Question

Gibson City reported the following items at December 31, 20X2. It has no component units and does not depreciate its infrastructure fixed assets. It issued

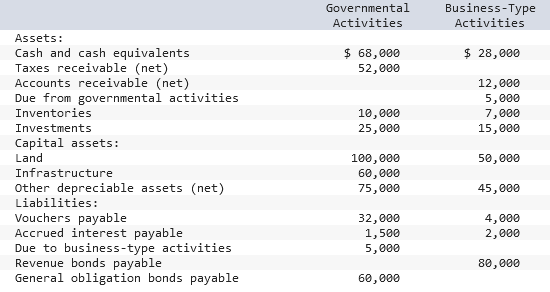

Gibson City reported the following items at December 31, 20X2. It has no component units and does not depreciate its infrastructure fixed assets. It issued all bondsgeneral obligation bonds and revenueto acquire capital assets. As of December 31, 20X2, net position of $25,000 was restricted for road maintenance in special revenue funds, and net position of $30,000 was restricted for debt service. Cash of $5,000 was restricted in business-type activities for plant maintenance.

Required:

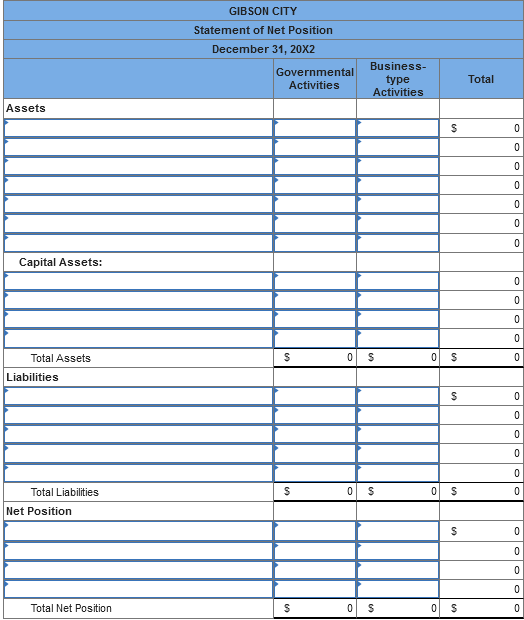

Using the information provided, prepare in good form a statement of net position for Gibson City at December 31, 20X2.

Note: Amounts to be deducted should be indicated with minus sign.

\begin{tabular}{lrr} Assets: & \begin{tabular}{c} Governmental \\ Activities \end{tabular} & \begin{tabular}{c} Business-Type \\ Activities \end{tabular} \\ Cash and cash equivalents & $68,000 & $28,000 \\ Taxes receivable (net) & 52,000 & \\ Accounts receivable (net) & & 12,000 \\ Due from governmental activities & 10,000 & 5,000 \\ Inventories & 25,000 & 7,000 \\ Investments & & 15,000 \\ Capital assets: & 100,000 & 50,000 \\ Land & 60,000 & \\ Infrastructure & 75,000 & 45,000 \\ Other depreciable assets (net) & & \\ Liabilities: & 32,000 & 4,000 \\ Vouchers payable & 1,500 & 2,000 \\ Accrued interest payable & 5,000 & 80,000 \\ Due to business-type activities & & \\ Revenue bonds payable & 60,000 & \end{tabular} GIBSON CITY Statement of Net Position December 31, 20X2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started