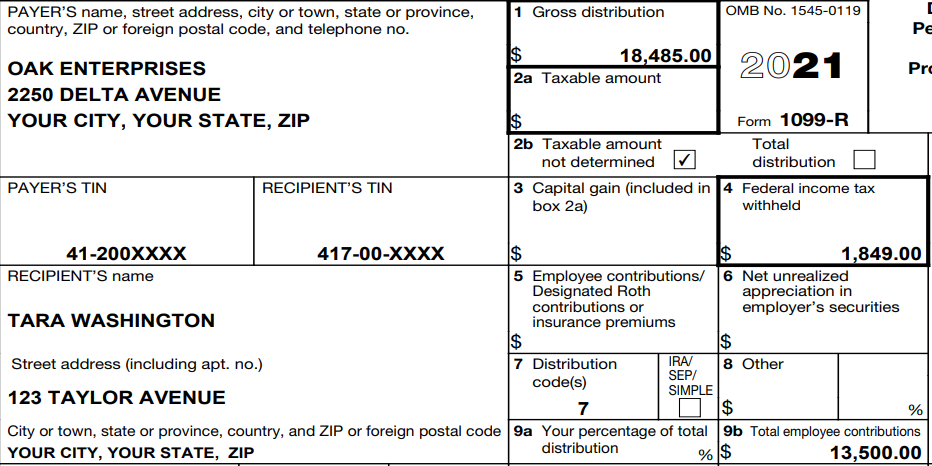

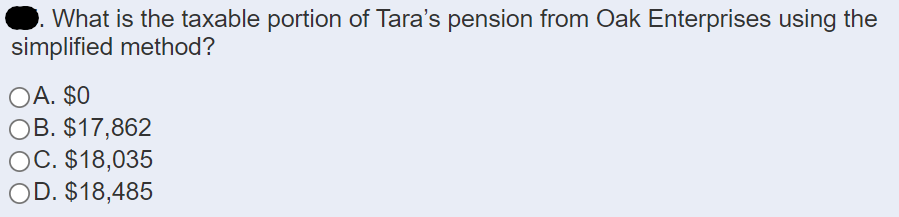

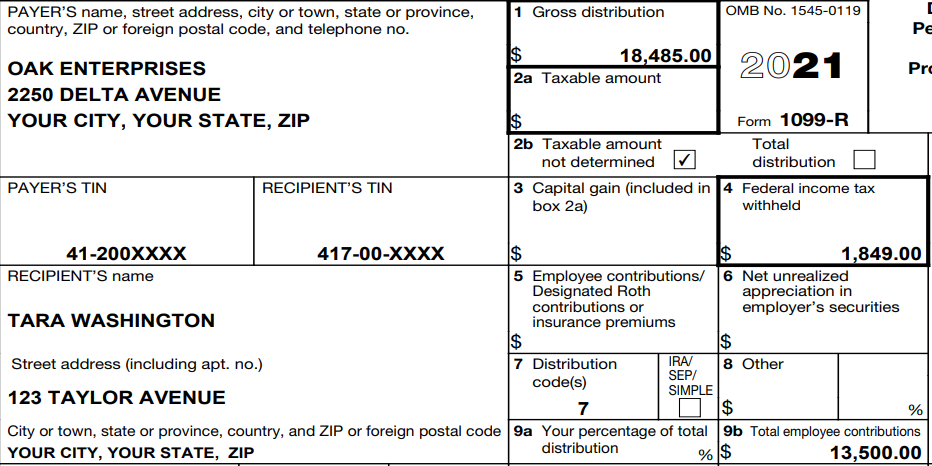

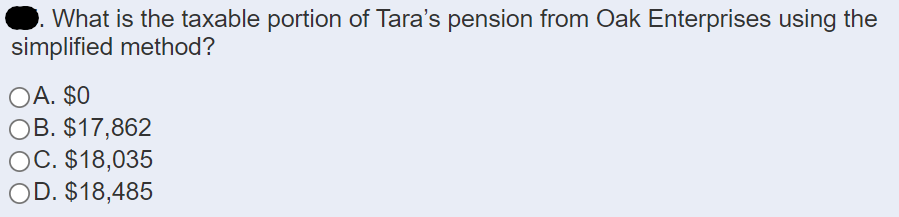

Gilbert is an elementary school teacher at a public school. Gilbert and Tara are married and choose to file Married Filing Jointly on their 2021 tax return. Gilbert worked a total of 1,280 hours in 2021. During the school year, he spent $500 on unreimbursed classroom expenses. Tara retired in 2018 and began receiving her pension on October 1st of that year. She explains that this is a joint and survivor annuity. She has already recovered $1,013 of the cost of the plan. Gilbert settled with his credit card company on an outstanding bill and brought the Form 1099-C to the site. They aren't sure how it will impact their tax return for tax year 2021. The Washingtons determined that they were solvent as of the date of the canceled debt. Tara won $3,000 gambling at a casino and had additional lottery winnings of $150. Tara has documented casino losses of $1,500. Their son, Chandler, is in his second year of college pursuing a bachelor's degree in Logistics at a qualified educational institution. He received a scholarship and the terms require that it be used to pay tuition. Box 2 was not filled in and Box 7 was not checked on his Form 1098-T for the previous tax year. The Washingtons provided Form 1098-T and an account statement from the college that included additional expenses. The Washingtons paid $450 for books required for Chandler's courses. This information is also included on the College statement of account. Chandler does not have a felony drug conviction. The Washington's received the third Economic Impact Payment (EIP3) in the amount of $4,200 in 2021. . They are all U.S. citizens with valid Social Security numbers. PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. 1 Gross distribution OMB No. 1545-0119 PE $ 18,485.00 2a Taxable amount 2021 Pro OAK ENTERPRISES 2250 DELTA AVENUE YOUR CITY, YOUR STATE, ZIP $ Form 1099-R 2b Taxable amount Total not determined distribution 3 Capital gain (included in 4 Federal income tax box 2a) withheld PAYER'S TIN RECIPIENT'S TIN 41-200XXXX 417-00-XXXX $ 1,849.00 RECIPIENT'S name 5 Employee contributions/ 6 Net unrealized Designated Roth appreciation in contributions or employer's securities TARA WASHINGTON insurance premiums $ $ Street address (including apt. no.) 7 Distribution IRA 8 Other SEP/ code(s) 123 TAYLOR AVENUE SIMPLE 7 $ % City or town, state or province, country, and ZIP or foreign postal code 9a Your percentage of total 9b Total employee contributions YOUR CITY, YOUR STATE, ZIP distribution % $ 13,500.00 $ What is the taxable portion of Tara's pension from Oak Enterprises using the simplified method? OA. $0 OB. $17,862 OC. $18,035 OD. $18,485