Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give correct answer and kindly mention it Save Honework: Assignment 7 Score: 0 of 17 pts 4 of 6 (2 complete) HW Score: 24.08%, 24.08

Give correct answer and kindly mention it

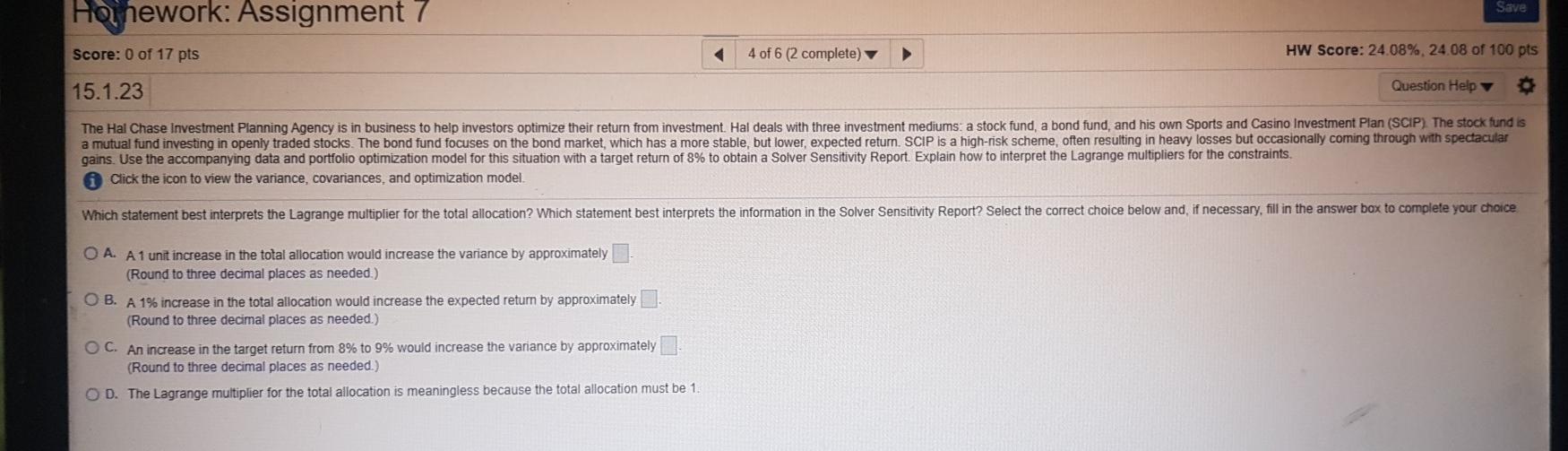

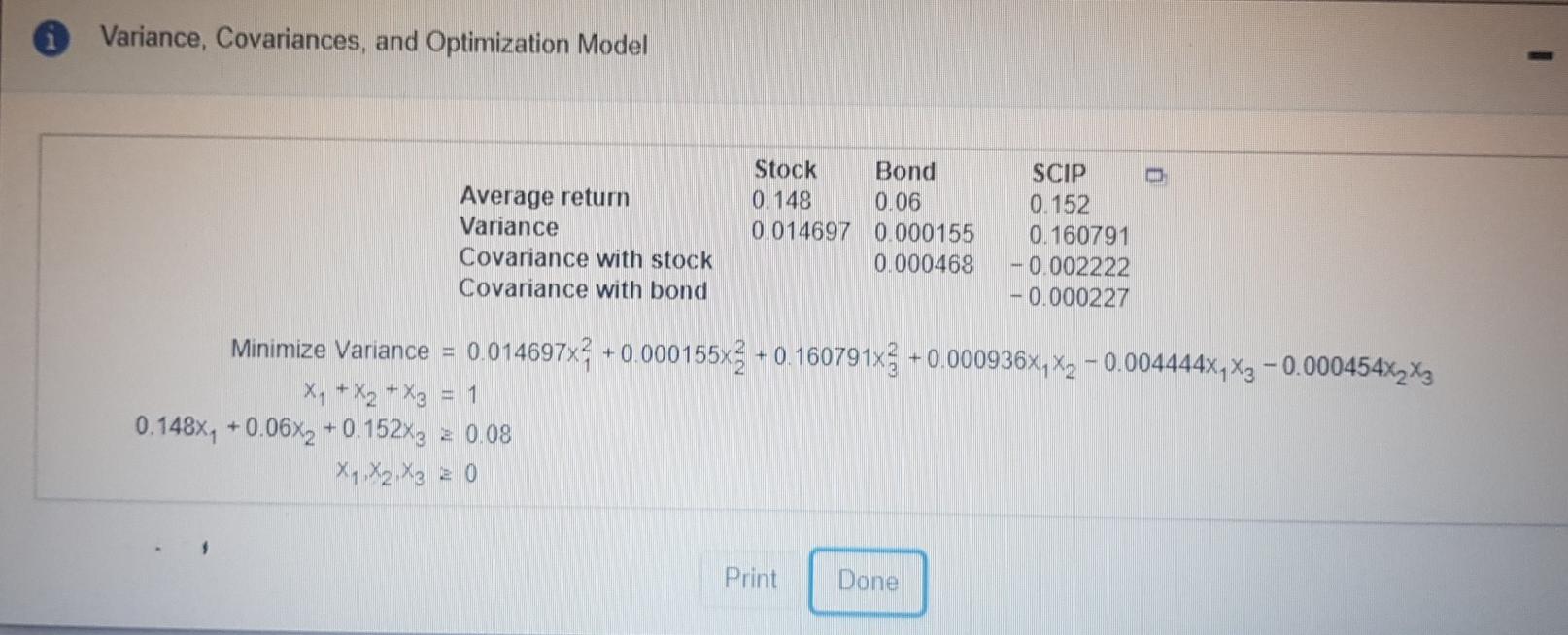

Save Honework: Assignment 7 Score: 0 of 17 pts 4 of 6 (2 complete) HW Score: 24.08%, 24.08 of 100 pts 15.1.23 Question Help The Hal Chase Investment Planning Agency is in business to help investors optimize their return from investment. Hal deals with three investment mediums: a stock fund, a bond fund, and his own Sports and Casino Investment Plan (SCIP) The stock fund is a mutual fund investing in openly traded stocks. The bond fund focuses on the bond market, which has a more stable, but lower, expected return. SCIP is a high-risk scheme, often resulting in heavy losses but occasionally coming through with spectacular gains. Use the accompanying data and portfolio optimization model for this situation with a target return of 8% to obtain a Solver Sensitivity Report. Explain how to interpret the Lagrange multipliers for the constraints. Click the icon to view the variance, covariances, and optimization model Which statement best interprets the Lagrange multiplier for the total allocation? Which statement best interprets the information in the Solver Sensitivity Report? Select the correct choice below and, if necessary, fill in the answer box to complete your choice O A. A1 unit increase in the total allocation would increase the variance by approximately (Round to three decimal places as needed.) OB. A 1% increase in the total allocation would increase the expected return by approximately (Round to three decimal places as needed.) OC. An increase in the target return from 8% to 9% would increase the variance by approximately (Round to three decimal places as needed.) OD. The Lagrange multiplier for the total allocation is meaningless because the total allocation must be 1 Variance, Covariances, and Optimization Model Average retum Variance Covariance with stock Covariance with bond Stock Bond 0.149 0.06 0.014697 0.000155 0.000468 SCIP 0.152 0.160791 -0.002222 -0.000227 Minimize Variance = 0.014697x? +0.000155x2 +0.160791x3 +0.000936X,X2 -0.004444X7X3 -0.000454xzxz X, + x2 + x3 = 1 0.148X, +0.06X2 +0.152X3 20.08 x X2 Xe 2 O Print Done Save Honework: Assignment 7 Score: 0 of 17 pts 4 of 6 (2 complete) HW Score: 24.08%, 24.08 of 100 pts 15.1.23 Question Help The Hal Chase Investment Planning Agency is in business to help investors optimize their return from investment. Hal deals with three investment mediums: a stock fund, a bond fund, and his own Sports and Casino Investment Plan (SCIP) The stock fund is a mutual fund investing in openly traded stocks. The bond fund focuses on the bond market, which has a more stable, but lower, expected return. SCIP is a high-risk scheme, often resulting in heavy losses but occasionally coming through with spectacular gains. Use the accompanying data and portfolio optimization model for this situation with a target return of 8% to obtain a Solver Sensitivity Report. Explain how to interpret the Lagrange multipliers for the constraints. Click the icon to view the variance, covariances, and optimization model Which statement best interprets the Lagrange multiplier for the total allocation? Which statement best interprets the information in the Solver Sensitivity Report? Select the correct choice below and, if necessary, fill in the answer box to complete your choice O A. A1 unit increase in the total allocation would increase the variance by approximately (Round to three decimal places as needed.) OB. A 1% increase in the total allocation would increase the expected return by approximately (Round to three decimal places as needed.) OC. An increase in the target return from 8% to 9% would increase the variance by approximately (Round to three decimal places as needed.) OD. The Lagrange multiplier for the total allocation is meaningless because the total allocation must be 1 Variance, Covariances, and Optimization Model Average retum Variance Covariance with stock Covariance with bond Stock Bond 0.149 0.06 0.014697 0.000155 0.000468 SCIP 0.152 0.160791 -0.002222 -0.000227 Minimize Variance = 0.014697x? +0.000155x2 +0.160791x3 +0.000936X,X2 -0.004444X7X3 -0.000454xzxz X, + x2 + x3 = 1 0.148X, +0.06X2 +0.152X3 20.08 x X2 Xe 2 O Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started