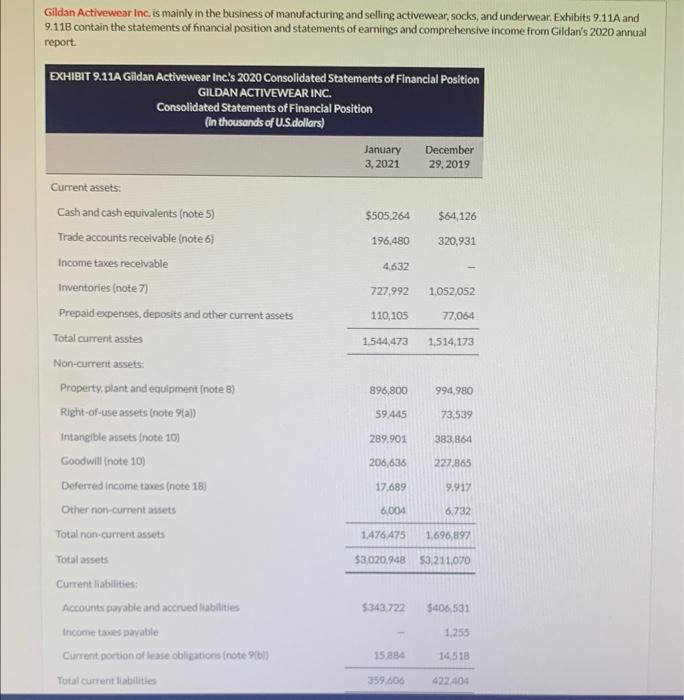

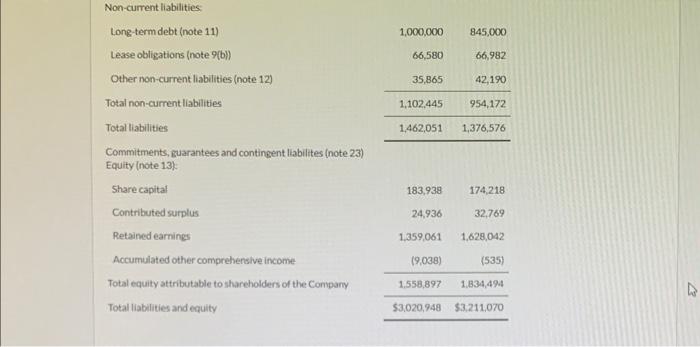

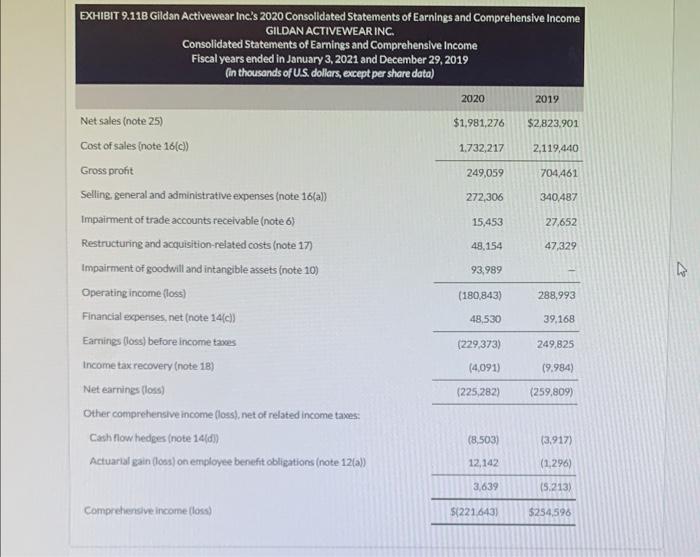

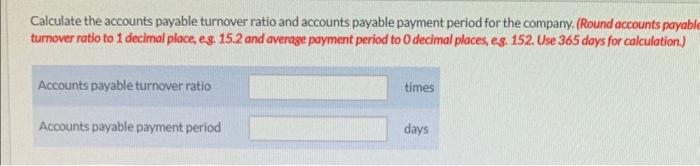

Gildan Activewoar inc is mainly in the business of manufacturing and selling activewear, socks, and underwear. Exhibits 9.11A and icome from Gildan's 2020 annual Non-cument liabilities: Long-term debt (note 11) Lease obligations (note 9(b)) Other non-current liabilities (note 12) Total non-current liabilities Total liabilities \begin{tabular}{rr} 35,865 & 42,190 \\ \hline 1,102,445 & 954,172 \\ \hline 1,462,051 & 1,376,576 \\ \hline \end{tabular} Commitments, guarantees and contingent liabilites (note 23) Equity (note 13): Share capital Contributed surplus Retained earnings Accumulated other comprehensive income Total equity attributable to shareholders of the Company Total liabiities and equity \begin{tabular}{rr} (9,038) & (535) \\ \hline 1,558,897 & 1,834,494 \\ \hline$3,020,948 & $3,211,070 \\ \hline \end{tabular} EXHIBIT 9.118 Gildan Activewear Inc's 2020 Consolidated Statements of Earnings and Comprehensive Income GILDANACTIVEWEARINC. Consolidated Statements of Eamings and Comprehensive Income Fiscal years ended in January 3,2021 and December 29,2019 (in thousonds of US. dollars, exept per share data) 2020 Net sales (note 25) $1,981,276$2,823,901 Cost of sales (note 16(c)) Gross profit \begin{tabular}{c|c} \hline 1,732,217 & 2,119,440 \\ \hline 249,059 & 704,461 \end{tabular} Selling general and administrative expenses (note 16 (a)) Impairment of trade accounts recelvable (note 6) Restructuring and acquisition-related costs (note 17) Impairment of goodwill and intangible assets (note 10) Operating income (loss) Financial expenses, net (note 14(c)) Earnings (loss) before income twoss Income tax recovery (note 18) Net earnings (loss) Other comprehensive income (loss), net of related income taves: Cach now hedges (note 14(d)) Actuarial gain (locs) on employee benefit oblieations (note 12(a)) Comprehersive income (loss) \begin{tabular}{r|r} \hline(8,503) & (3,917) \\ 12,142 & (1,296) \\ \hline 3,639 & (5.213) \\ \hline$(221,643) & $254.596 \\ \hline \end{tabular} Calculate the company's working capital for 2020 and 2019. (Enter amounts in thousands of dollars) eTextbook and Media Attempts: 0 (b) Calculate the current and quick ratios for 2020 and 2019. (Round answers to 1 decimal ploce, es. 15.1) Comment on trends: Calculate the accounts payable turnover ratio and accounts payable payment period for the company. (Round accounts payab) turnover ratio to 1 decimal place, eg. 15.2 and average payment period to 0 decimal ploces, eg. 152. Use 365 days for calculation.)