Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Giblin's Goodies pays employees weekly on Fridays. However, the company notices that March 31 is a Wednesday, and the pay period will end on

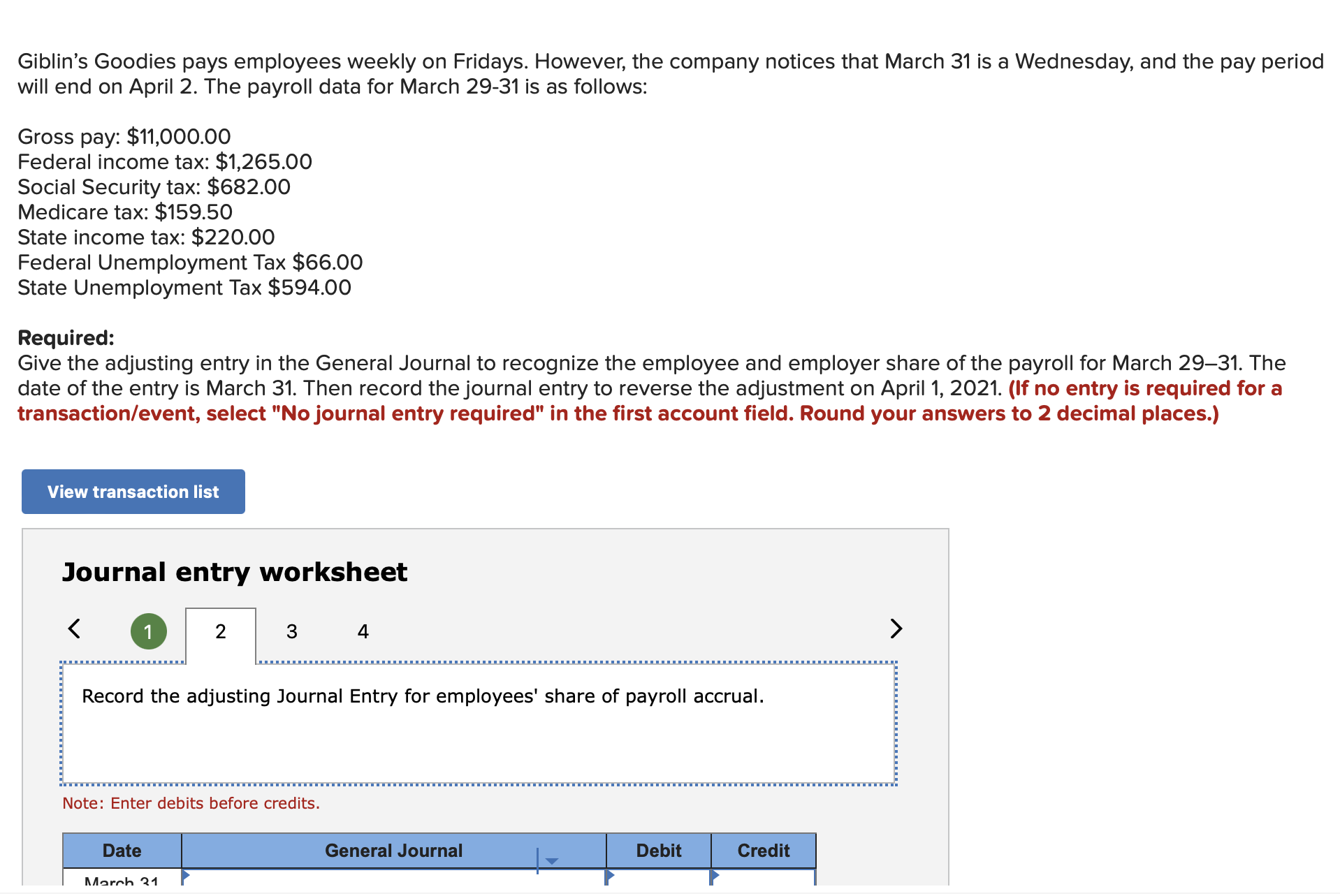

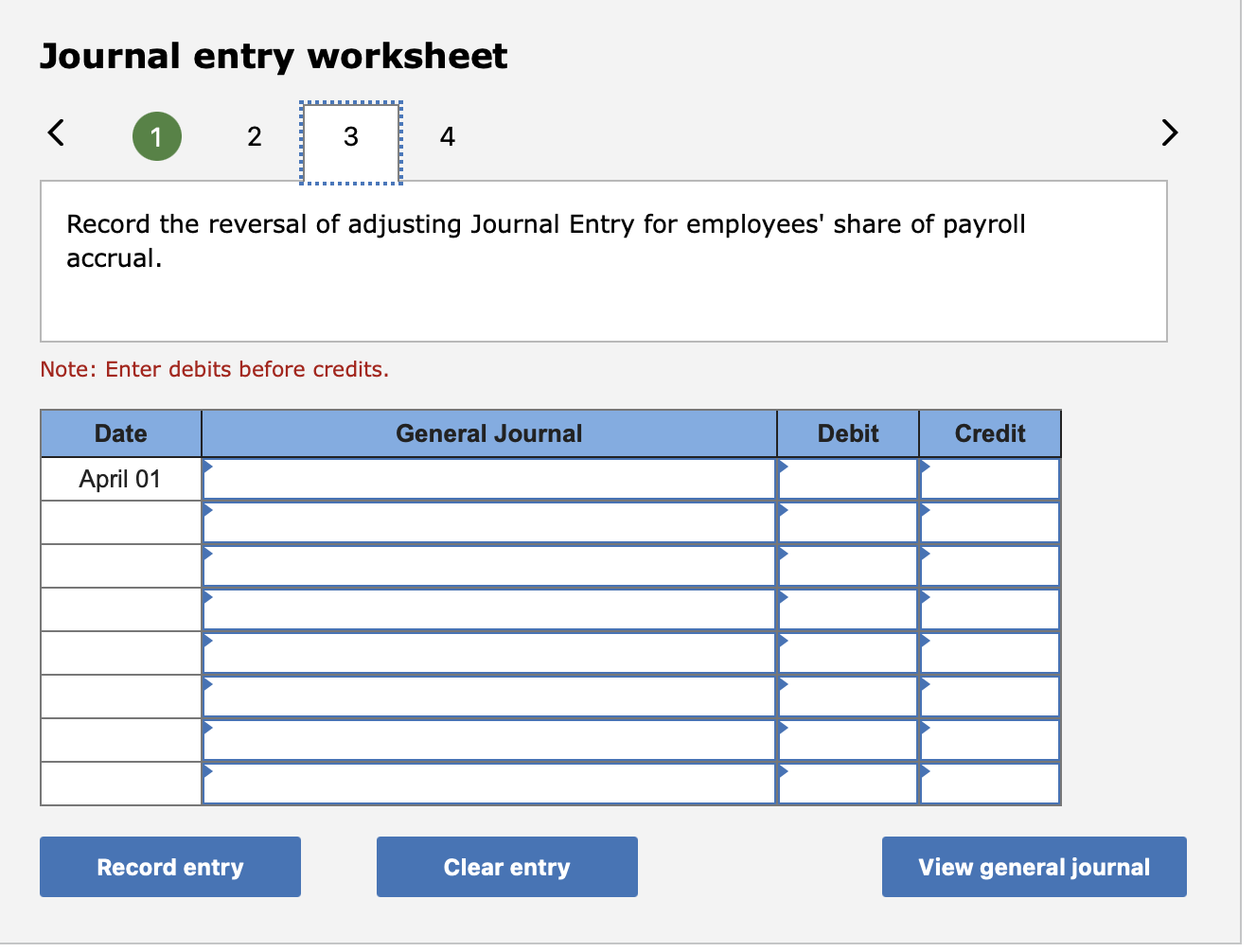

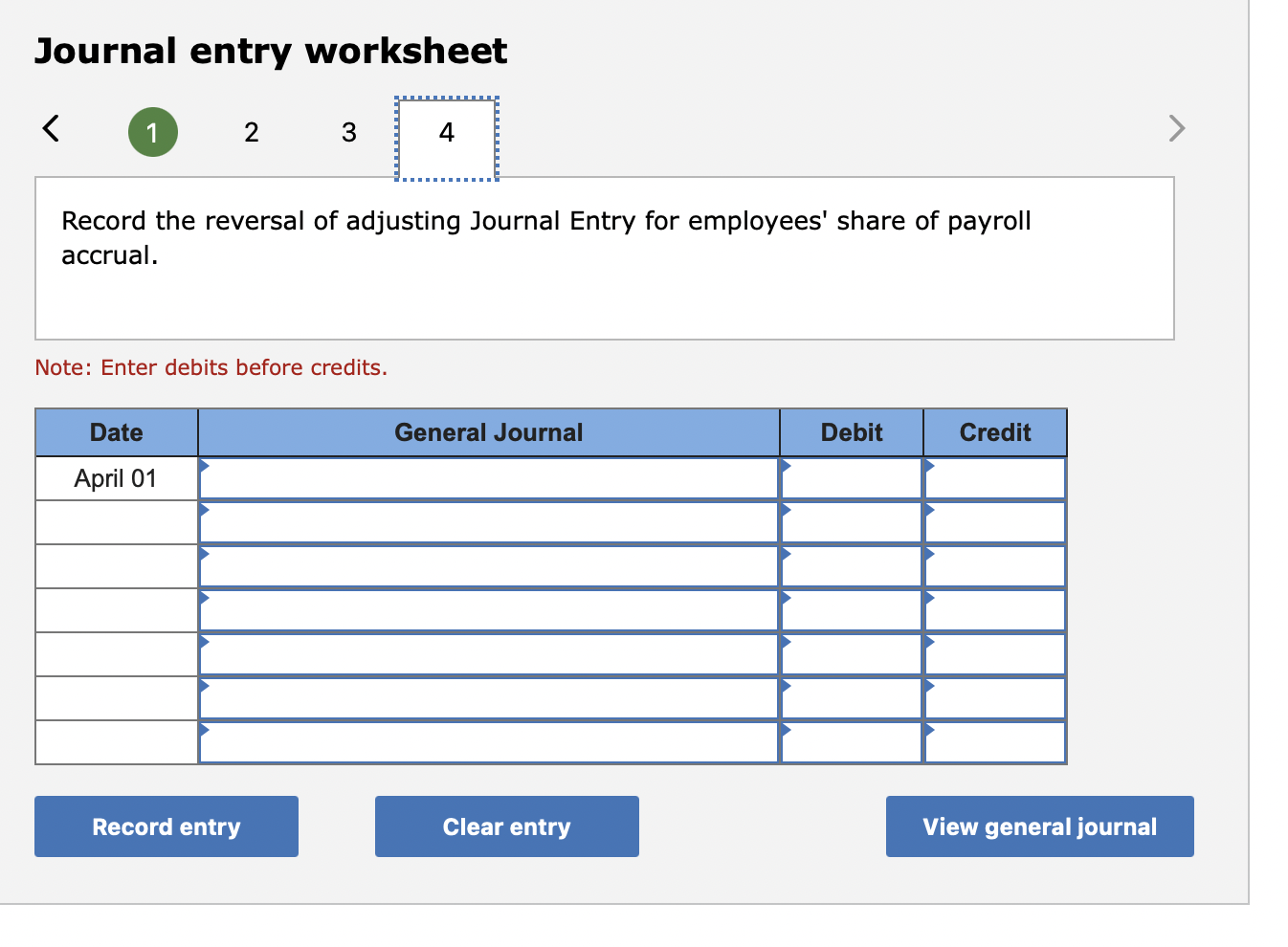

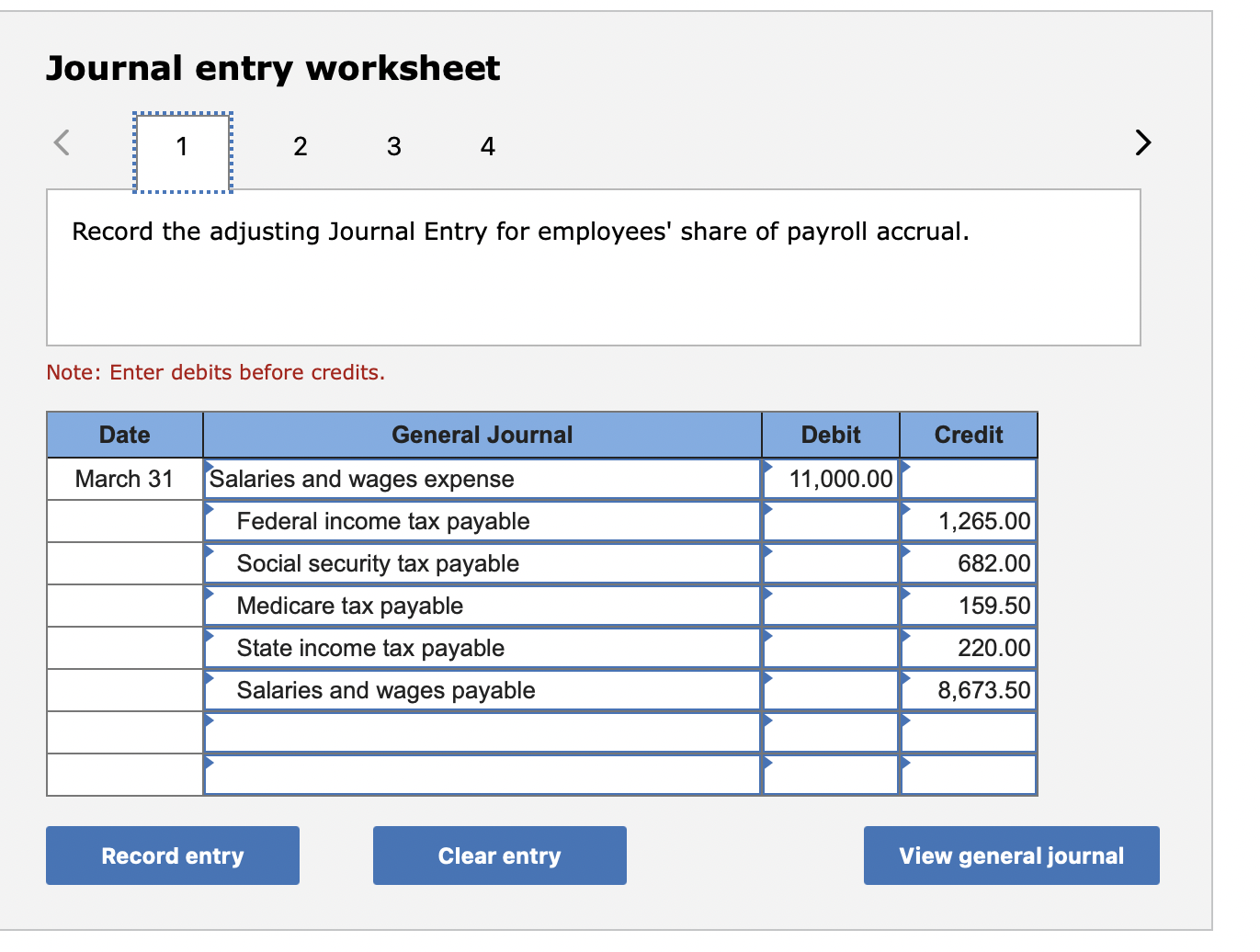

Giblin's Goodies pays employees weekly on Fridays. However, the company notices that March 31 is a Wednesday, and the pay period will end on April 2. The payroll data for March 