Answered step by step

Verified Expert Solution

Question

1 Approved Answer

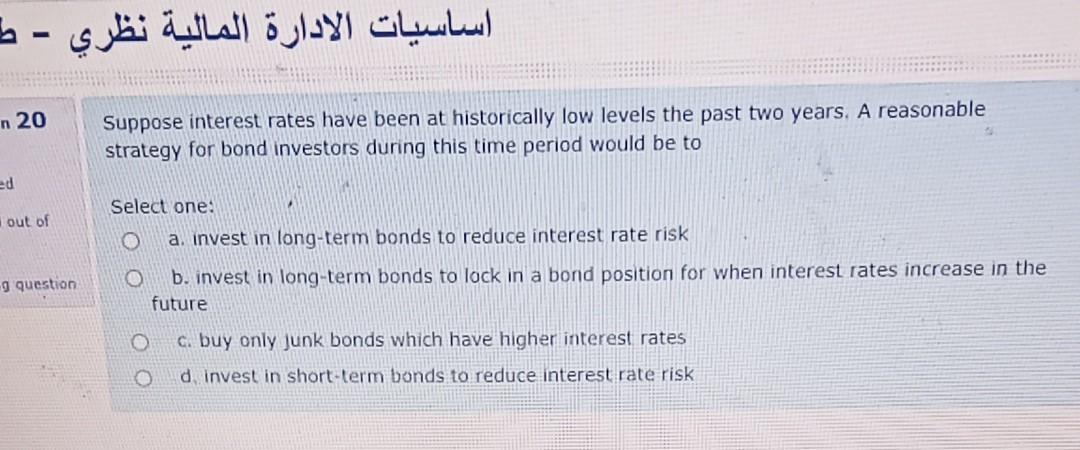

- n 20 Suppose interest rates have been at historically low levels the past two years. A reasonable strategy for bond investors during this time

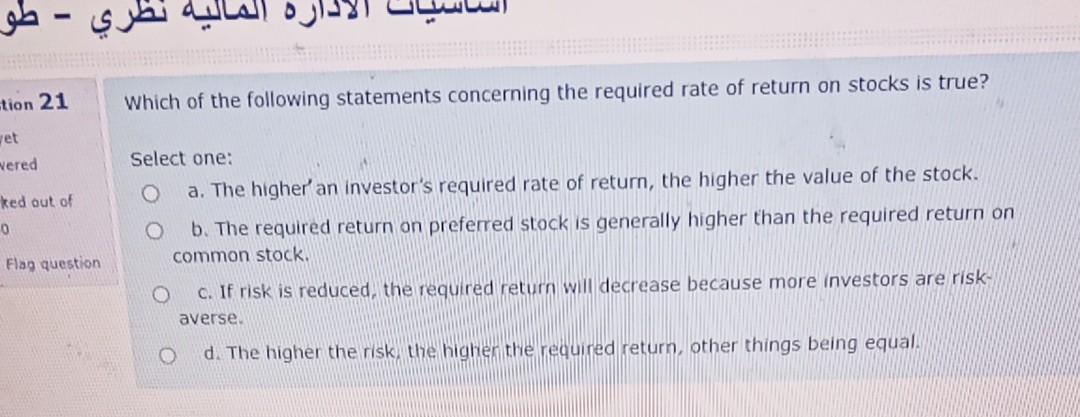

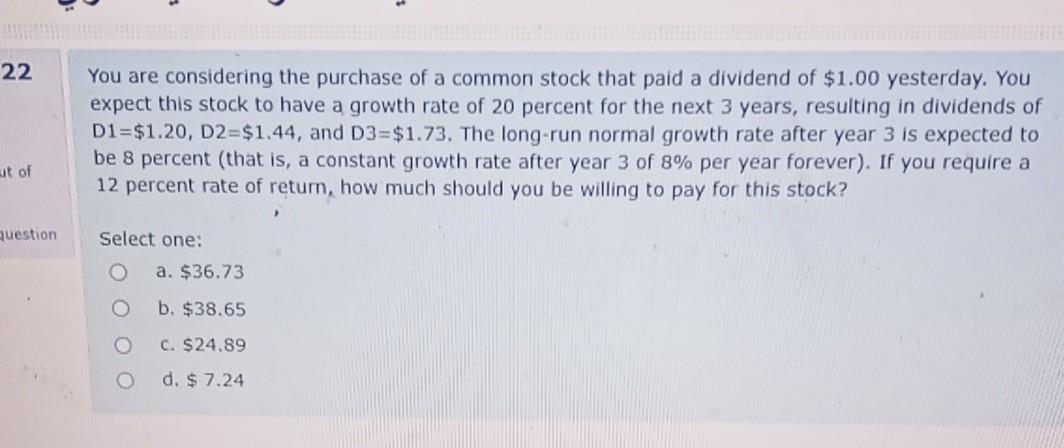

- n 20 Suppose interest rates have been at historically low levels the past two years. A reasonable strategy for bond investors during this time period would be to ed out of Select one: a, invest in long-term bonds to reduce interest rate risk b. invest in long-term bonds to lock in a bond position for when interest rates increase in the future -g question c. buy only junk bonds which have higher interest rates d invest in short-term bonds to reduce interest rate risk tion 21 Which of the following statements concerning the required rate of return on stocks is true? vet wered ked out of 0 Flag question Select one: o a. The higher' an investor's required rate of return, the higher the value of the stock. O b. The required return on preferred stock is generally higher than the required return on common stock. c. If risk is reduced, the required return will decrease because more investors are risk- averse O d. The higher the risk the higher the required return, other things being equal. 22 You are considering the purchase of a common stock that paid a dividend of $1.00 yesterday. You expect this stock to have a growth rate of 20 percent for the next 3 years, resulting in dividends of D1=$1.20, D2=$1.44, and D3=$1.73. The long-run normal growth rate after year 3 is expected to be 8 percent (that is, a constant growth rate after year 3 of 8% per year forever). If you require a 12 percent rate of return, how much should you be willing to pay for this stock? at of question Select one: a. $36.73 b. $38.65 C. $24.89 o d. $ 7.24 - n 20 Suppose interest rates have been at historically low levels the past two years. A reasonable strategy for bond investors during this time period would be to ed out of Select one: a, invest in long-term bonds to reduce interest rate risk b. invest in long-term bonds to lock in a bond position for when interest rates increase in the future -g question c. buy only junk bonds which have higher interest rates d invest in short-term bonds to reduce interest rate risk tion 21 Which of the following statements concerning the required rate of return on stocks is true? vet wered ked out of 0 Flag question Select one: o a. The higher' an investor's required rate of return, the higher the value of the stock. O b. The required return on preferred stock is generally higher than the required return on common stock. c. If risk is reduced, the required return will decrease because more investors are risk- averse O d. The higher the risk the higher the required return, other things being equal. 22 You are considering the purchase of a common stock that paid a dividend of $1.00 yesterday. You expect this stock to have a growth rate of 20 percent for the next 3 years, resulting in dividends of D1=$1.20, D2=$1.44, and D3=$1.73. The long-run normal growth rate after year 3 is expected to be 8 percent (that is, a constant growth rate after year 3 of 8% per year forever). If you require a 12 percent rate of return, how much should you be willing to pay for this stock? at of question Select one: a. $36.73 b. $38.65 C. $24.89 o d. $ 7.24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started