Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gilpin Manufacturing, Inc. has a manufacturing machine that needs attention. View the additional information. View the net cash flows. Gilpin Manufacturing. Inc. uses straight -

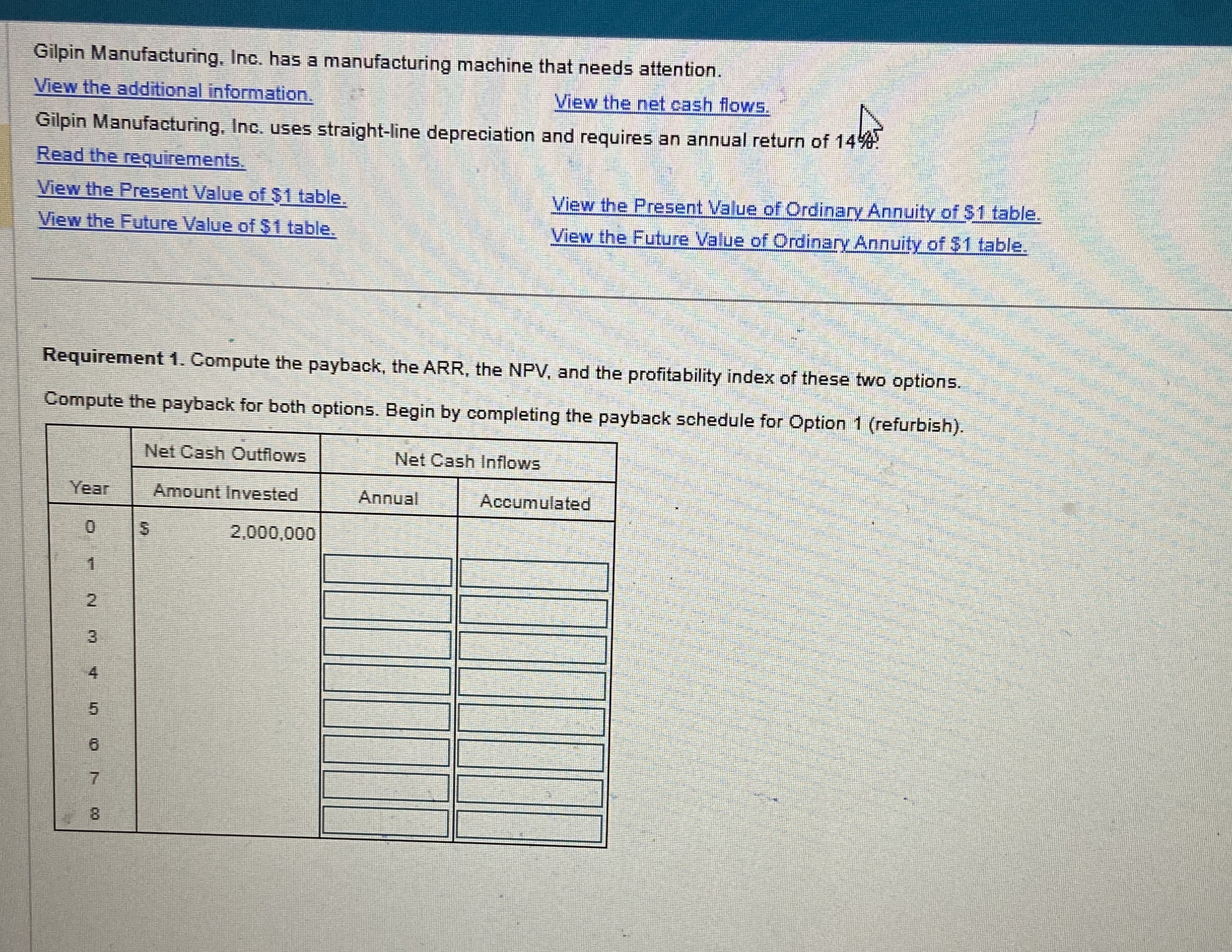

Gilpin Manufacturing, Inc. has a manufacturing machine that needs attention.

View the additional information.

View the net cash flows.

Gilpin Manufacturing. Inc. uses straightline depreciation and requires an annual return of

Read the requirements.

View the Present Value of $ table.

View the Future Value of $ table.

View the Present Value of Ordinary Annuity of $ table.

View the Future Value of Ordinary Annuity of $ table.

Requirement Compute the payback, the ARR, the NPV and the profitability index of these two options.

Compute the payback for both options. Begin by completing the payback schedule for Option refurbish

tableYearNet Cash Outflows,Net Cash InflowsAmount Invested,Annual,Accumulatedztable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started