Answered step by step

Verified Expert Solution

Question

1 Approved Answer

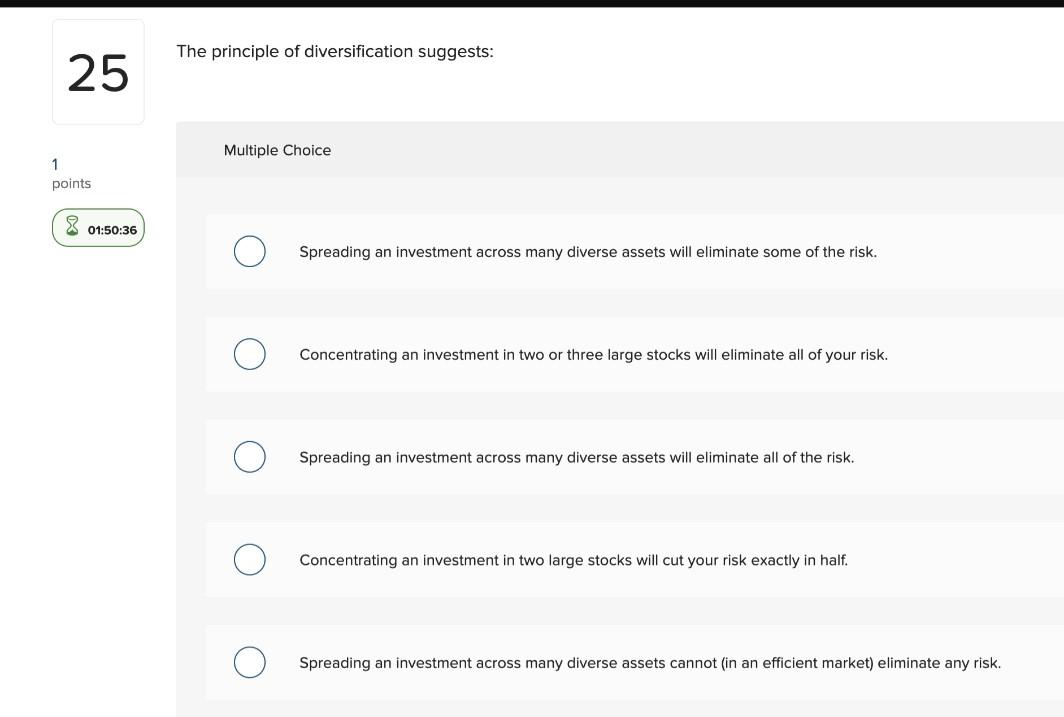

give final answers of both questions only in 20 minutes please urgently... I'll give you up thumb definitely The principle of diversification suggests: 25 Multiple

give final answers of both questions only in 20 minutes please urgently... I'll give you up thumb definitely

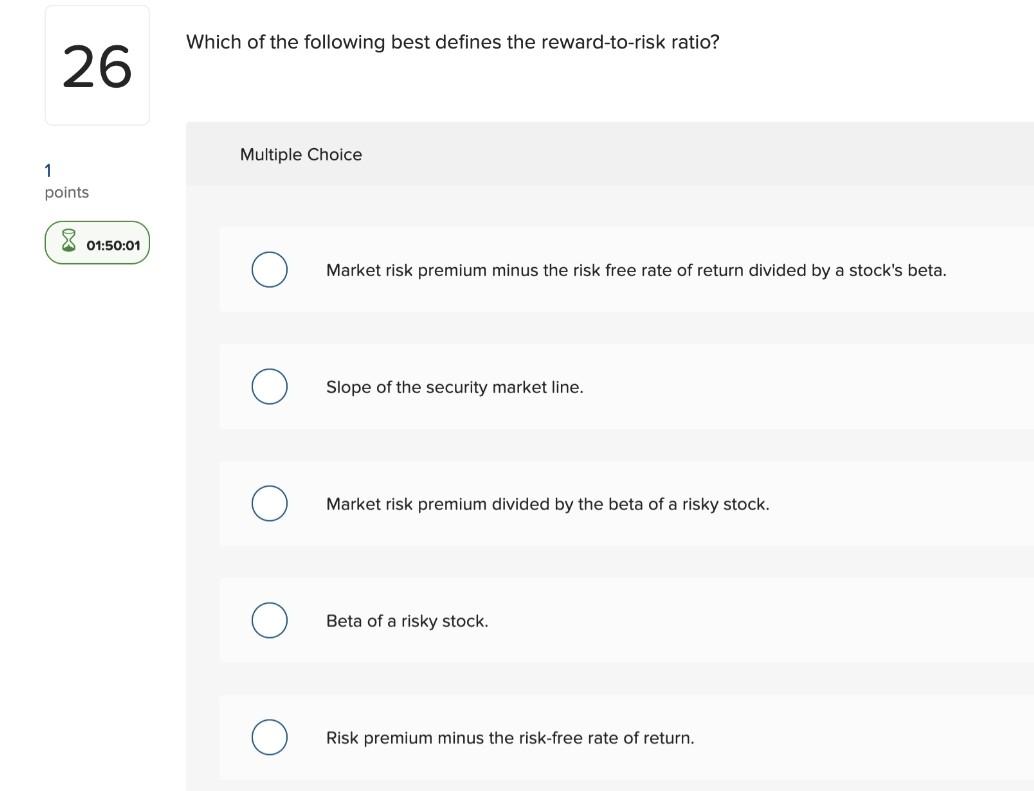

The principle of diversification suggests: 25 Multiple Choice 1 points 3 01:50:36 Spreading an investment across many diverse assets will eliminate some of the risk. Concentrating an investment in two or three large stocks will eliminate all of your risk. Spreading an investment across many diverse assets will eliminate all of the risk. Concentrating an investment in two large stocks will cut your risk exactly in half. Spreading an investment across many diverse assets cannot (in an efficient market) eliminate any risk. Which of the following best defines the reward-to-risk ratio? 26 Multiple Choice 1 points 01:50:01 Market risk premium minus the risk free rate of return divided by a stock's beta. Slope of the security market line. Market risk premium divided by the beta of a risky stock. Beta of a risky stock. Risk premium minus the risk-free rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started