Give a summary to the following questions:

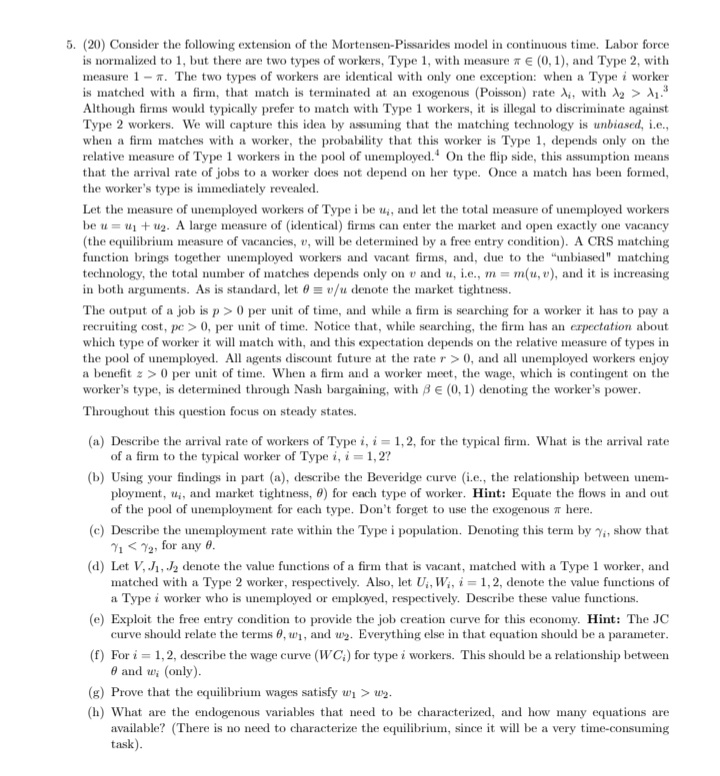

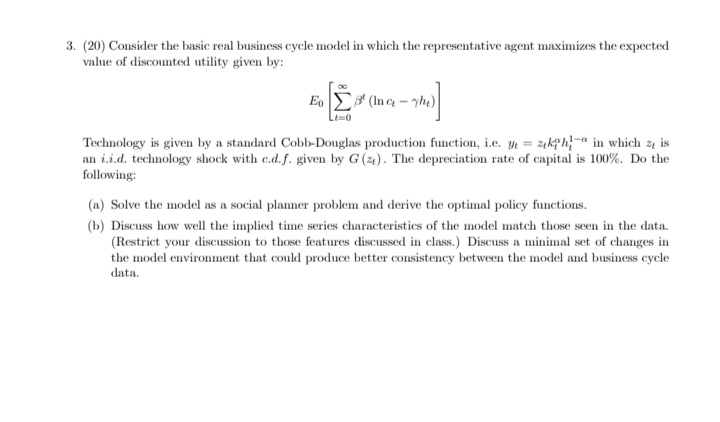

5. (20) Consider the following extension of the Mortensen-Pissarides model in continuous time. Labor force is normalized to 1, but there are two types of workers, Type 1, with measure * e (0, 1), and Type 2, with measure 1 - 7. The two types of workers are identical with only one exception: when a Type i worker is matched with a firm, that match is terminated at an exogenous (Poisson) rate A, with Ag > M1. Although firms would typically prefer to match with Type 1 workers, it is illegal to discriminate against Type 2 workers. We will capture this idea by assuming that the matching technology is unbiased, i.e., when a firm matches with a worker, the probability that this worker is Type 1, depends only on the relative measure of Type 1 workers in the pool of unemployed.' On the flip side, this assumption means that the arrival rate of jobs to a worker does not depend on her type. Once a match has been formed, the worker's type is immediately revealed. Let the measure of unemployed workers of Type i be wi, and let the total measure of unemployed workers be u = u1 + u2. A large measure of (identical) firms can enter the market and open exactly one vacancy (the equilibrium measure of vacancies, v, will be determined by a free entry condition). A CRS matching function brings together unemployed workers and vacant firms, and, due to the "unbiased" matching technology, the total number of matches depends only on e and u, i.e., m = m(u, v), and it is increasing in both arguments. As is standard, let 0 = v/u denote the market tightness. The output of a job is p > 0 per unit of time, and while a firm is searching for a worker it has to pay a recruiting cost, pe > 0, per unit of time. Notice that, while searching, the firm has an expectation about which type of worker it will match with, and this expectation depends on the relative measure of types in the pool of unemployed. All agents discount future at the rate r > 0, and all unemployed workers enjoy a benefit = > 0 per unit of time. When a firm and a worker meet, the wage, which is contingent on the worker's type, is determined through Nash bargaining, with S E (0, 1) denoting the worker's power. Throughout this question focus on steady states. (a) Describe the arrival rate of workers of Type i, i = 1, 2, for the typical firm. What is the arrival rate of a firm to the typical worker of Type i, i = 1, 2? (b) Using your findings in part (a), describe the Beveridge curve (i.e., the relationship between unem- ployment, wi, and market tightness, #) for each type of worker. Hint: Equate the flows in and out of the pool of unemployment for each type. Don't forget to use the exogenous a here. (c) Describe the unemployment rate within the Type i population. Denoting this term by y, show that 1 wy. (h) What are the endogenous variables that need to be characterized, and how many equations are available? (There is no need to characterize the equilibrium, since it will be a very time-consuming task).4. (20) Consider the standard growth model in discrete time. There is a large number of identical households (normalized to 1). Each household wants to maximize life-time discounted utility Each household has the following endowments: a) an initial capital stock zo at time 0, b) one unit of productive time per period that can be devoted to work, and c) one unit of land. Final output is produced according to ye = F (ku, nt, 4), where F is a CRS production function, and ke, ne, 4 denote capital, labor, and land services, respectively. This technology is owned by firms whose number will be determined in equilibrium. Output can be consumed (c) or invested (i). We