Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GigaPsience Inc. is introducing an advanced version of a product that will have a 5-year project life. It requires an immediate (t=0) fixed asset investment

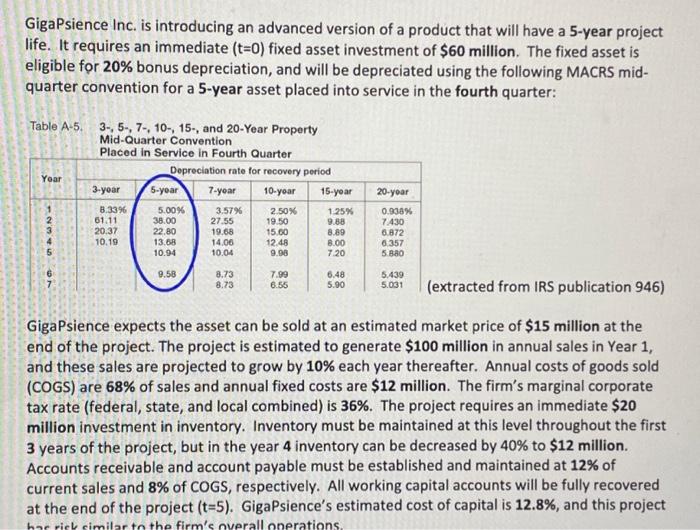

GigaPsience Inc. is introducing an advanced version of a product that will have a 5-year project life. It requires an immediate (t=0) fixed asset investment of $60 million. The fixed asset is eligible for 20% bonus depreciation, and will be depreciated using the following MACRS mid- quarter convention for a 5-year asset placed into service in the fourth quarter: Table A-5. 3-, 5-, 7-, 10-, 15-, and 20-Year Property Mid-Quarter Convention Placed in Service in Fourth Quarter Year 12345 6 3-year 8.33% 61.11 20.37 10.19 Depreciation rate for recovery period 10-year 2.50% 5-year 5.00% 38.00 22.80 13.68 10.94 9.58 7-year 3.57% 27.55 19.68 14.06 10.04 8.73 8.73 19.50 15.60 12.48 9.98 7.99 6.55 15-year 1.25% 9.88 8.89 8.00 7.20 6.48 5.90 20-year 0.938% 7.430 6.872 6.357 5.880 5.439 5.031 (extracted from IRS publication 946) GigaPsience expects the asset can be sold at an estimated market price of $15 million at the end of the project. The project is estimated to generate $100 million in annual sales in Year 1, and these sales are projected to grow by 10% each year thereafter. Annual costs of goods sold (COGS) are 68% of sales and annual fixed costs are $12 million. The firm's marginal corporate tax rate (federal, state, and local combined) is 36%. The project requires an immediate $20 million investment in inventory. Inventory must be maintained at this level throughout the first 3 years of the project, but in the year 4 inventory can be decreased by 40% to $12 million. Accounts receivable and account payable must be established and maintained at 12% of current sales and 8% of COGS, respectively. All working capital accounts will be fully recovered at the end of the project (t=5). GigaPsience's estimated cost of capital is 12.8%, and this project has risk similar to the firm's overall operations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started