Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Give the complete solutions and draw cash flow diagram in each problem. 1. A new company is considering purchasing a new machine to replace its

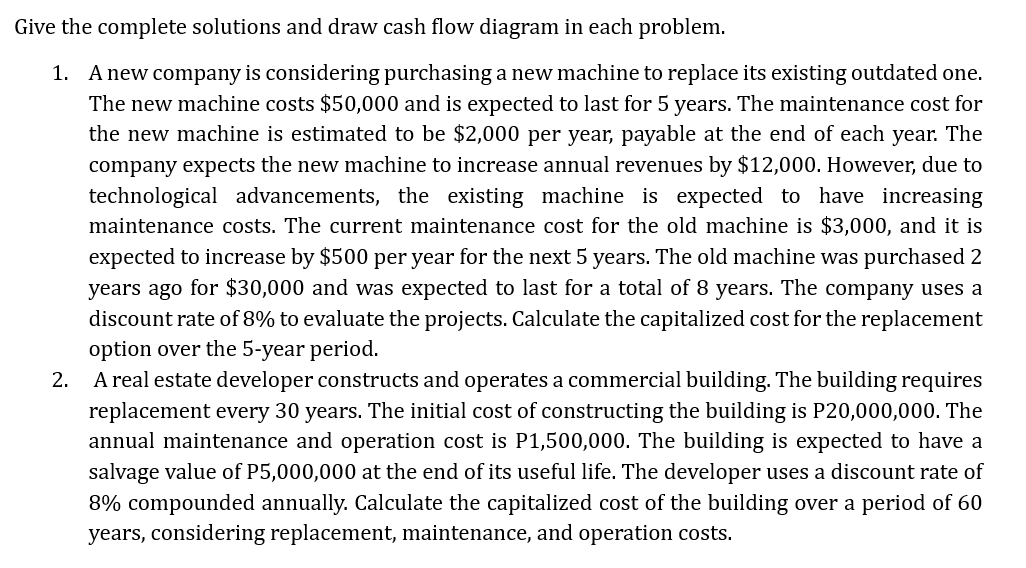

Give the complete solutions and draw cash flow diagram in each problem. 1. A new company is considering purchasing a new machine to replace its existing outdated one. The new machine costs $50,000 and is expected to last for 5 years. The maintenance cost for the new machine is estimated to be $2,000 per year, payable at the end of each year. The company expects the new machine to increase annual revenues by $12,000. However, due to technological advancements, the existing machine is expected to have increasing maintenance costs. The current maintenance cost for the old machine is $3,000, and it is expected to increase by $500 per year for the next 5 years. The old machine was purchased 2 years ago for $30,000 and was expected to last for a total of 8 years. The company uses a discount rate of 8% to evaluate the projects. Calculate the capitalized cost for the replacement option over the 5-year period. 2. A real estate developer constructs and operates a commercial building. The building requires replacement every 30 years. The initial cost of constructing the building is P20,000,000. The annual maintenance and operation cost is P1,500,000. The building is expected to have a salvage value of P5,000,000 at the end of its useful life. The developer uses a discount rate of 8% compounded annually. Calculate the capitalized cost of the building over a period of 60 years, considering replacement, maintenance, and operation costs

Give the complete solutions and draw cash flow diagram in each problem. 1. A new company is considering purchasing a new machine to replace its existing outdated one. The new machine costs $50,000 and is expected to last for 5 years. The maintenance cost for the new machine is estimated to be $2,000 per year, payable at the end of each year. The company expects the new machine to increase annual revenues by $12,000. However, due to technological advancements, the existing machine is expected to have increasing maintenance costs. The current maintenance cost for the old machine is $3,000, and it is expected to increase by $500 per year for the next 5 years. The old machine was purchased 2 years ago for $30,000 and was expected to last for a total of 8 years. The company uses a discount rate of 8% to evaluate the projects. Calculate the capitalized cost for the replacement option over the 5-year period. 2. A real estate developer constructs and operates a commercial building. The building requires replacement every 30 years. The initial cost of constructing the building is P20,000,000. The annual maintenance and operation cost is P1,500,000. The building is expected to have a salvage value of P5,000,000 at the end of its useful life. The developer uses a discount rate of 8% compounded annually. Calculate the capitalized cost of the building over a period of 60 years, considering replacement, maintenance, and operation costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started