Answered step by step

Verified Expert Solution

Question

1 Approved Answer

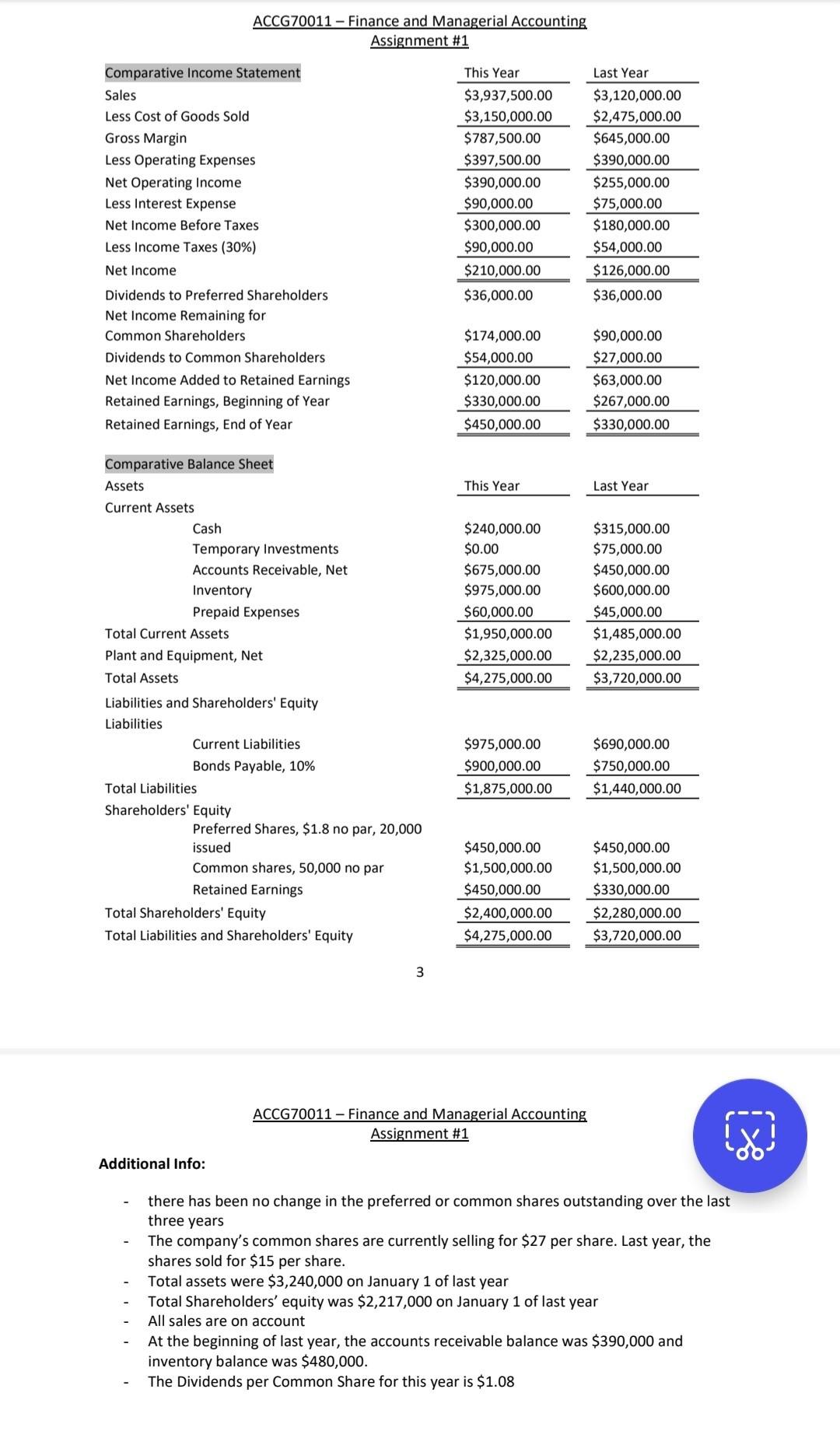

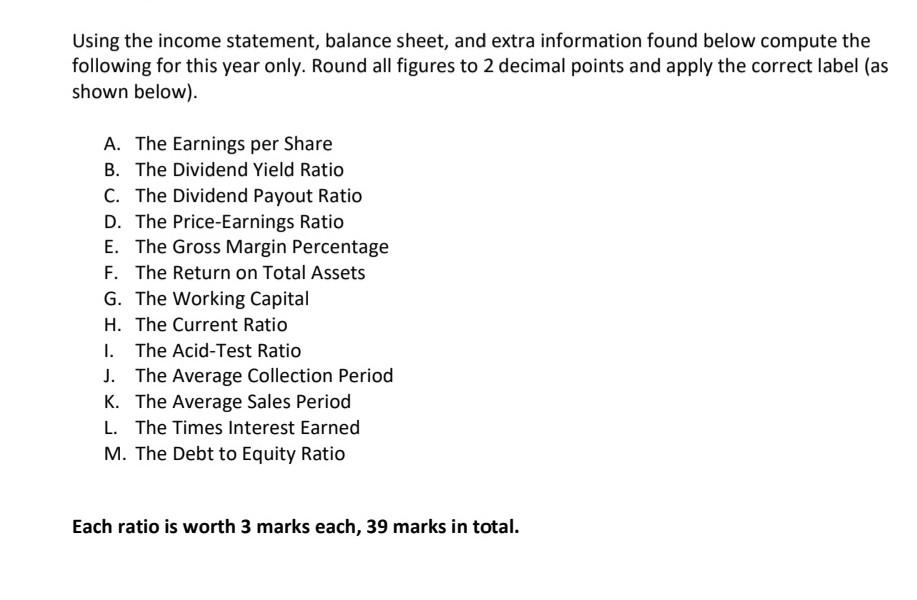

give answers in details From A to M ASAP. ACCG70011 - Finance and Managerial Accounting Assignment #1 Additional Info: there has been no change in

give answers in details From A to M ASAP.

ACCG70011 - Finance and Managerial Accounting Assignment \#1 Additional Info: there has been no change in the preferred or common shares outstanding over tne rast three years - The company's common shares are currently selling for $27 per share. Last year, the shares sold for $15 per share. - Total assets were $3,240,000 on January 1 of last year - Total Shareholders' equity was $2,217,000 on January 1 of last year - All sales are on account - At the beginning of last year, the accounts receivable balance was $390,000 and inventory balance was $480,000. - The Dividends per Common Share for this year is $1.08 Using the income statement, balance sheet, and extra information found below compute the following for this year only. Round all figures to 2 decimal points and apply the correct label (as shown below). A. The Earnings per Share B. The Dividend Yield Ratio C. The Dividend Payout Ratio D. The Price-Earnings Ratio E. The Gross Margin Percentage F. The Return on Total Assets G. The Working Capital H. The Current Ratio I. The Acid-Test Ratio J. The Average Collection Period K. The Average Sales Period L. The Times Interest Earned M. The Debt to Equity Ratio Each ratio is worth 3 marks each, 39 marks in totalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started