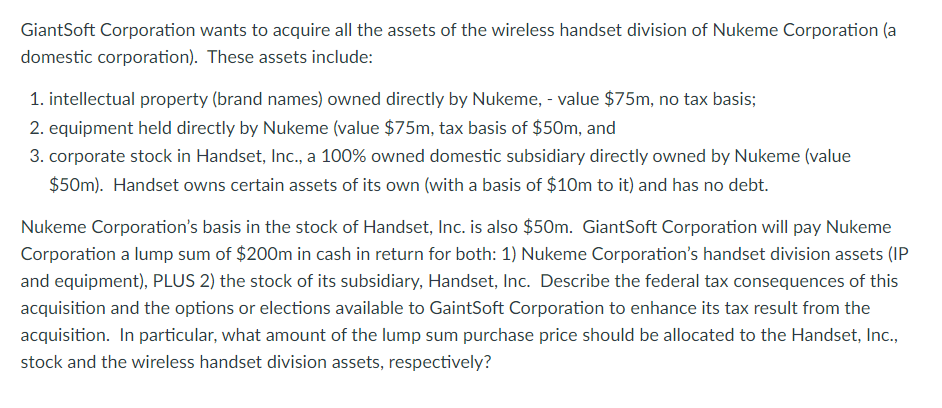

GiantSoft Corporation wants to acquire all the assets of the wireless handset division of Nukeme Corporation ( a domestic corporation ) . These assets include:

GiantSoft Corporation wants to acquire all the assets of the wireless handset division of Nukeme Corporation a

domestic corporation These assets include:

intellectual property brand names owned directly by Nukeme, value $ no tax basis;

equipment held directly by Nukeme value $ tax basis of $ and

corporate stock in Handset, Inc., a owned domestic subsidiary directly owned by Nukeme value

$ Handset owns certain assets of its own with a basis of $ to it and has no debt.

Nukeme Corporation's basis in the stock of Handset, Inc. is also $ GiantSoft Corporation will pay Nukeme

Corporation a lump sum of $ in cash in return for both: Nukeme Corporation's handset division assets IP

and equipment PLUS the stock of its subsidiary, Handset, Inc. Describe the federal tax consequences of this

acquisition and the options or elections available to GaintSoft Corporation to enhance its tax result from the

acquisition. In particular, what amount of the lump sum purchase price should be allocated to the Handset, Inc.,

stock and the wireless handset division assets, respectively?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started