ginance for corporate action

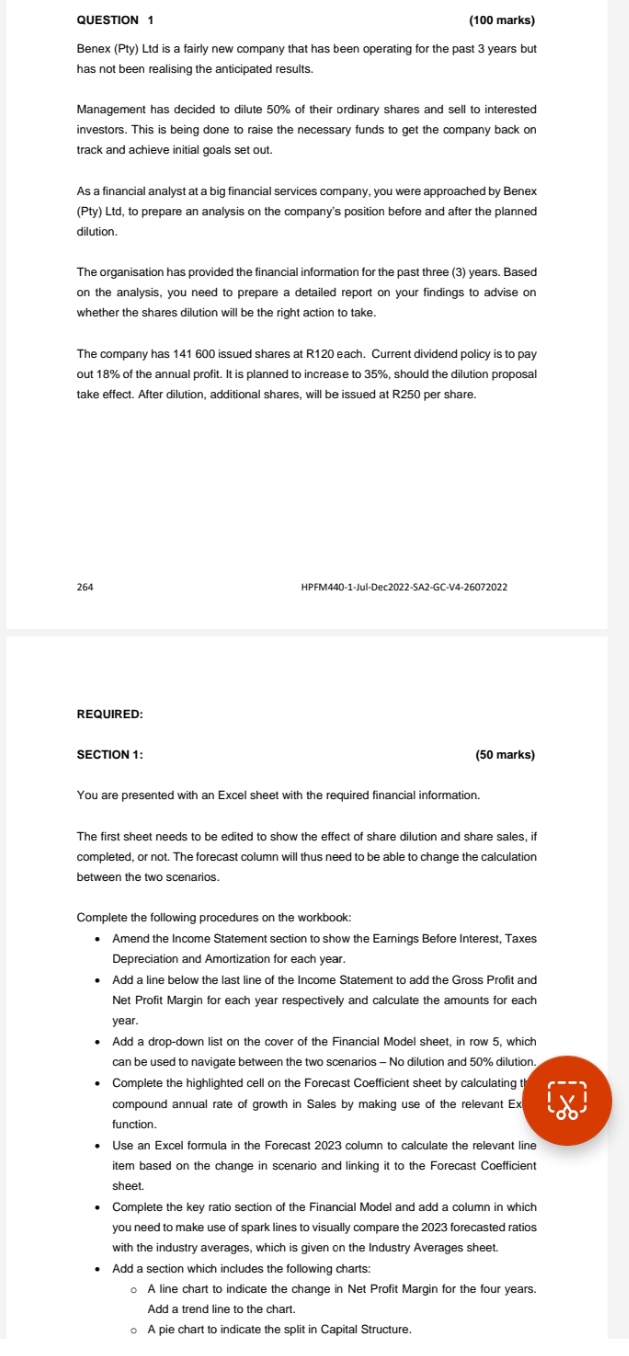

QUESTION 1 (100 marks) Benex (Pty) Lid is a fairly new company that has been operating for the past 3 years but has not been realising the anticipated results. Management has decided to dilute 50% of their ordinary shares and sell to interested investors. This is being done to raise the necessary funds to get the company back on track and achieve initial goals set out. As a financial analyst at a big financial services company, you were approached by Benex (Pty) Lid, to prepare an analysis on the company's position before and after the planned dilution. The organisation has provided the financial information for the past three (3) years. Based on the analysis, you need to prepare a detailed report on your findings to advise on whether the shares dilution will be the right action to take. The company has 141 600 issued shares at R120 each. Current dividend policy is to pay out 18% of the annual profit. It is planned to increase to 35%, should the dilution proposal take effect. After dilution, additional shares, will be issued at R250 per share. 264 HPFM440-1-Jul-Dec2022-SA2-GC-V4-26072022 REQUIRED: SECTION 1: (50 marks) You are presented with an Excel sheet with the required financial information. The first sheet needs to be edited to show the effect of share dilution and share sales, if completed, or not. The forecast column will thus need to be able to change the calculation between the two scenarios. Complete the following procedures on the workbook: . Amend the Income Statement section to show the Earnings Before Interest, Taxes Depreciation and Amortization for each year. Add a line below the last line of the Income Statement to add the Gross Profit and Net Profit Margin for each year respectively and calculate the amounts for each year. Add a drop-down list on the cover of the Financial Model sheet, in row 5, which can be used to navigate between the two scenarios - No dilution and 50% dilution. Complete the highlighted cell on the Forecast Coefficient sheet by calculating th compound annual rate of growth in Sales by making use of the relevant Ex function. Use an Excel formula in the Forecast 2023 column to calculate the relevant line item based on the change in scenario and linking it to the Forecast Coefficient sheet. Complete the key ratio section of the Financial Model and add a column in which you need to make use of spark lines to visually compare the 2023 forecasted ratios with the industry averages, which is given on the Industry Averages sheet. Add a section which includes the following charts: o A line chart to indicate the change in Net Profit Margin for the four years. Add a trend line to the chart. o A pie chart to indicate the split in Capital Structure