Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gibson Construction Company began operations on January 1, Year 1, when it acquired $18,000 cash from the issuance of common stock. During the year,

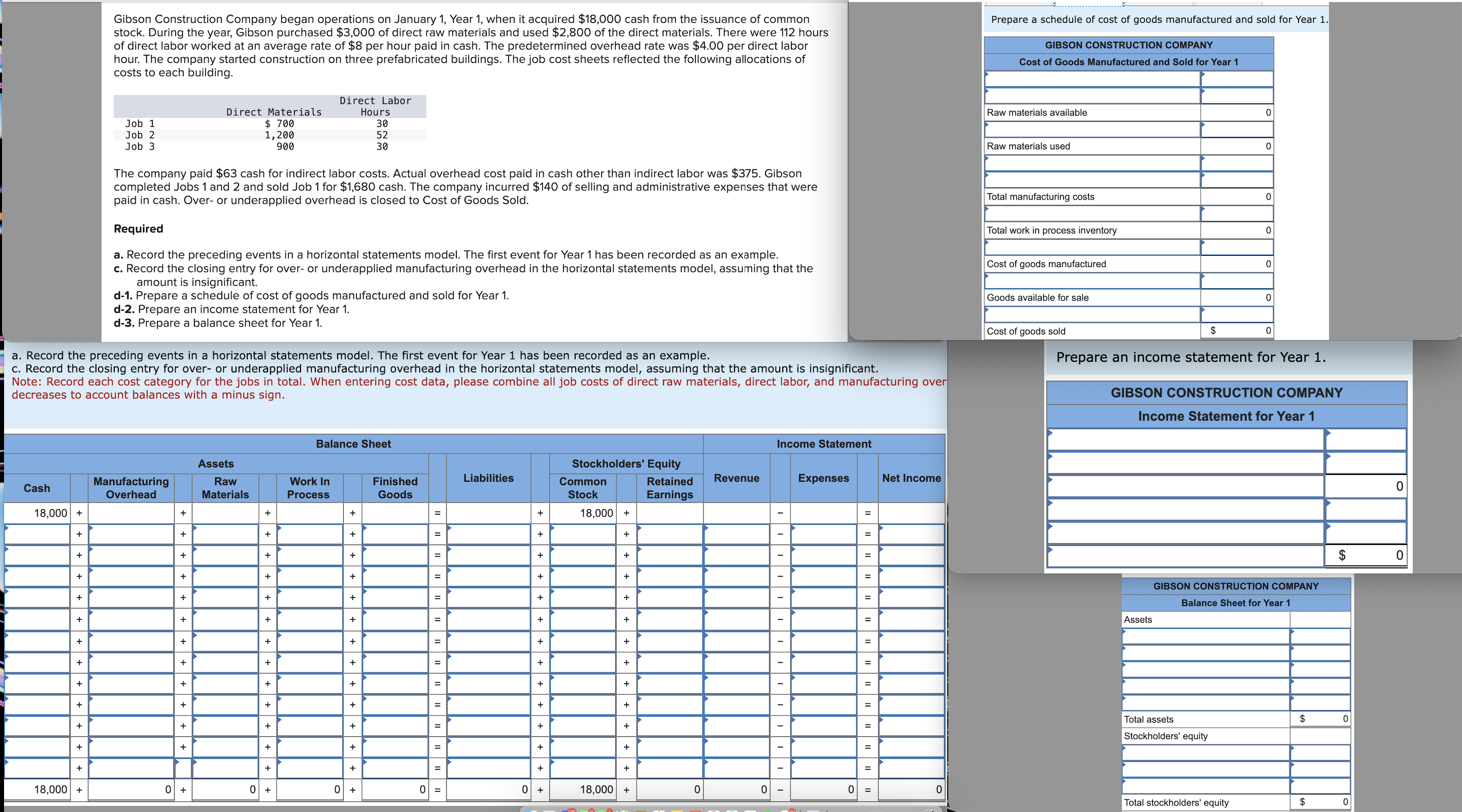

Gibson Construction Company began operations on January 1, Year 1, when it acquired $18,000 cash from the issuance of common stock. During the year, Gibson purchased $3,000 of direct raw materials and used $2,800 of the direct materials. There were 112 hours of direct labor worked at an average rate of $8 per hour paid in cash. The predetermined overhead rate was $4.00 per direct labor hour. The company started construction on three prefabricated buildings. The job cost sheets reflected the following allocations of costs to each building. Prepare a schedule of cost of goods manufactured and sold for Year 1. GIBSON CONSTRUCTION COMPANY Cost of Goods Manufactured and Sold for Year 1 Direct Labor Job 1 Job 2 Job 3 Direct Materials $ 700 Hours 1,200 900 30 52 30 Raw materials available Raw materials used 0 0 The company paid $63 cash for indirect labor costs. Actual overhead cost paid in cash other than indirect labor was $375. Gibson completed Jobs 1 and 2 and sold Job 1 for $1,680 cash. The company incurred $140 of selling and administrative expenses that were paid in cash. Over- or underapplied overhead is closed to Cost of Goods Sold. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d-1. Prepare a schedule of cost of goods manufactured and sold for Year 1. d-2. Prepare an income statement for Year 1. d-3. Prepare a balance sheet for Year 1. a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. Note: Record each cost category for the jobs in total. When entering cost data, please combine all job costs of direct raw materials, direct labor, and manufacturing over decreases to account balances with a minus sign. Total manufacturing costs 0 Total work in process inventory 0 Cost of goods manufactured Goods available for sale 0 0 Cost of goods sold $ 0 Prepare an income statement for Year 1. GIBSON CONSTRUCTION COMPANY Income Statement for Year 1 Cash 18,000 + + Manufacturing Overhead + + Assets Raw Materials + + Balance Sheet Work In Process Finished Goods + = + Liabilities + = + Stockholders' Equity Common Stock Retained Earnings Revenue 18,000+ + + + + + = + + + + + + + + + + = + + + + + + + = + + + + + + + + + + + + = + + + + + + = + + + + + + = + + + + + = + + + + + + + + = + + 0 = 0+ 18,000 + 0 + + 18,000 + 0+ 0 + 0+ Income Statement -|---|--|- - |- Expenses Net Income = = = = Assets = = = = GIBSON CONSTRUCTION COMPANY Balance Sheet for Year 1 EA Total assets Stockholders' equity $ 0 0 = 0 Total stockholders' equity $ 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started