Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GIVE ANSWER AS A TABLE NOT WRITTEN OUT. PLEASE SHOW ANSWER AS A TABLE!!!!! Use the appropriate worksheet to complete the following activities: 1. Complete

GIVE ANSWER AS A TABLE NOT WRITTEN OUT. PLEASE SHOW ANSWER AS A TABLE!!!!!

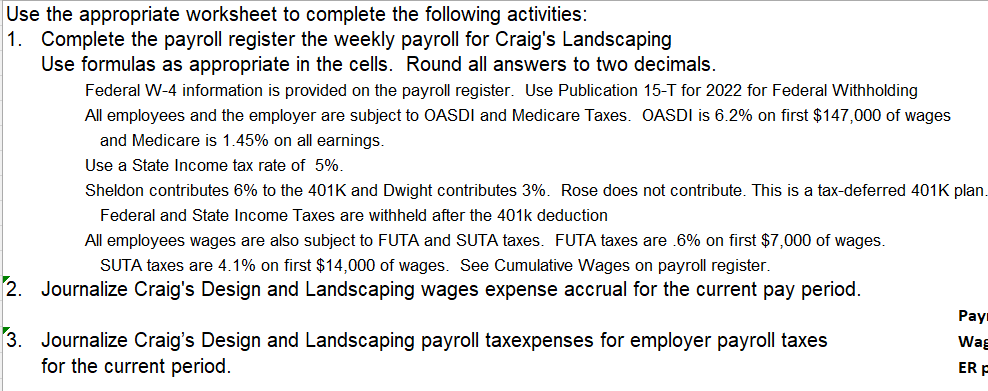

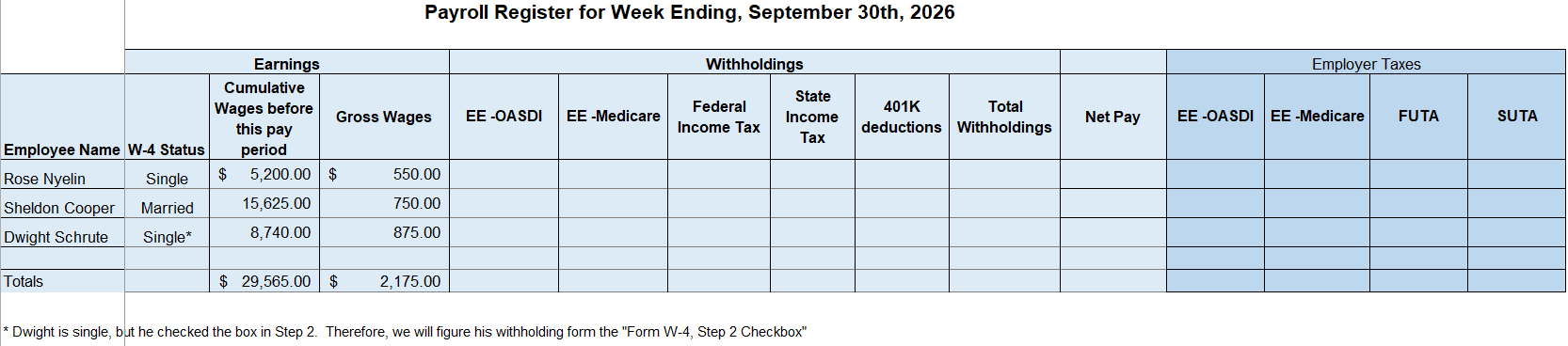

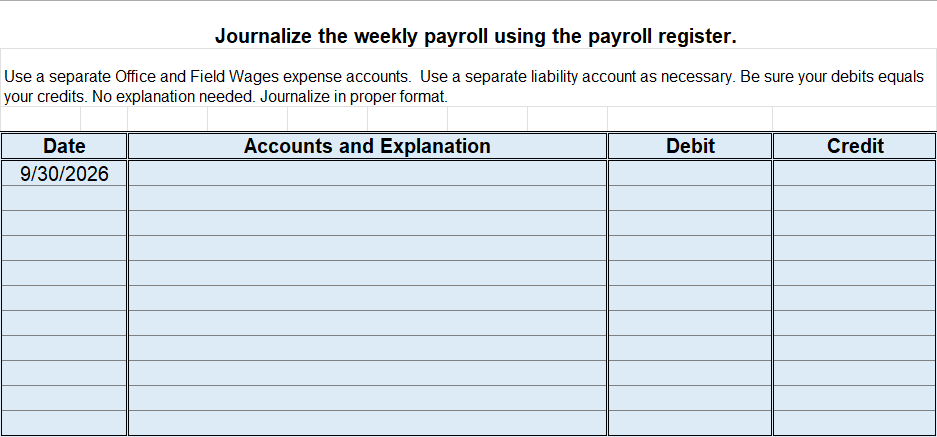

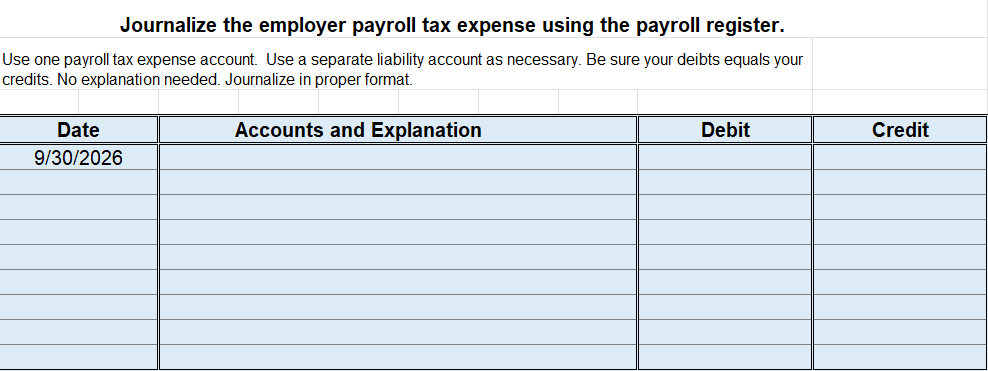

Use the appropriate worksheet to complete the following activities: 1. Complete the payroll register the weekly payroll for Craig's Landscaping Use formulas as appropriate in the cells. Round all answers to two decimals. Federal W-4 information is provided on the payroll register. Use Publication 15-T for 2022 for Federal Withholding All employees and the employer are subject to OASDI and Medicare Taxes. OASDI is 6.2% on first $147,000 of wages and Medicare is 1.45% on all earnings. Use a State Income tax rate of 5%. Sheldon contributes 6% to the 401K and Dwight contributes 3%. Rose does not contribute. This is a tax-deferred 401K plan Federal and State Income Taxes are withheld after the 401k deduction All employees wages are also subject to FUTA and SUTA taxes. FUTA taxes are . 6% on first $7,000 of wages. SUTA taxes are 4.1% on first $14,000 of wages. See Cumulative Wages on payroll register. 2. Journalize Craig's Design and Landscaping wages expense accrual for the current pay period. 3. Journalize Craig's Design and Landscaping payroll taxexpenses for employer payroll taxes for the current period. Journalize the employer payroll tax expense using the payroll register. Ise one payroll tax expense account. Use a separate liability account as necessary. Be sure your deibts equals your redits. No explanation needed. Journalize in proper format. Payroll Register for Week Ending, September 30th, 2026 Journalize the weekly payroll using the payroll register. Jse a separate Office and Field Wages expense accounts. Use a separate liability account as necessary. Be sure your debits equals our credits. No explanation needed. Journalize in proper format

