Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2) QUESTION 4: Engin Zengin leased his flat as a residence on April 2024, and the monthly rent was TL 30,000. In April 2024,

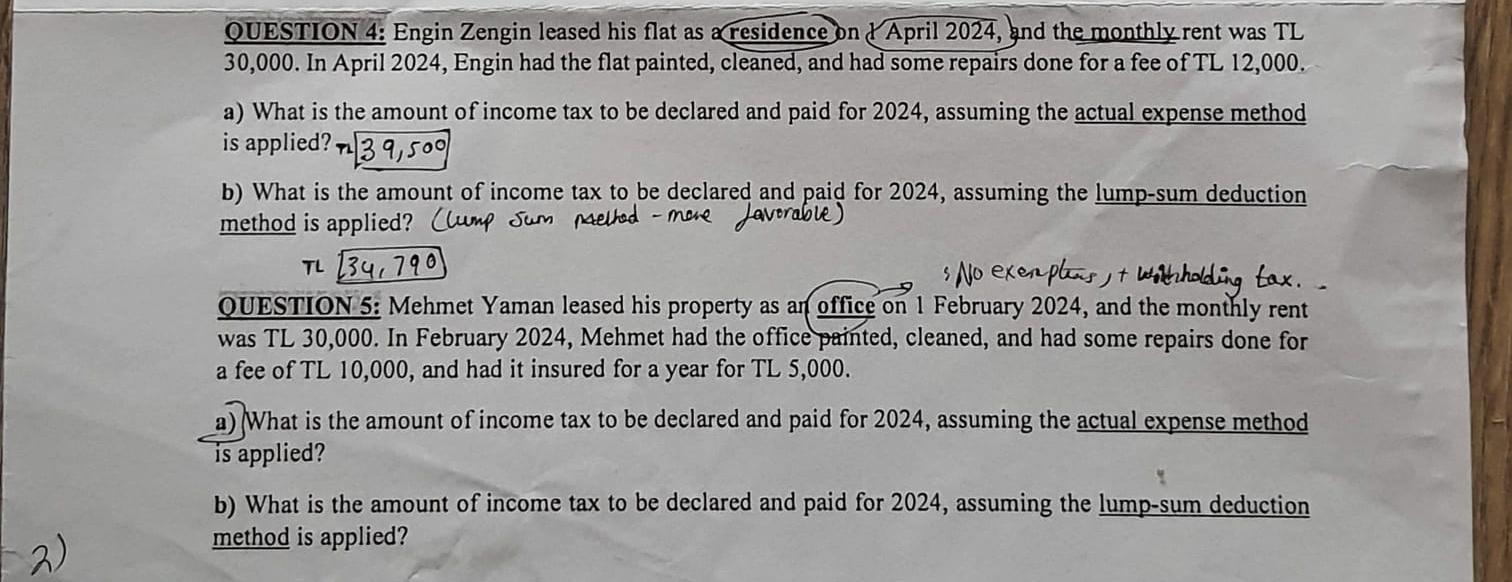

2) QUESTION 4: Engin Zengin leased his flat as a residence on April 2024, and the monthly rent was TL 30,000. In April 2024, Engin had the flat painted, cleaned, and had some repairs done for a fee of TL 12,000. a) What is the amount of income tax to be declared and paid for 2024, assuming the actual expense method is applied? 39,500 TL b) What is the amount of income tax to be declared and paid for 2024, assuming the lump-sum deduction method is applied? (lump sum melted - more favorable) TL 34,790 No exemplans, + Withholding tax. . QUESTION 5: Mehmet Yaman leased his property as an office on 1 February 2024, and the monthly rent was TL 30,000. In February 2024, Mehmet had the office painted, cleaned, and had some repairs done for a fee of TL 10,000, and had it insured for a year for TL 5,000. a) What is the amount of income tax to be declared and paid for 2024, assuming the actual expense method is applied? b) What is the amount of income tax to be declared and paid for 2024, assuming the lump-sum deduction method is applied?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the income tax for Mehmet Yaman for 2024 a Usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started