assume that households own the capital stock (so they make the investment decision) and the land, and they rent out capital, labor, and land services to the firms. The depreciation rate of the capital stock (r,) is denoted by 6.' The land does not depreciate, i.e. it is in fixed supply. Finally, we assume that households own the firms, i.e. they are claimants to the firms' profits. The functions u and F have the usual properties that we have described in class." (a) Consider an Arrow-Debreu world. Describe the households' and firms' problems and carefully define an AD equilibrium. How many firms operate in this equilibrium? (b) In this economy, why is it a good idea to describe the AD equilibrium capital stock allocation by solving the (easier) Social Planner's Problem? From now on assume that F(ke, n, 4) = Aking:1,-21-02 and 6 = 1, with A > 0 and 01, 02 E (0, 1). The household's instantaneous utility function is given by u(c) = In(c). (c) Fully characterize (ie. find a closed form solution for) the equilibrium allocation of the capital stock. (Hint: Guess and verify a "policy rule" of the form kit = gof, where g is an unknown to be determined.) In the remaining questions, for full credit, your answers should be functions only of the parameters of the model, i.e. 01, 02, 8, A, To etc. (d) What is the ADE value of the rental rate of capital as t - co? (e) What is the ADE price of the consumption good in t = 1? (f) What is the ADE price of land services in t = 273. (20) Consider the basic real business cycle model in which the representative agent maximizes the expected value of discounted utility given by: Eo Es' (Ina - The) 1=0 Technology is given by a standard Cobb-Douglas production function, i.e. y = akph, " in which z, is an Lid. technology shock with c.d.f. given by G () . The depreciation rate of capital is 100%. Do the following: (a) Solve the model as a social planner problem and derive the optimal policy functions. (b) Discuss how well the implied time series characteristics of the model match those seen in the data. (Restrict your discussion to those features discussed in class.) Discuss a minimal set of changes in the model environment that could produce better consistency between the model and business cycle data.1. (10) Consider a consumer with preferences U = e- plu(ci)dt, where p is the subjective discount rate, c is consumption, and u(c) = Inc. She receives an exogenous flow of income y and can borrow or lend freely at a constant interest rate r, subject to a no-Ponzi-game condition that rules out infinite debt. Her flow budget constraint is a =raty - c, where a represents financial wealth and an is the initial value. (a) Derive the first-order conditions for optimal consumption. (b) At what rate does consumption change? Interpret its sign. (c) Derive the optimal decision rule for consumption. Provide an interpretation for the case p = r. 2. (20) Consider the following optimal growth model. Agents' preferences are given by The term A, denotes an i.i.d. demand shock. Output is a concave function of beginning of period capital and a technology shock. That is, It is assumed that & is i.i.d.both over time and with respect to At. (That is, the two shocks are independently distributed.) The depreciation rate of capital is 100%. Within this environment, do the following (a) Set up the social planner problem as a dynamic programming problem and derive the necessary conditions. (b) Conjecture a solution to the policy functions for consumption and savings. Derive the equations that determine these optimal policy functions and characterize their qualitative behavior. (c) Suppose one period (real) bonds were introduced into this economy. How do demand shocks affect interest rates in this economy? Explain