Answered step by step

Verified Expert Solution

Question

1 Approved Answer

give me five type answer You observe the following information regarding Companies X and Y: Company X has a higher expected return than company Y.

give me five type answer

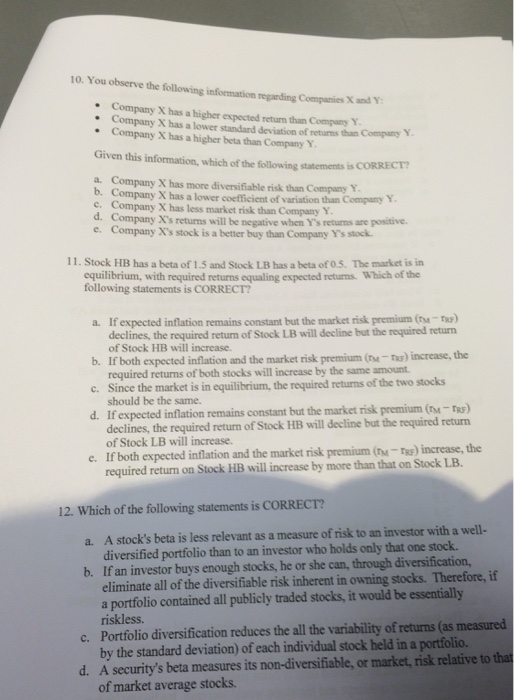

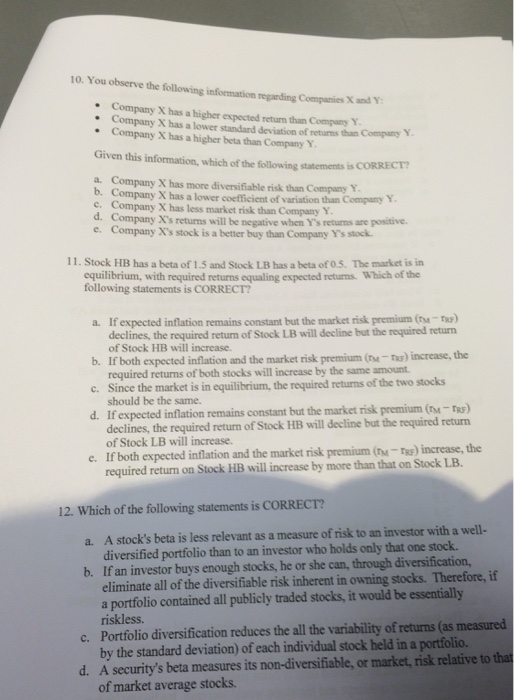

You observe the following information regarding Companies X and Y: Company X has a higher expected return than company Y. Company Y has a lower standard deviation of returns than Company Y. Company X has a higher beta than Company Y. Given this information, which of the following statements is CORRECT? Company X has more diversifiable risk than Company Y. Company S has a lower coefficient of variation than Company Y. Company X has less market risk than Company Y. Company X's returns will be negative when be negative when Y's returns are positive. Company X's stock is a better buy than company Y's stock. Stock HB has a beta of 1.5 and Stock LB has a beta of 0.5. The market is in equilibrium, with required returns equaling expected returns. Which of the following statements is CORRECT? If expected inflation remains constant but the market risk premium (tau _M - tau_RF) declines, the required return of Stock LB mill decline but the required return of Stock MB will increase. If both expected inflation and the market risk premium (tau_M - tau_RF) increase, the required returns of both stocks will increase by the same amount Since the market is in equilibrium, the required returns of the two stocks should be the same. If expected inflation remains constant but the market risk premium (tau_M - tau_RF) declines, the required return of Stock HB will decline but the required return of Stock LB will increase. If both expected inflation and the market risk premium (tau _M - tau _RF) increase, the required return on Stock HB will increase by more than that on Stock LB. Which of the following statements is CORRECT? A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock. If an investor buys enough stocks, he or she can, through diversification, eliminate all of the diversifiable risk inherent in owning stocks. Therefore, if a portfolio contained all publicly traded stocks, it would be essentially riskless. Portfolio diversification reduces the all the variability of returns (as measured by the standard deviation) of each individual stock held in a portfolio. A security's beta measures its non-diversifiable, or market risk relative to that of market average stocks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started