Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Aisyah's financial and personal position for the tax year 2019 are as follows: Her salary working as an economist RM5.120 per month. She

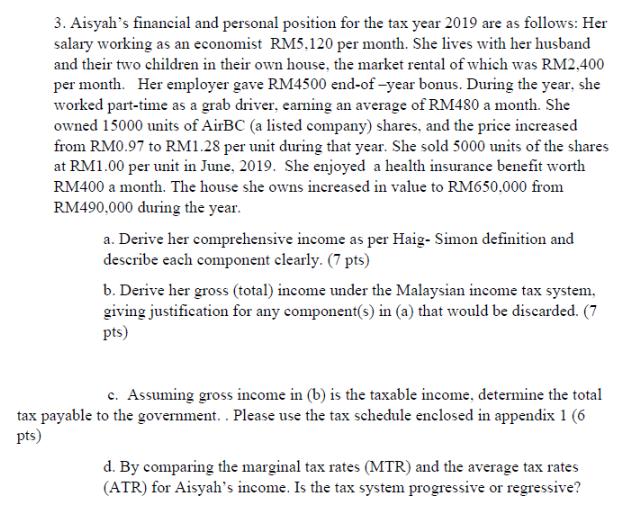

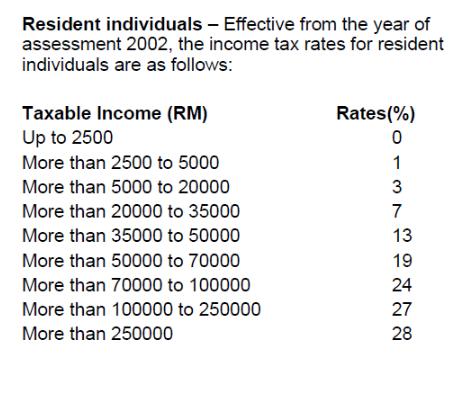

3. Aisyah's financial and personal position for the tax year 2019 are as follows: Her salary working as an economist RM5.120 per month. She lives with her husband and their two children in their own house, the market rental of which was RM2,400 per month. Her employer gave RM4500 end-of-year bonus. During the year, she worked part-time as a grab driver, earning an average of RM480 a month. She owned 15000 units of AirBC (a listed company) shares, and the price increased from RM0.97 to RM1.28 per unit during that year. She sold 5000 units of the shares at RM1.00 per unit in June, 2019. She enjoyed a health insurance benefit worth RM400 a month. The house she owns increased in value to RM650.000 from RM490,000 during the year. a. Derive her comprehensive income as per Haig- Simon definition and describe each component clearly. (7 pts) b. Derive her gross (total) income under the Malaysian income tax system, giving justification for any component(s) in (a) that would be discarded. (7 pts) c. Assuming gross income in (b) is the taxable income, determine the total tax payable to the government. . Please use the tax schedule enclosed in appendix 1 (6 pts) d. By comparing the marginal tax rates (MTR) and the average tax rates (ATR) for Aisyah's income. Is the tax system progressive or regressive? Resident individuals - Effective from the year of assessment 2002, the income tax rates for resident individuals are as follows: Taxable Income (RM) Up to 2500 More than 2500 to 5000 More than 5000 to 20000 More than 20000 to 35000 More than 35000 to 50000 More than 50000 to 70000 More than 70000 to 100000 More than 100000 to 250000 More than 250000 Rates (%) 0 TANSONN8 1 3 7 13 19 24 27 28

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

aAisyahs comprehensive income for the tax year 2019 would include her salary the market rental of her house her endofyear bonus her income from parttime work as a grab driver the sale of her shares he...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started