Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give answer of empty boxes in picture with calculation please only answer if you can answer all 8 boxes Based in Winnipeg, Manitoba, Clearview Systems

Give answer of empty boxes in picture with calculation

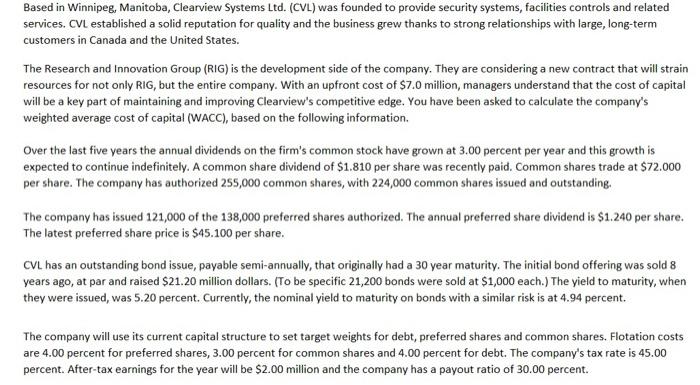

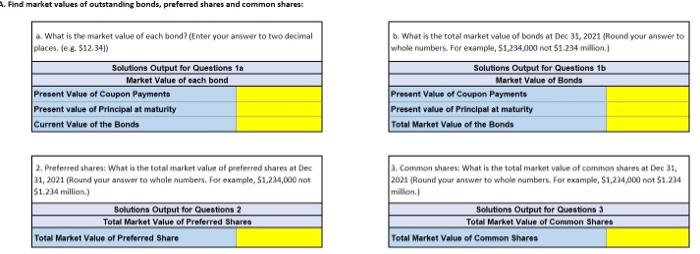

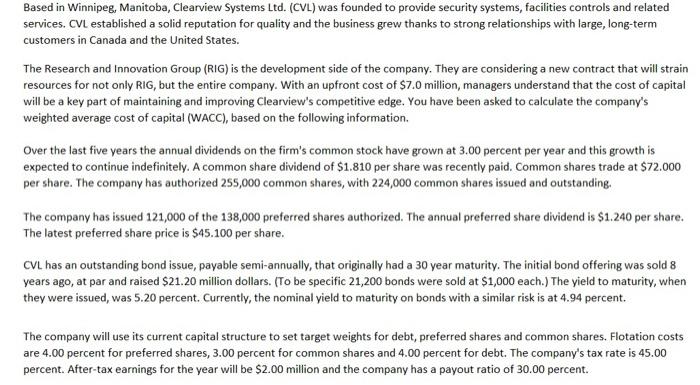

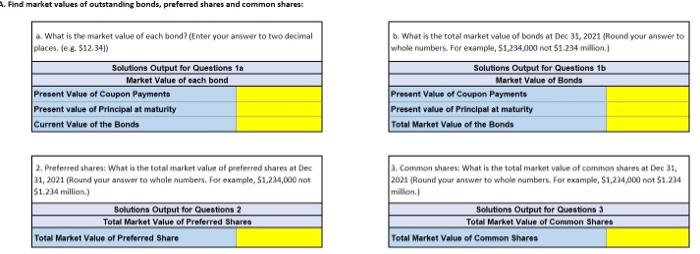

Based in Winnipeg, Manitoba, Clearview Systems Ltd. (CVL) was founded to provide security systems, facilities controls and related services. CVL established a solid reputation for quality and the business grew thanks to strong relationships with large, long-term customers in Canada and the United States. The Research and Innovation Group (RIG) is the development side of the company. They are considering a new contract that will strain resources for not only RIG, but the entire company. With an upfront cost of $7.0 million, managers understand that the cost of capital will be a key part of maintaining and improving Clearview's competitive edge. You have been asked to calculate the company's weighted average cost of capital (WACC), based on the following information. Over the last five years the annual dividends on the firm's common stock have grown at 3.00 percent per year and this growth is expected to continue indefinitely. A common share dividend of $1.810 per share was recently paid. Common shares trade at $72.000 per share. The company has authorized 255,000 common shares, with 224,000 common shares issued and outstanding. The company has issued 121,000 of the 138,000 preferred shares authorized. The annual preferred share dividend is $1.240 per share. The latest preferred share price is $45.100 per share. CVL has an outstanding bond issue, payable semi-annually, that originally had a 30 year maturity. The initial bond offering was sold 8 years ago, at par and raised $21.20 million dollars. (To be specific 21,200 bonds were sold at $1,000 each.) The yield to maturity, when they were issued, was 5.20 percent. Currently, the nominal yield to maturity on bonds with a similar risk is at 4.94 percent. The company will use its current capital structure to set target weights for debt, preferred shares and common shares. Flotation costs are 4.00 percent for preferred shares, 3.00 percent for common shares and 4.00 percent for debt. The company's tax rate is 45.00 percent. After-tax earnings for the year will be $2.00 million and the company has a payout ratio of 30.00 percent. 4. Find market values of outstanding bonds, preferred shares and common shares: a. What is the market value of each bond? (Enter your answer to two decimal b. What is the totat market walue of bonds at Dec 31,2021 Round your answer to places, \{e. g. \$12,34\}\} whole mimbers. For example, 51,234,000 not 51.234 million.) \begin{tabular}{|l|} \hline Solutions Output for Questions 1 as \\ \hline Market Value of each bond \\ \hline Present Value of Coupen Payments \\ Present value of Principal at maturity \\ Current Value of the Bonds \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \multicolumn{1}{|c|}{ Solutions Output for Questions 1b} \\ \hline Market Value of Bonds \\ \hline PresentValueofCeuponPaymentsPresentvalueofPrineipalatmaturityTotalMarketValueoftheBonds \\ \hline \end{tabular} 2. Preterted ahares: What ht the total market value of preferred shares at Dec 3. Commen shaces: What is the total market valse of commen shares at Dec 31. 21, 2021 (Aecund your answer to whole numbers. for example, 51,234,000 not $1.234 million.) 2021 (Reund yoar anwwer to whole nambers, for example, 51,214,000 net 51.234 milion.) \begin{tabular}{|c|} \hline Solutions Output for Questions 2 \\ \hline Total Market Value of Preferred Shares \\ \hline Total Market Value of Preterred Share \\ \hline \end{tabular} \begin{tabular}{|l|} \hline Solutions Output for Ouestions 3 \\ \hline Total Market Value of Common Shares \\ \hline Total Market Value of Common Shares \\ \hline \end{tabular} please only answer if you can answer all 8 boxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started