Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Giet gerwine Otfice learn more QUESTION 1 ( 1 4 Marks ) Mr Zuma will be retiring from the Government Employees Pension Fund on 1

Giet gerwine Otfice

learn more

QUESTION Marks

Mr Zuma will be retiring from the Government Employees Pension Fund on

December His total aftertax lump sum is projected to be R and he will receive R in aftertax annuity income. He has no other sources of income and will depend solely on his retirement income. His monthly living expenses after retirement are projected to be R

He intends on investing the retirement lump sum to generate income to supplement his annuity income. Mr Zuma enjoys reading financial news and recently came across a statement Warren Buffet made in one of his annual reports.

In his Berkshire Hathaway annual report, Buffett discussed how a portion of his wife's inheritance would be managed. He directed the trustee to invest in a lowcost S&P index fund and in shortterm government bonds. This split emphasises his faith in index funds for longterm growth while offering some stability with the bonds.

Mr Zuma believes this advice will work perfectly for him as well, since he needs long term growth and stability in his portfolio. Combined with the low fees associated with index funds, he believes this will be the best approach to help him achieve his retirement objectives. He therefore, plans to invest his retirement lump sum in line with this strategy but will rather inwest in a money market fund instead of shortterm government bonds. He is sure that even without any investment skills, he can easily implement Mr Buffet's advice on his own.

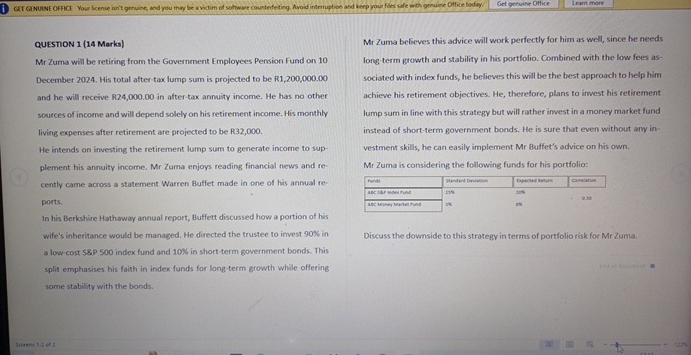

Mr Zuma is considering the following funds for his portfolio:

tablefendeTinsteyd Pricition,Copicies tertant,complitionascisprades tian,ant,

Discuss the downside to this strategy in terms of portfolio risk for Mr Zuma.

Soreens er

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started