Question

Gild owns 60% of Leeds. On january 1 2008 Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 1, 2004

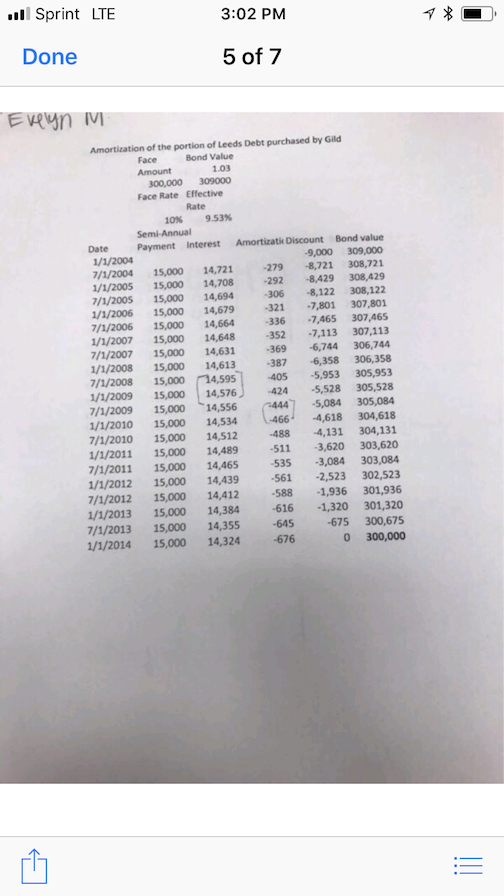

Gild owns 60% of Leeds. On january 1 2008 Gild purchased 50 percent of Leeds' bonds outstanding which were originally issued on January 1, 2004 at 103. The total bond issue has a face value of $600,000, pays 10 percent interest semi-annually, and has a 10 year maturity. Any premium or discount is amortized using the effective interest method. Gild paid $298,000 for its investment in Leeds' bonds and intends to hold the bonds until maturity. Assume Gild accounts for its investment in Leeds stock using the fully adjusted equity method.

Required

A) Present the worksheet elimination entries related to the debt necessary to prepare consolidated financial statements for 2008.

B) Present the worksheet elimination entries necessary to prepare consolidated financial statements for 2009.

Sprint LTE 3:02 PM Done 5 of 7 Amortization of the portion of Leeds Debt purchased by Gild Face Bond Value 300,000 309000 Face Rate Effective 10% 953% Date Payment Interest Amortizati Discount Bond value 1/1/2004 9,000 309,000 /1/2004 15,000 14,721 279 -8,721 308,72:1 1/1/2005 15,000 14,708 292 8,429 308,429 7/1/2005 15,000 14,694 306 8,122 308,122 1/1/2006 15,000 14,679 321 7,801 307,801 7/1/2006 15,000 14,664 -336 7,465 307,465 1/1/2007 15,000 14,648 -352 7,113 307,113 /1/2007 15,000 14,631 369 6,744 306,744 1/1/2008 15,000 14,613 -387 6,358 306,358 7/1/2008 15,000 4,595 405 5,953 305,953 1/1/2009 15,000 14,576 424 5,528 305,528 7/1/2009 15,000 ,556 444 5,084 305,084 1/1/2010 15,000 14,534 466 4,618 304,618 7/1/2010 15,000 14,512488 4,131 304,131 1/1/2011 15,000 14,489511 -3,620 303,620 /1/2011 15,000 14,465 535 3,084 303,084 1/1/2012 15,000 14,439 561 2,523 302,523 7/1/2012 15,000 14,412 -588 1,936 301,936 1/1/2013 15,000 14,384 616 1,320 301,320 7/1/2013 15,000 14,355-645 -675 300,675 1/1/2014 15,000 14,324-676 0 300,000 Sprint LTE 3:02 PM Done 5 of 7 Amortization of the portion of Leeds Debt purchased by Gild Face Bond Value 300,000 309000 Face Rate Effective 10% 953% Date Payment Interest Amortizati Discount Bond value 1/1/2004 9,000 309,000 /1/2004 15,000 14,721 279 -8,721 308,72:1 1/1/2005 15,000 14,708 292 8,429 308,429 7/1/2005 15,000 14,694 306 8,122 308,122 1/1/2006 15,000 14,679 321 7,801 307,801 7/1/2006 15,000 14,664 -336 7,465 307,465 1/1/2007 15,000 14,648 -352 7,113 307,113 /1/2007 15,000 14,631 369 6,744 306,744 1/1/2008 15,000 14,613 -387 6,358 306,358 7/1/2008 15,000 4,595 405 5,953 305,953 1/1/2009 15,000 14,576 424 5,528 305,528 7/1/2009 15,000 ,556 444 5,084 305,084 1/1/2010 15,000 14,534 466 4,618 304,618 7/1/2010 15,000 14,512488 4,131 304,131 1/1/2011 15,000 14,489511 -3,620 303,620 /1/2011 15,000 14,465 535 3,084 303,084 1/1/2012 15,000 14,439 561 2,523 302,523 7/1/2012 15,000 14,412 -588 1,936 301,936 1/1/2013 15,000 14,384 616 1,320 301,320 7/1/2013 15,000 14,355-645 -675 300,675 1/1/2014 15,000 14,324-676 0 300,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started