Answered step by step

Verified Expert Solution

Question

1 Approved Answer

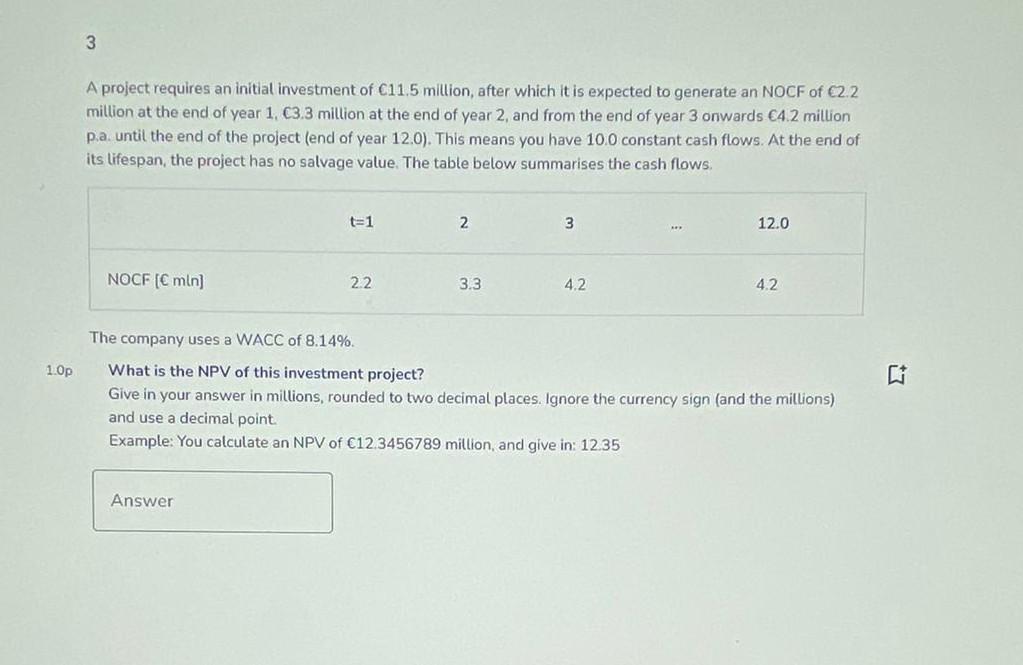

give answer in 20 mins i will give upvote 3 A project requires an initial investment of C11.5 million, after which it is expected to

give answer in 20 mins i will give upvote

3 A project requires an initial investment of C11.5 million, after which it is expected to generate an NOCF of 2.2 million at the end of year 1. 03.3 million at the end of year 2, and from the end of year 3 onwards 4.2 million pia. until the end of the project (end of year 12.0). This means you have 10.0 constant cash flows. At the end of its lifespan, the project has no salvage value. The table below summarises the cash flows. t=1 2 3 12.0 NOCF ( mln) 2.2 3.3 42 4.2 The company uses a WACC of 8.14%. 1.0p What is the NPV of this investment project? Give in your answer in millions, rounded to two decimal places. Ignore the currency sign (and the millions) and use a decimal point Example: You calculate an NPV of 12.3456789 million, and give in: 12.35Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started