This is a new company. Question: create a first-year cash budget, three-year balance sheet, and three-year income statement. The first-year budget should be broken down monthly. Details are below:

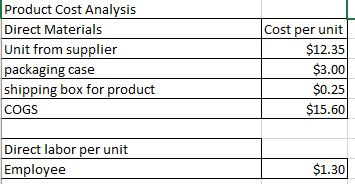

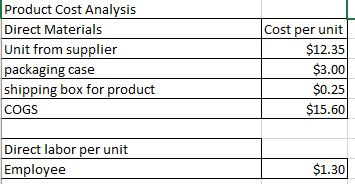

COGS are 15.60 per unit

Direct labor is 1.30 per unit

Variable MOH is 32.15 per unit

Fixed MOH is 12855 per month

Patent 14000 (one time fee)

Bank loan 300000 (The entire loan will be given in month 1 for the opening balance).

Repayment period 6 years

Interest rate 4%

Estimated production 510 per month

Product cost 85.95

Starting inventory is 1000 units ($15,600 total cost)

The company does not extend credit to anyone

It has no business partners or investors during this time period.

It will pay up front for the units that it purchases from its suppliers.

Owners capital is $10000

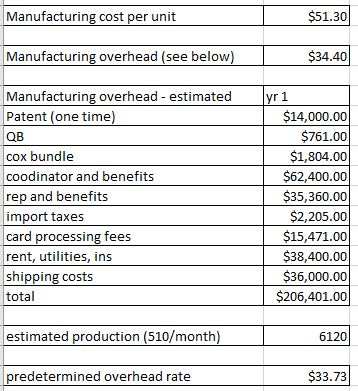

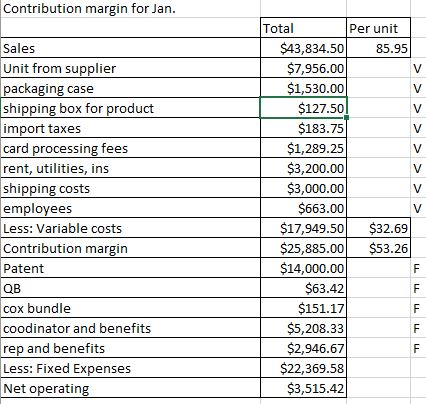

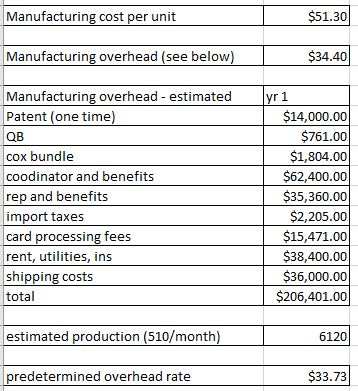

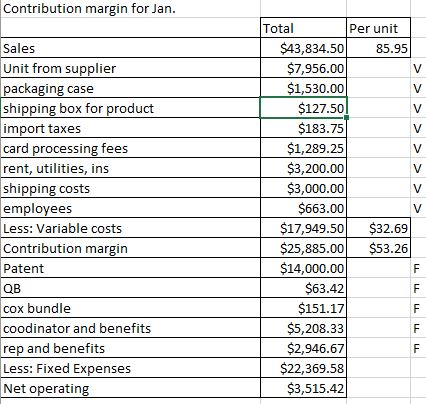

Product Cost Analysis Direct Materials Unit from supplier packaging case shipping box for product COGS Cost per unit $12.35 $3.00 $0.25 $15.60 Direct labor per unit Employee $1.30 Manufacturing cost per unit $51.30 Manufacturing overhead (see below) $34.40 yr 1 Manufacturing overhead - estimated Patent (one time) QB cox bundle coodinator and benefits rep and benefits import taxes card processing fees rent, utilities, ins shipping costs total $14,000.00 $761.00 $1,804.00 $62,400.00 $35,360.00 $2,205.00 $15,471.001 $38,400.00 $36,000.00 $206,401.00 estimated production (510/month) 6120 predetermined overhead rate $33.73 Contribution margin for Jan. V V V Total Per unit $43,834.50 85.95 $7,956.00 $1,530.00 $127.50 $183.75 $1,289.25 $3,200.00 $3,000.00 $663.00 $17,949.50 $32.69 $25,885.00 $53.26 $14,000.00 $63.42 $151.17 $5,208.33 $2,946.67 $22,369.58 $3,515.42 Sales Unit from supplier packaging case shipping box for product import taxes card processing fees rent, utilities, ins shipping costs employees Less: Variable costs Contribution margin Patent QB cox bundle coodinator and benefits rep and benefits Less: Fixed Expenses Net operating V V V V V F F 11 11 F Product Cost Analysis Direct Materials Unit from supplier packaging case shipping box for product COGS Cost per unit $12.35 $3.00 $0.25 $15.60 Direct labor per unit Employee $1.30 Manufacturing cost per unit $51.30 Manufacturing overhead (see below) $34.40 yr 1 Manufacturing overhead - estimated Patent (one time) QB cox bundle coodinator and benefits rep and benefits import taxes card processing fees rent, utilities, ins shipping costs total $14,000.00 $761.00 $1,804.00 $62,400.00 $35,360.00 $2,205.00 $15,471.001 $38,400.00 $36,000.00 $206,401.00 estimated production (510/month) 6120 predetermined overhead rate $33.73 Contribution margin for Jan. V V V Total Per unit $43,834.50 85.95 $7,956.00 $1,530.00 $127.50 $183.75 $1,289.25 $3,200.00 $3,000.00 $663.00 $17,949.50 $32.69 $25,885.00 $53.26 $14,000.00 $63.42 $151.17 $5,208.33 $2,946.67 $22,369.58 $3,515.42 Sales Unit from supplier packaging case shipping box for product import taxes card processing fees rent, utilities, ins shipping costs employees Less: Variable costs Contribution margin Patent QB cox bundle coodinator and benefits rep and benefits Less: Fixed Expenses Net operating V V V V V F F 11 11 F