Use the appropriate worksheet to complete the following activities: 1. Complete the payroll register the weekly payroll for Craig's Landscaping Use formulas as appropriate in the cells. Round all answers to two decimals. Federal W-4 information is provided on the payroll register. Use Publication 15-T for 2022 for Federal Withholding All employees and the employer are subject to OASDI and Medicare Taxes. OASDI is 6.2% on first $147,000 of wages and Medicare is 1.45% on all earnings. Use a State Income tax rate of 5%. Sheldon contributes 6% to the 401K and Dwight contributes 3%. Rose does not contribute. This is a tax-deferred 401K plan Federal and State Income Taxes are withheld after the 401k deduction All employees wages are also subject to FUTA and SUTA taxes. FUTA taxes are . 6% on first $7,000 of wages. SUTA taxes are 4.1% on first $14,000 of wages. See Cumulative Wages on payroll register. 2. Journalize Craig's Design and Landscaping wages expense accrual for the current pay period. 3. Journalize Craig's Design and Landscaping payroll taxexpenses for employer payroll taxes for the current period. Journalize the employer payroll tax expense using the payroll register. Ise one payroll tax expense account. Use a separate liability account as necessary. Be sure your deibts equals your redits. No explanation needed. Journalize in proper format. Payroll Register for Week Ending, September 30th, 2026 Journalize the weekly payroll using the payroll register. Jse a separate Office and Field Wages expense accounts. Use a separate liability account as necessary. Be sure your debits equals our credits. No explanation needed. Journalize in proper format Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started