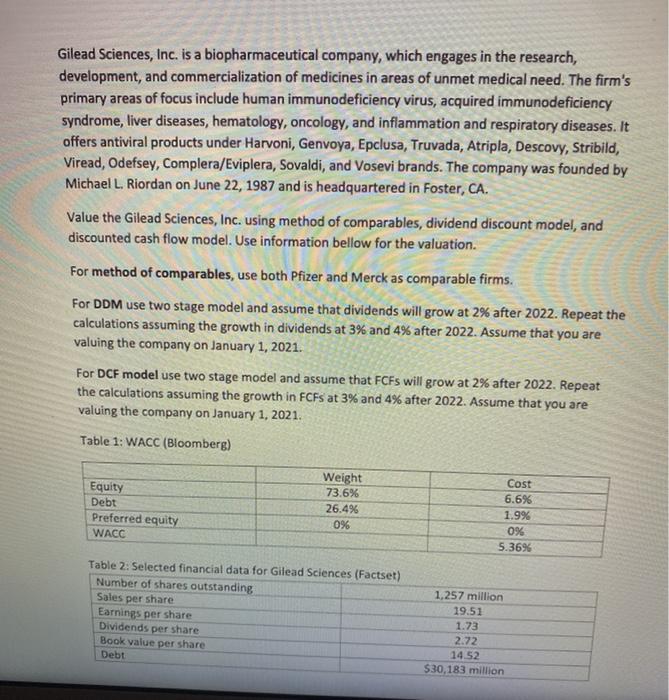

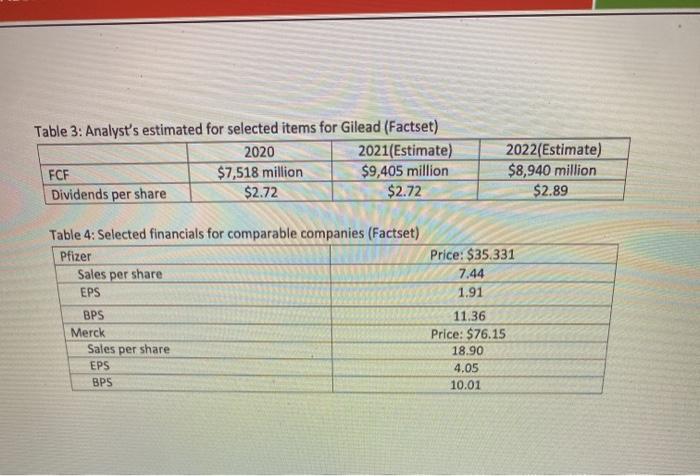

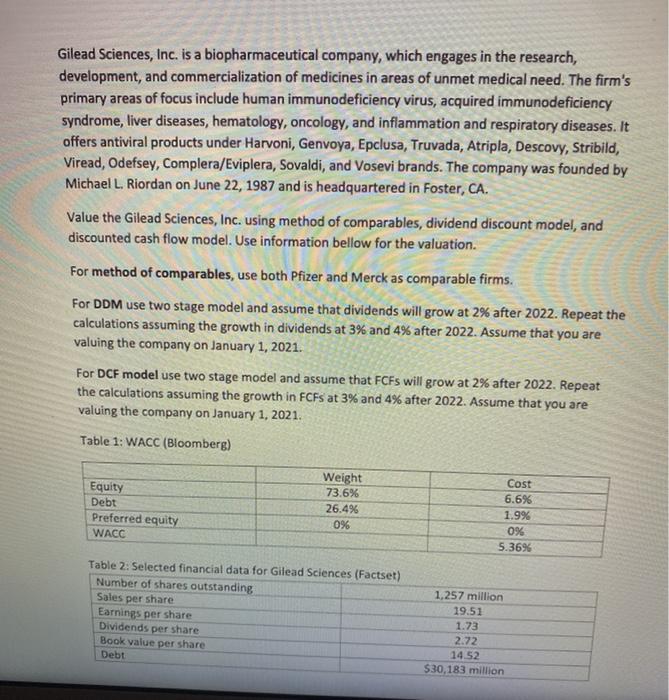

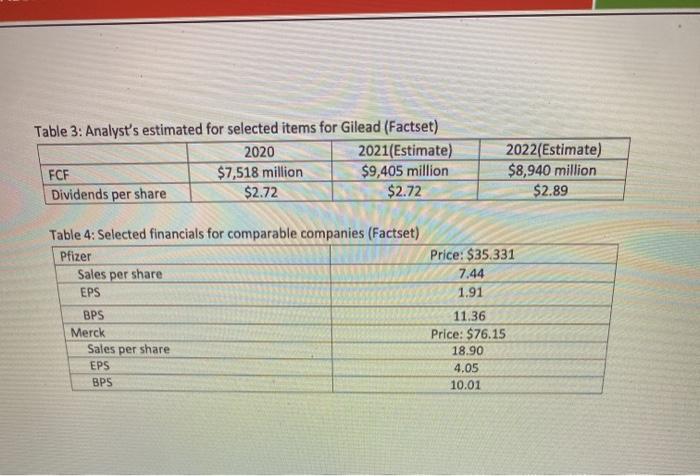

Gilead Sciences, Inc. is a biopharmaceutical company, which engages in the research, development, and commercialization of medicines in areas of unmet medical need. The firm's primary areas of focus include human immunodeficiency virus, acquired immunodeficiency syndrome, liver diseases, hematology, oncology, and inflammation and respiratory diseases. It offers antiviral products under Harvoni, Genvoya, Epclusa, Truvada, Atripla, Descovy, Stribild, Viread, Odefsey, Complera/Eviplera, Sovaldi, and Vosevi brands. The company was founded by Michael L. Riordan on June 22, 1987 and is headquartered in Foster, CA. Value the Gilead Sciences, Inc. using method of comparables, dividend discount model, and discounted cash flow model. Use information bellow for the valuation. For method of comparables, use both Pfizer and Merck as comparable firms. For DDM use two stage model and assume that dividends will grow at 2% after 2022. Repeat the calculations assuming the growth in dividends at 3% and 4% after 2022. Assume that you are valuing the company on January 1, 2021. For DCF model use two stage model and assume that FCFs will grow at 2% after 2022. Repeat the calculations assuming the growth in FCFs at 3% and 4% after 2022. Assume that you are valuing the company on January 1, 2021. Table 1: WACC (Bloomberg) Equity Debt Preferred equity WACC Weight 73.6% 26.4% 0% Cost 6.6% 1.996 0% 5.36% Table 2: Selected financial data for Gilead Sciences (Factset) Number of shares outstanding Sales per share Earnings per share Dividends per share Book value per share Debt 1,257 million 19.51 1.73 2.72 14.52 $30,183 million Table 3: Analyst's estimated for selected items for Gilead (Factset) 2020 2021(Estimate) FCF $7,518 million $9,405 million Dividends per share $2.72 $2.72 2022(Estimate) $8,940 million $2.89 Table 4: Selected financials for comparable companies (Factset) Pfizer Sales per share EPS BPS Merck