Answered step by step

Verified Expert Solution

Question

1 Approved Answer

give me all answer if you can The company issued $800,000, ten-year bonds with a coupon rate of 6% on January 1, 2009. Interest is

give me all answer if you can

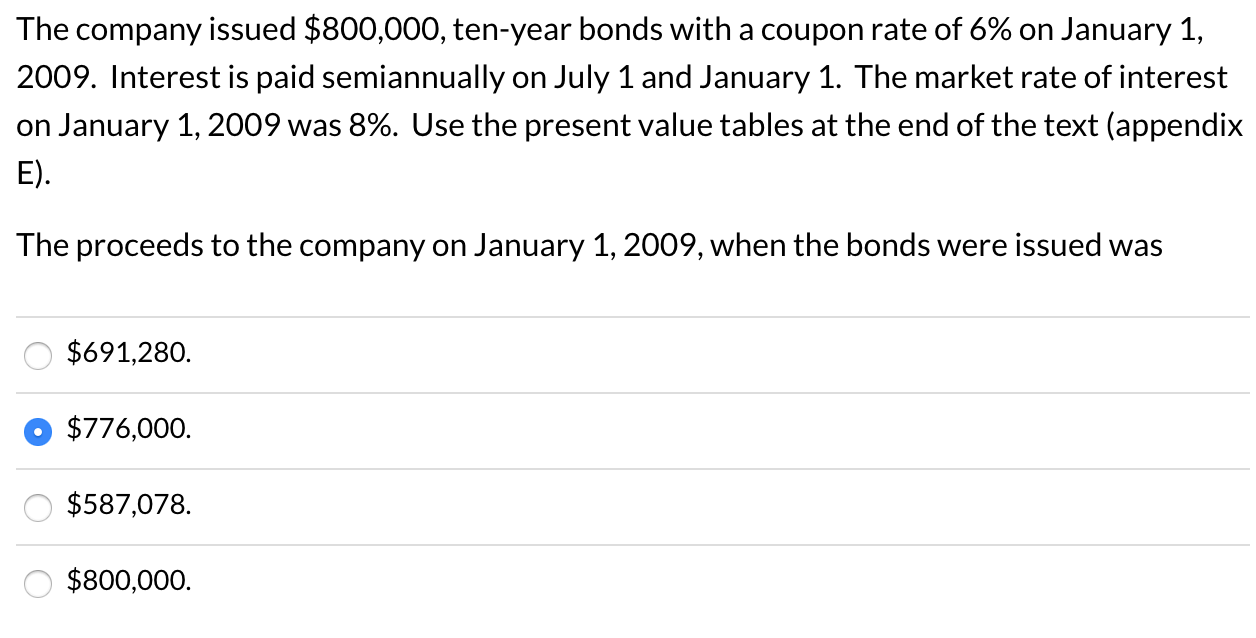

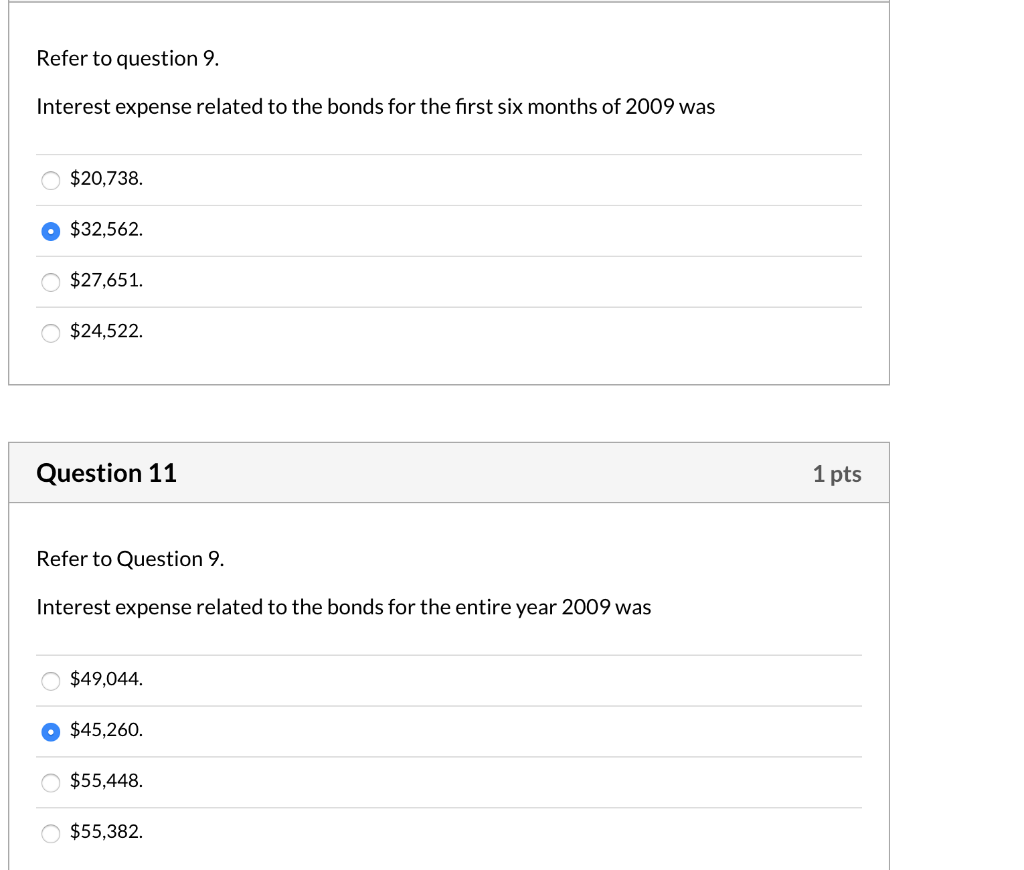

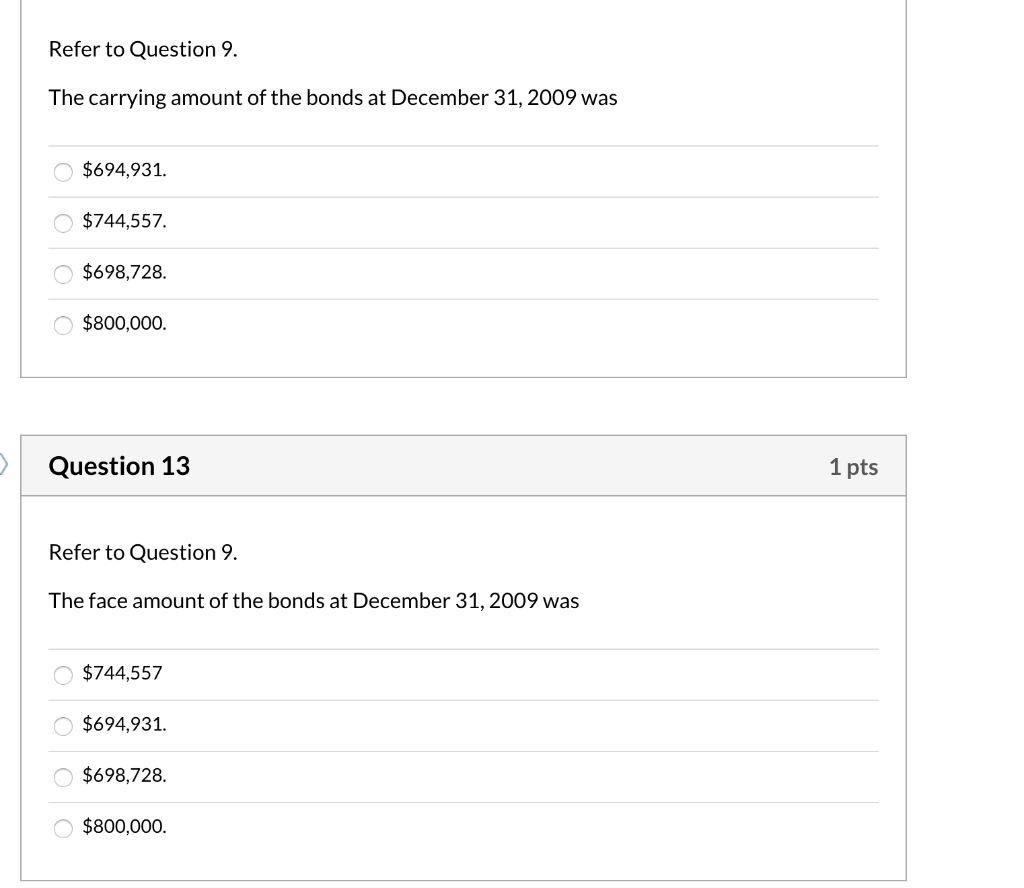

The company issued $800,000, ten-year bonds with a coupon rate of 6% on January 1, 2009. Interest is paid semiannually on July 1 and January 1. The market rate of interest on January 1, 2009 was 8%. Use the present value tables at the end of the text (appendix E). The proceeds to the company on January 1, 2009, when the bonds were issued was O $691,280. $776,000. 0 $587,078. 0 $800,000. Refer to question 9. Interest expense related to the bonds for the first six months of 2009 was $20,738. O $32,562. $27,651. $24,522. Question 11 1 pts Refer to Question 9. Interest expense related to the bonds for the entire year 2009 was $49,044. $45,260. $55,448. $55,382. Refer to Question 9. The carrying amount of the bonds at December 31, 2009 was $694,931. $744,557. $698,728. $800,000 Question 13 1 pts Refer to Question 9. The face amount of the bonds at December 31, 2009 was $744,557 $694,931. $698,728. $800,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started