Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give me a different answer than what's already in chegg. DO NOT ANSWER IF YOUR GOING TO COPY THE ANSWER THATS ALREADY ON CHEGG 10

Give me a different answer than what's already in chegg. DO NOT ANSWER IF YOUR GOING TO COPY THE ANSWER THATS ALREADY ON CHEGG

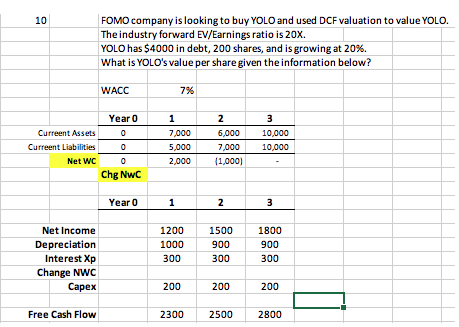

10 FOMO company is looking to buy YOLO and used DCF valuation to value YOLO. The industry forward EV/Earnings ratio is 20X. YOLO has $4000 in debt, 200 shares, and is growing at 20% What is YOLO's value per share given the information below? WACC 7% Year 0 Curreent Assets 0 Curreent Liabilities 0 Net WC 0 Chg NwC 1 7,000 5,000 2,000 2 6,000 7,000 () (1,000) 3 10,000 10,000 Year 0 1 2 3 Net Income Depreciation Interest Xp Change NWC Capex 1200 1000 300 1500 900 300 1800 900 300 200 200 200 Free Cash Flow 2300 2500 2800 10 FOMO company is looking to buy YOLO and used DCF valuation to value YOLO. The industry forward EV/Earnings ratio is 20X. YOLO has $4000 in debt, 200 shares, and is growing at 20% What is YOLO's value per share given the information below? WACC 7% Year 0 Curreent Assets 0 Curreent Liabilities 0 Net WC 0 Chg NwC 1 7,000 5,000 2,000 2 6,000 7,000 () (1,000) 3 10,000 10,000 Year 0 1 2 3 Net Income Depreciation Interest Xp Change NWC Capex 1200 1000 300 1500 900 300 1800 900 300 200 200 200 Free Cash Flow 2300 2500 2800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started