Sales per share EPS BPS Price: $35.331 7.44 1.91 11.36 Price: $76.15 18.90 4.05 10.01 Gilead Sciences, Inc. is a biopharmaceutical company, which engages in the research, development, and commercialization of medicines in areas of unmet medical need. The firm's primary areas of focus include human immunodeficiency virus, acquired immunodeficiency syndrome, liver diseases, hematology, oncology, and inflammation and respiratory diseases. It offers antiviral products under Harvoni, Genvoya, Epclusa, Truvada, Atripla, Descovy, Stribild, Viread, Odefsey, Complera/Eviplera, Sovaldi, and Vosevi brands. The company was founded by Michael L. Riordan on June 22, 1987 and is headquartered in Foster, CA. Value the Gilead Sciences, Inc. using method of comparables, dividend discount model, and discounted cash flow model. Use information bellow for the valuation. For method of comparables, use both Pfizer and Merck as comparable firms. For DDM use two stage model and assume that dividends will grow at 2% after 2022. Repeat the calculations assuming the growth in dividends at 3% and 4% after 2022. Assume that you are valuing the company on January 1, 2021. For DCF model use two stage model and assume that FCFs will grow at 2% after 2022. Repeat the calculations assuming the growth in FCFs at 3% and 4% after 2022. Assume that you are valuing the company on January 1, 2021. Table 1: WACC (Bloomberg) Equity Debt Preferred equity WACC Weight 73.6% 26.4% 0% Cost 6.6% 1.996 0% 5.36% Table 2: Selected financial data for Gilead Sciences (Factset) Number of shares outstanding Sales per share Earnings per share Dividends per share Book value per share Debt 1,257 million 19.51 1.73 2.72 14.52 $30,183 million Table 3: Analyst's estimated for selected items for Gilead (Factset) 2020 2021(Estimate) FCF $7,518 million $9,405 million Dividends per share $2.72 $2.72 2022(Estimate) $8,940 million $2.89 Table 4: Selected financials for comparable companies (Factset) Pfizer Sales per share EPS BPS Merck Sales per share EPS BPS Price: $35.331 7.44 1.91 11.36 Price: $76.15 18.90 4.05 10.01