29-31 is as follows: Gross pay: $11,000.00 Federal income tax: $1,265.00 Social Security tax: $682.00 Medicare tax: $159.50 State income tax: $220.00 Federal Unemployment Tax $66.00 State Unemployment Tax $594.00 Required: Give the adjusting entry in the General Journal to recognize the employee and employer share of the payroll for March 2931. The date of the entry is March 31. Then record the journal entry to reverse the adjustment on April 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet < 1 2 3 Record the adjusting Journal Entry for employees' share of payroll accrual. Note: Enter debits before credits. Date March 31 General Journal Debit Credit Journal entry worksheet < 1 2 3 4 Record the reversal of adjusting Journal Entry for employees' share of payroll accrual. Note: Enter debits before credits. Date April 01 General Journal Debit Credit > View general journal Record entry Clear entry Journal entry worksheet < 1 2 3 4 Record the reversal of adjusting Journal Entry for employees' share of payroll accrual. Note: Enter debits before credits. Date April 01 General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet 2 3 4 Record the adjusting Journal Entry for employees' share of payroll accrual. Note: Enter debits before credits. Date March 31 General Journal Debit Credit Salaries and wages expense 11,000.00 Federal income tax payable 1,265.00 Social security tax payable Medicare tax payable State income tax payable Salaries and wages payable 682.00 159.50 220.00 8,673.50 View general journal Record entry Clear entry >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started