Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gina Haley works for an employer located in Manitoba, which follows Manitoba Employment Standards. The following information is available for the weekly pay period

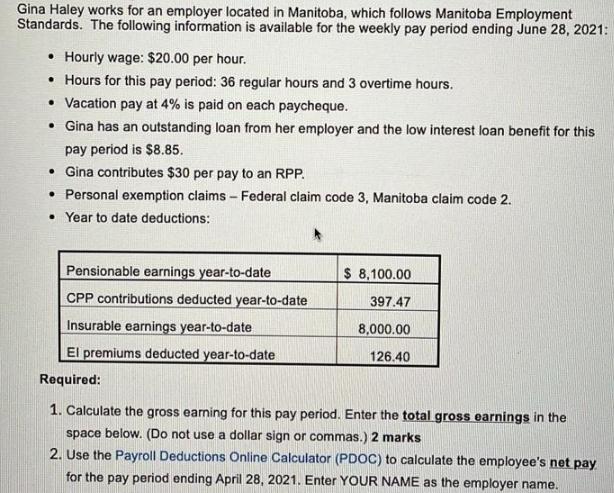

Gina Haley works for an employer located in Manitoba, which follows Manitoba Employment Standards. The following information is available for the weekly pay period ending June 28, 2021: Hourly wage: $20.00 per hour. Hours for this pay period: 36 regular hours and 3 overtime hours. Vacation pay at 4% is paid on each paycheque. Gina has an outstanding loan from her employer and the low interest loan benefit for this pay period is $8.85. Gina contributes $30 per pay to an RPP. Personal exemption claims - Federal claim code 3, Manitoba claim code 2. Year to date deductions: Pensionable earnings year-to-date CPP contributions deducted year-to-date Insurable earnings year-to-date El premiums deducted year-to-date Required: $ 8,100.00 397.47 8,000.00 126.40 1. Calculate the gross earning for this pay period. Enter the total gross earnings in the space below. (Do not use a dollar sign or ommas.) 2 marks 2. Use the Payroll Deductions Online Calculator (PDOC) to calculate the employee's net pay for the pay period ending April 28, 2021. Enter YOUR NAME as the employer name.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Kina Haley weekly payment 20 per ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started