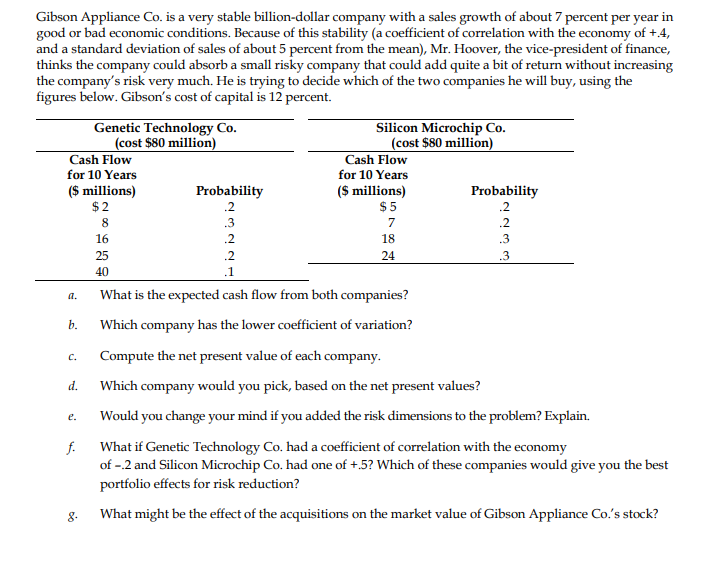

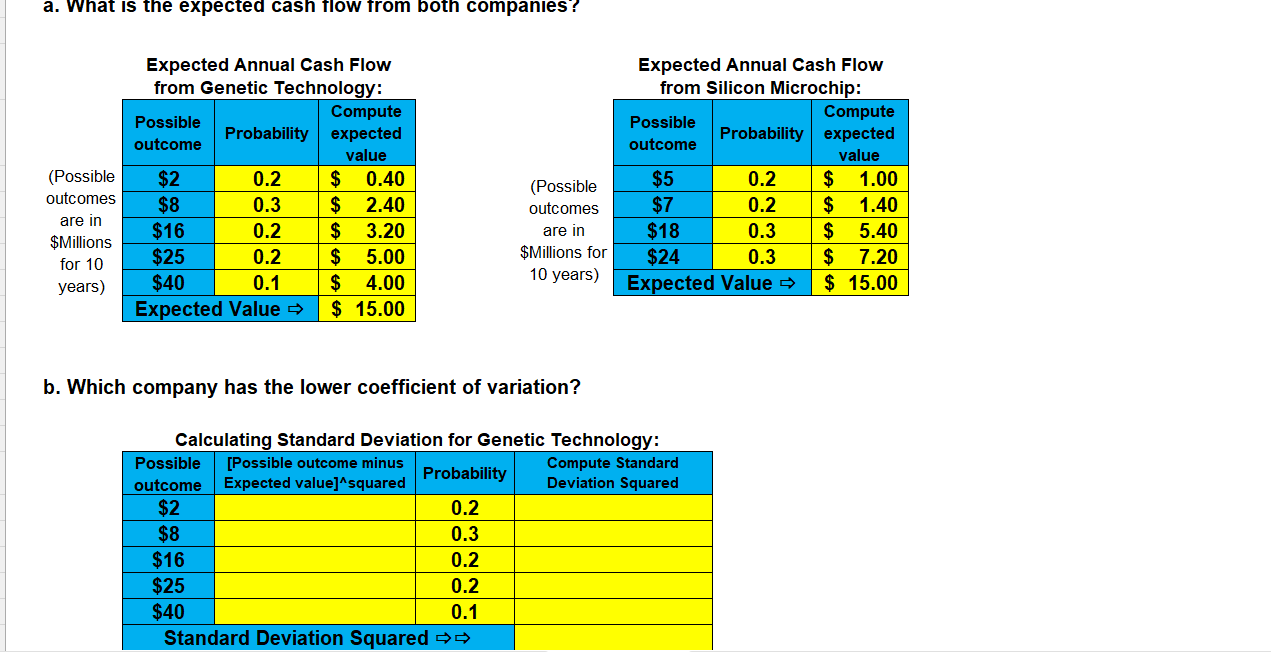

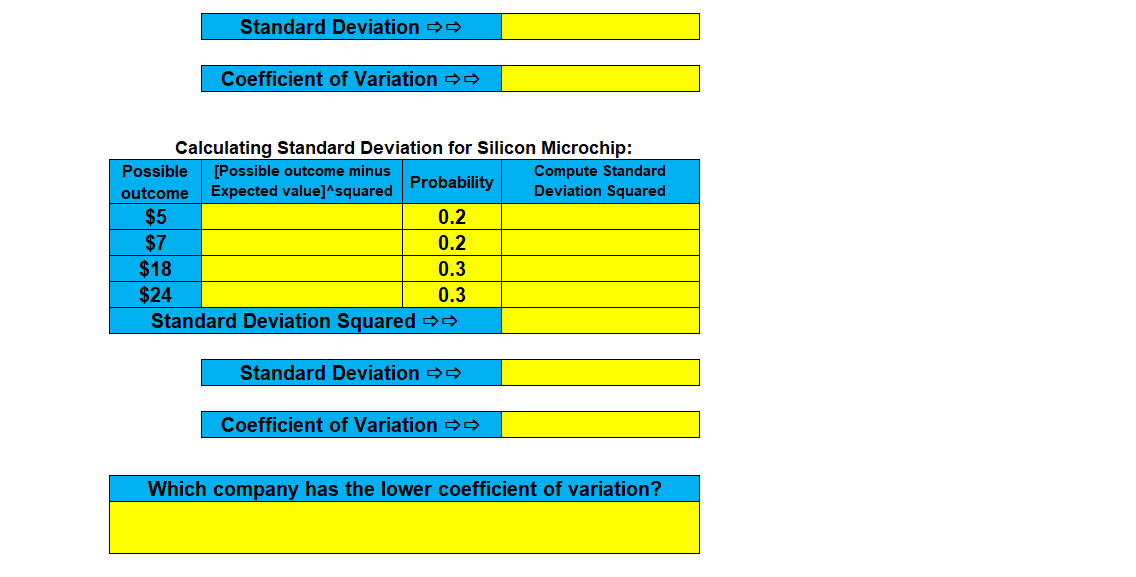

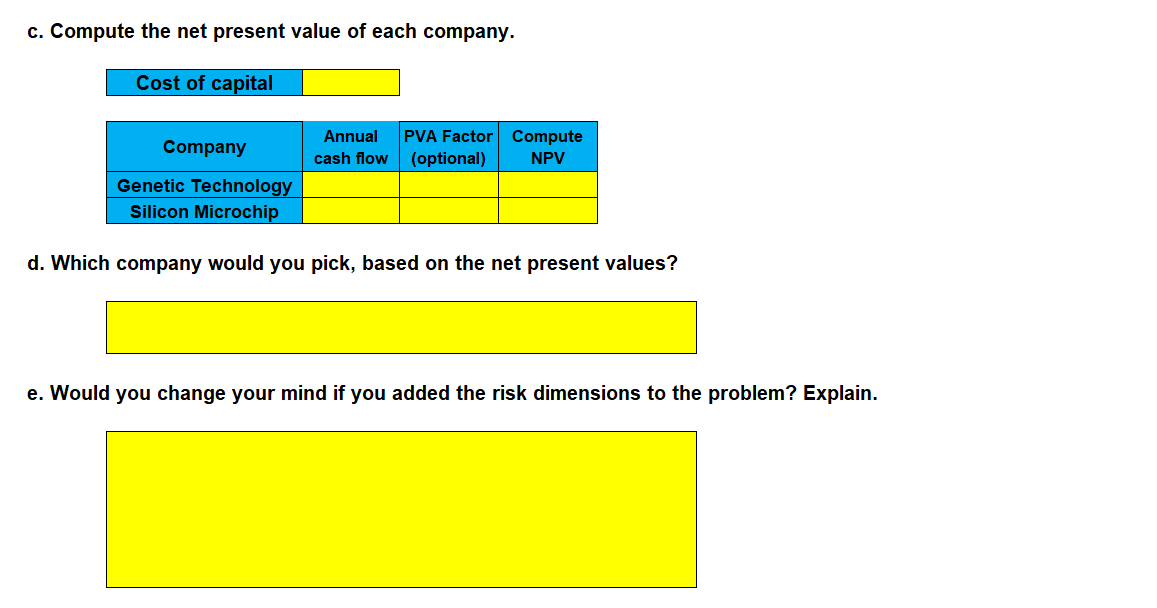

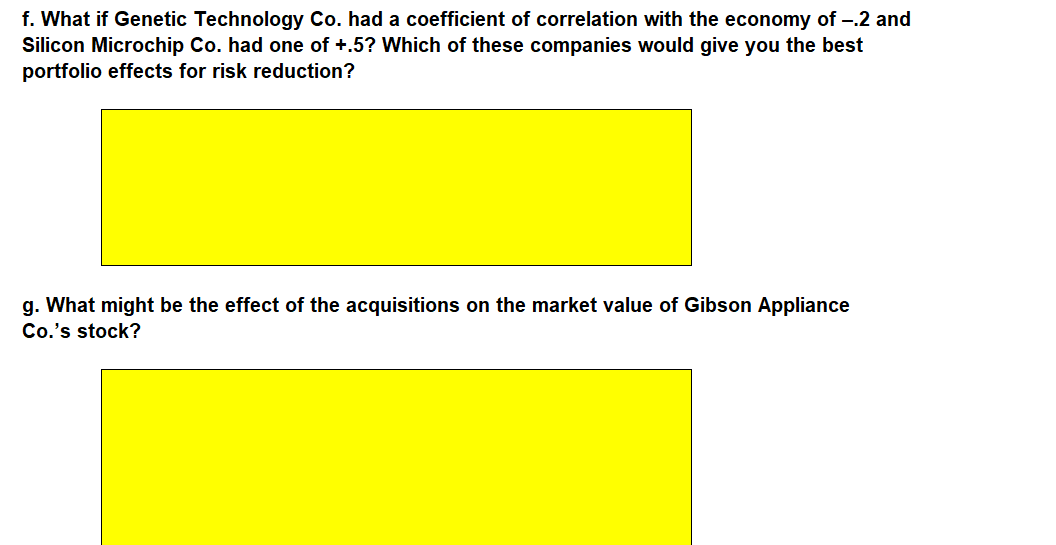

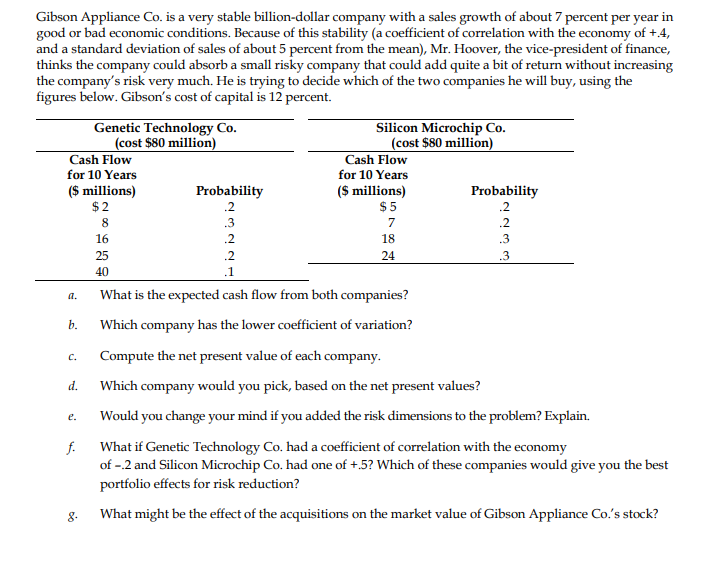

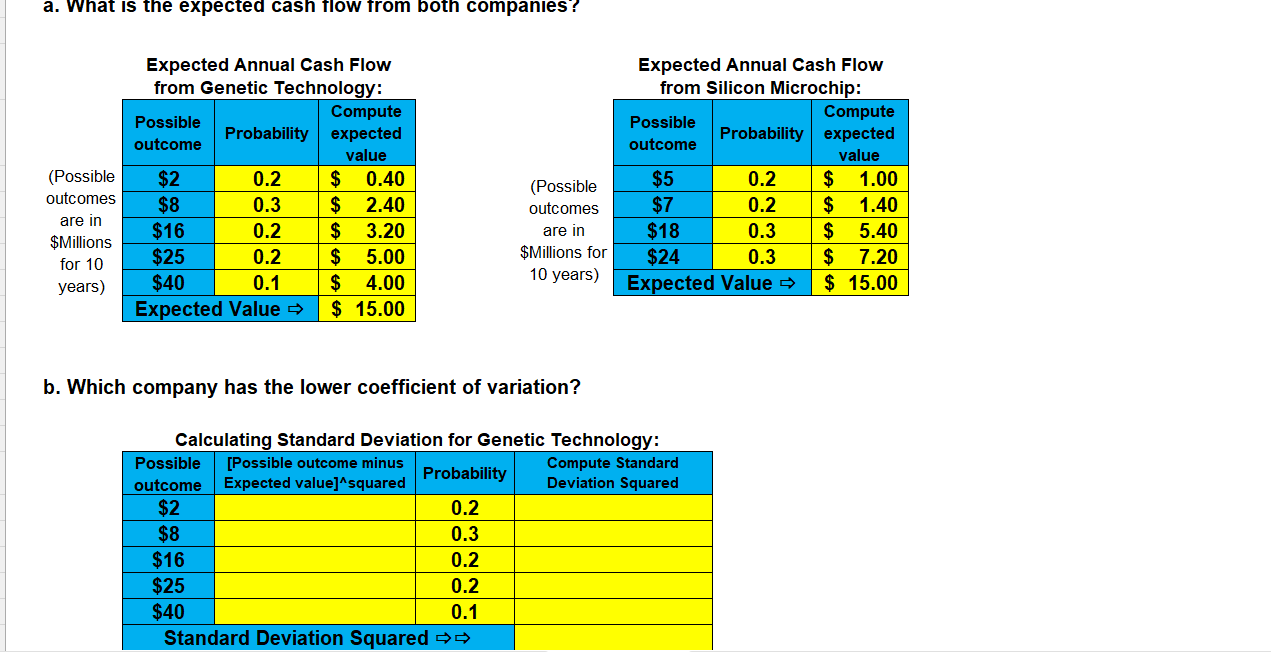

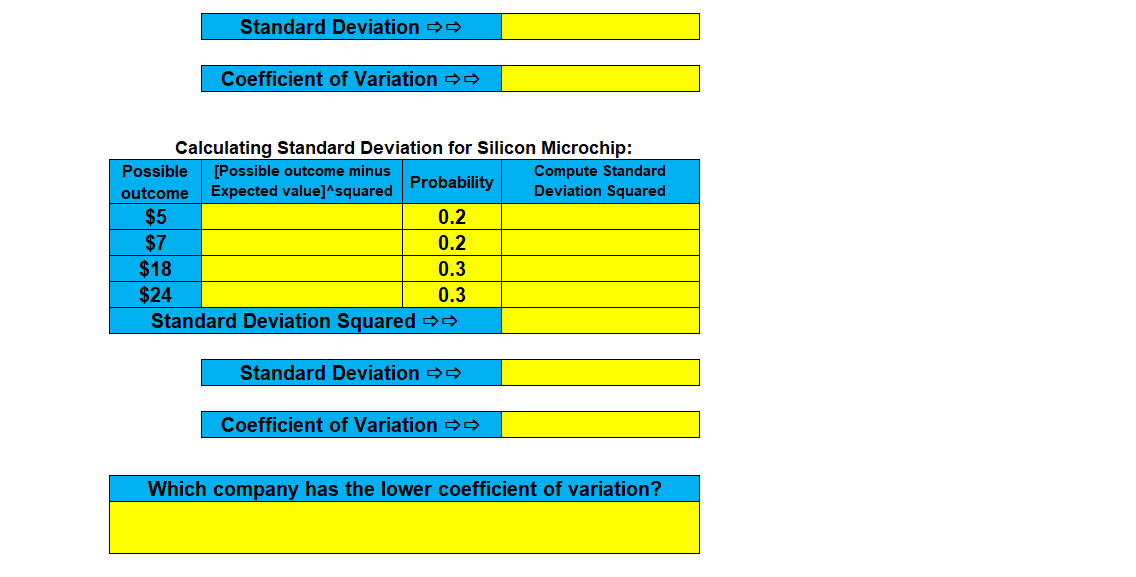

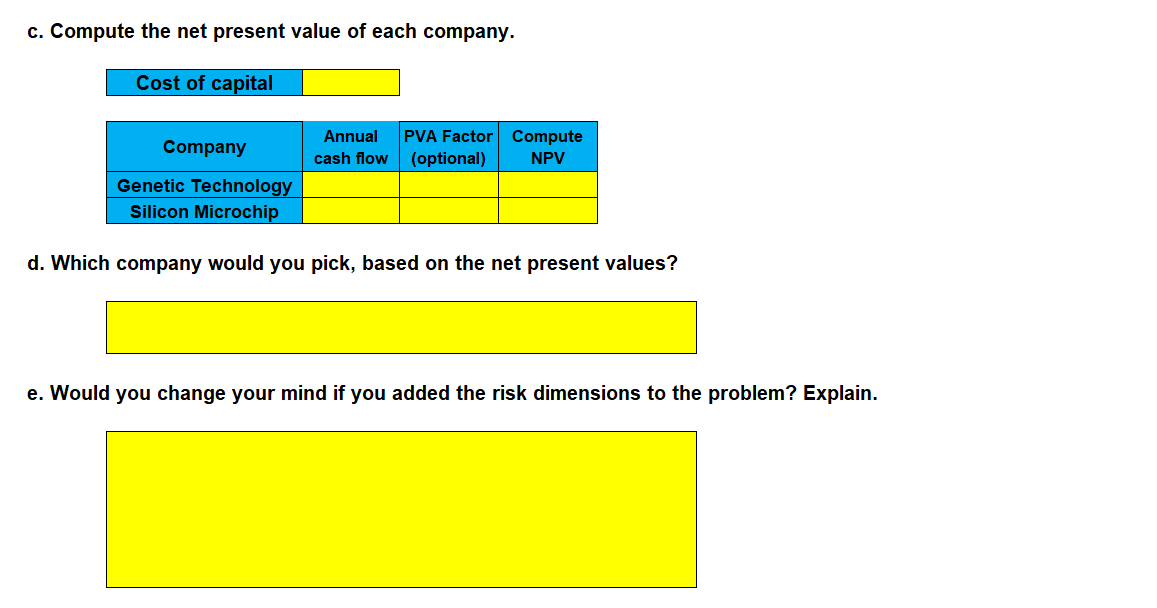

Gibson Appliance Co. is a very stable billion-dollar company with a sales growth of about 7 percent per year in good or bad