Answered step by step

Verified Expert Solution

Question

1 Approved Answer

give me correct answer please. Required information Katy Carmichael, CPA, was just promoted to audit manager in the technology sector at a large public accounting

give me correct answer please.

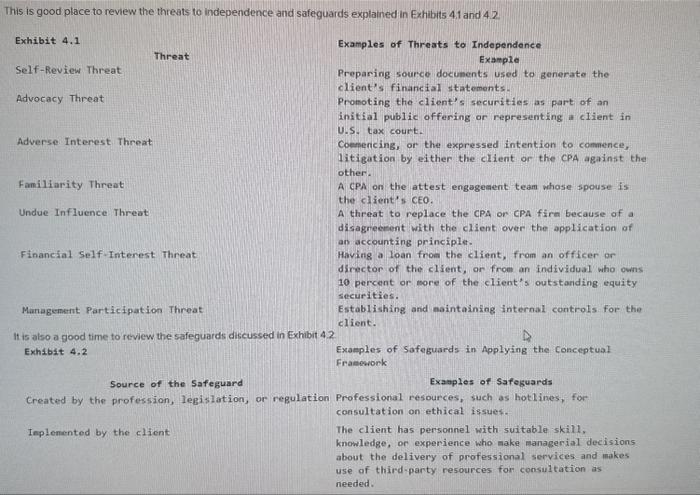

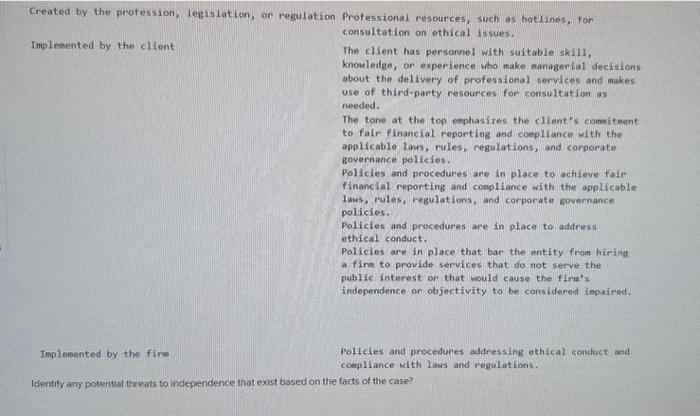

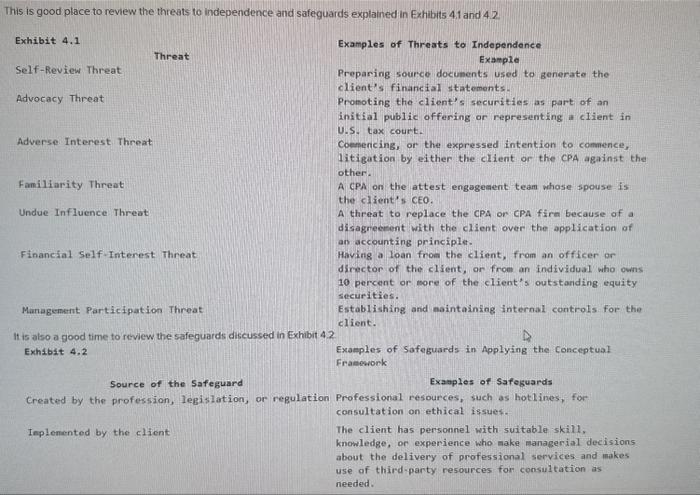

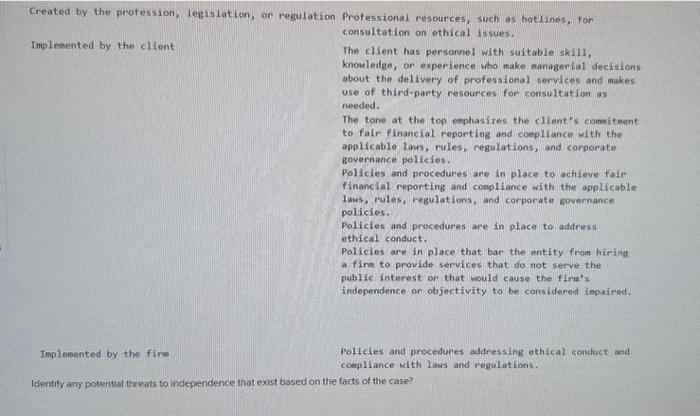

Required information Katy Carmichael, CPA, was just promoted to audit manager in the technology sector at a large public accounting firm. She started at the firm six years ago and has worked on a number of the same client audits for multiple years. She prefers being placed on same client audits year after year because she believes her knowledge about the cllent grows each year, resulting in a better audit. Public accounting firms tend to do this as it provides continuity between the firm and the client and often results in a more efficient (less costly) audit as well.) Katy was thrilled to learn that she would be retaining three of her prior audit clients, including what she considers her favorite client (DGS-Drako Gaming Solutions). She has friendships with those in financial reporting area including the CFO with whom she has made joint business investments. The audit planning for DGS's next audit is about to begin. As is common practice with all audits, each member of the audit engagement team is asked to fill out a questionnaire about any type of relationship (personal, business, or financial) they might have (or any other member of the engagement team might have) with the client company, any of its customers, suppliers, employees, or direct family members of their employees. Katy wili soon be meeting with the firm's compliance partner assigned to the DGS audit to go through the completed questionnaire. In that regard, answer the following questions This is good place to review the threats to independence and safeguards explained in Exhibits 4.1 and 4.2. This is good place to review the threats to independence and safeguards explained in Exhibits 4.1 and 4.2 Exhibit 4.1 Self-Review Threat Threat Examples of Threats to Independence Self-Review Threat Advocacy Threat Preparing source docunents used to generate the client's financial statements. Pronoting the client's securities as part of an initial public offering or representing a client in U.S. tax court. Adverse Interest Threat Coenencing, or the expressed intention to comence, other. Faniliarity Threat A CPA on the attest engagement team whase spouse is Undue Influence Threat Financial Self-Interest Threat Management Participation Threat the client's CEO. disagreesent with the client over the application of an accounting principle. It is also a good time to review the safeguards discussed in Exhibit 4.2 Having a loan from the client, from an officer or director of the client, on from an individual who owns 10 percent or sore of the client's outstanding equity Establishing and naintaining internal controls for the client. Exhibit 4.2 Exaples of Safeguards in Applying the Conceptual Framenork Source of the Safeguard Examples of Safeguards created by the profession, legislation, or regulation Professional resources, such as hotlines, for consultation on ethical issues. Iaplenented by the client The client has personnel with suitable skill, knowledge, on experience who make managerial decisions about the delivery of professional services and makes use of third-party resources for consultation as needed. Created by the protession, legislation, or regulation Protessional resources, such as hotines, for consultation on ethical issues. Implenented by the client The client has pensonnel with suitable ski11, knowledge, on experience who make managerial decisions about the delivery of professional services and makes use of third-party resources for consultation as needed. The tone at the top emphasizes the client's comsitment to fair financial reporting and compliance with the applicable lans, rules, regulations, and corporate governance policies. Policies and procedures are in place to achieve fair financial reporting and compliance with the applicable laws, rules, regulations, and corporate governance policies. Policies and procedures are in place to address ethical conduct. Policies are in place that ban the entity from hiring a firm to provide services that do not serve the public interest on that would cause the firm's independence or objectivity to be considered insaired. Implemented by the firm Pollcies and procedunes addressing othical conduct and coepliance with laws and regulations. Identify any potential threats to independence that exist based on the facts of the case

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started