economic conditions. Because of this stability (a coefficient of correlation with the economy of +.4 , and a standard deviation of sales of about 5 percent from the mean), Mr. Hoover, the vice-president of finance, thinks the company could absorb a small risky company that could add quite a bit of return without increasing the company's risk very much. He is trying to decide which of the two companies he will buy, using the figures below. Gibson's cost of capital is 12 percent. a. What is the expected cash flow from both companies? b. Which company has the lower coefficient of variation? c. Compute the net present value of each company. d. Which company would you pick, based on the net present values? e. Would you change your mind if you added the risk dimensions to the problem? Explain. f. What if Genetic Technology Co. had a coefficient of correlation with the economy of -.2 and Silicon Microchip Co. had one of +.5 ? Which of these companies would give you the best portfolio effects for risk reduction? g. What might be the effect of the acquisitions on the market value of Gibson Appliance Co.'s stock? a. What is the expected cash flow from both companies? Expected Annual Cash Flow Expected Annual Cash Flow from Genetic Technology: from Silicon Microchip: (Possible outcomes are in \$Millions for 10 years) b. Which company has the lower coefficient of variation? Calculatinq Standard Deviation for Genetic Technoloqv: Calculating Standard Deviation for Silicon Microchip: c. Compute the net present value of each company. d. Which company would you pick, based on the net present values? e. Would you change your mind if you added the risk dimensions to the problem? Explain. f. What if Genetic Technology Co. had a coefficient of correlation with the economy of -.2 and Silicon Microchip Co. had one of +.5 ? Which of these companies would give you the best portfolio effects for risk reduction? g. What might be the effect of the acquisitions on the market value of Gibson Appliance Co.'s stock