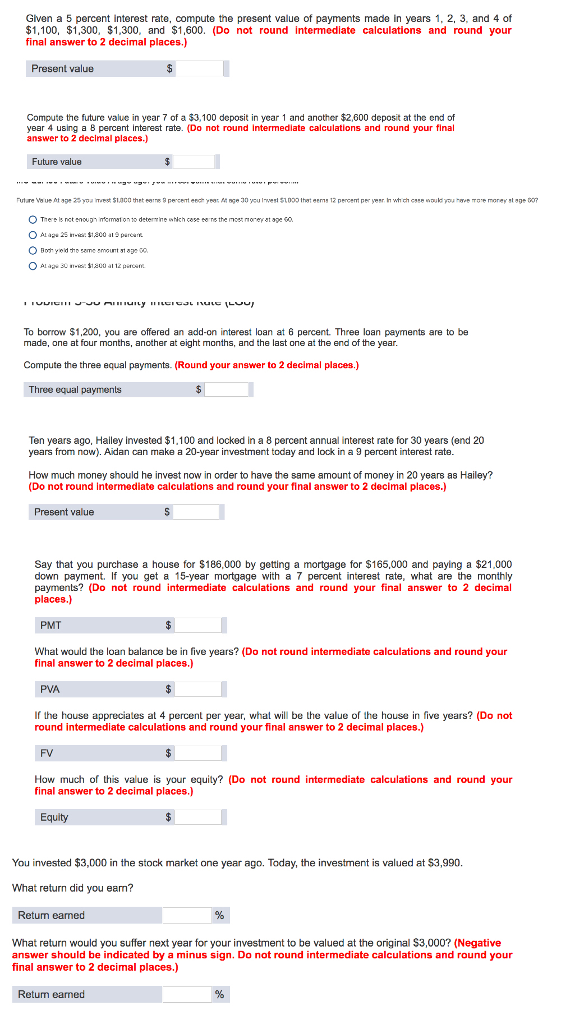

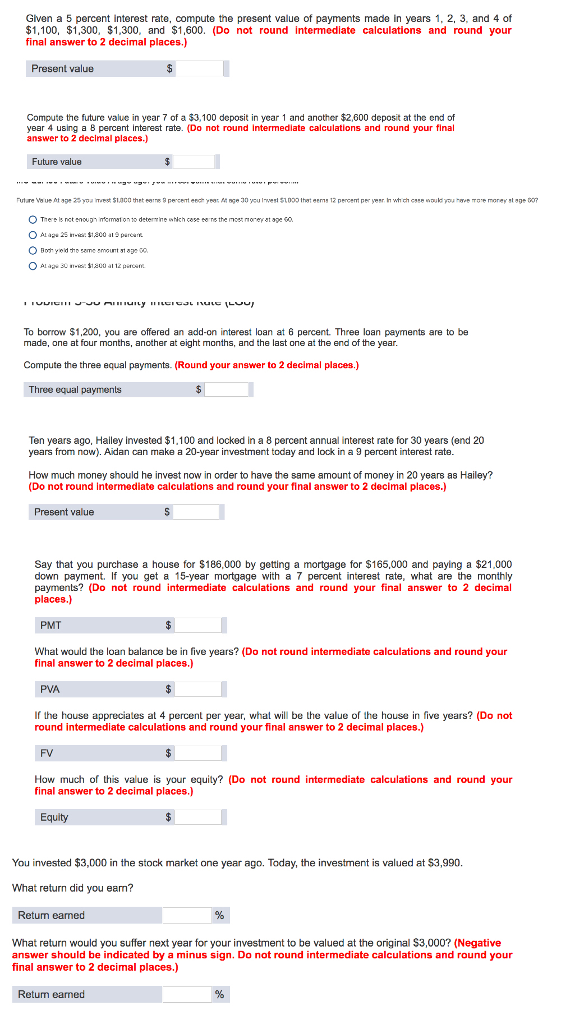

Given a 5 percent interest rate, compute the present value of payments made in years 1, 2, 3, and 4 of $1,100, $1,300, $1,300, and $1,600. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Compute the future value in year 7 of a $3,100 deposit in ycar 1 and another $2,600 deposit at the end of year 4 using a 8 percent intarest rate. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value To borrow $1,200, you are offered an add-on interest loan at 6 percent. Three loan payments are to be made, one at four months, another at eight months, and the last one at the end of the year Compute the three equal payments. (Round your answer to 2 decimal places.) Three equal payments Ten years ago, Haile invested $1,100 and locked in a 8 percent annual interest rate for 30 years (end 20 years from now). Aidan can make a 20-year investment today and lock in a 9 percent interest rate. How much money should he invest now in order to have the same amount of money in 20 years as Hailey? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Say that you purchase a house for S186,000 by getting a mortgage for $165,000 and paying a $21,000 down payment. If you get a 15-year mortgage with a 7 percent interest rate, what are the monthhy payments? (Do not round intermediate calculations and round your final answer to 2 decimal places.) PMT What would the loan balance be in five years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) PVA If the house appreciates at 4 percent per year, what will be the value of the house in five years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) FV How much of this value is your equity? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Equity You invested $3,000 in the stock market one year ago. Today, the investment is valued at $3,990 What return did you eam? Retum eamed What return would you suffer next year for your investment to be valued at the original $3,000? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Retum eaned Given a 5 percent interest rate, compute the present value of payments made in years 1, 2, 3, and 4 of $1,100, $1,300, $1,300, and $1,600. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Compute the future value in year 7 of a $3,100 deposit in ycar 1 and another $2,600 deposit at the end of year 4 using a 8 percent intarest rate. (Do not round intermediate calculations and round your final answer to 2 decimal places.) Future value To borrow $1,200, you are offered an add-on interest loan at 6 percent. Three loan payments are to be made, one at four months, another at eight months, and the last one at the end of the year Compute the three equal payments. (Round your answer to 2 decimal places.) Three equal payments Ten years ago, Haile invested $1,100 and locked in a 8 percent annual interest rate for 30 years (end 20 years from now). Aidan can make a 20-year investment today and lock in a 9 percent interest rate. How much money should he invest now in order to have the same amount of money in 20 years as Hailey? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Present value Say that you purchase a house for S186,000 by getting a mortgage for $165,000 and paying a $21,000 down payment. If you get a 15-year mortgage with a 7 percent interest rate, what are the monthhy payments? (Do not round intermediate calculations and round your final answer to 2 decimal places.) PMT What would the loan balance be in five years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) PVA If the house appreciates at 4 percent per year, what will be the value of the house in five years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) FV How much of this value is your equity? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Equity You invested $3,000 in the stock market one year ago. Today, the investment is valued at $3,990 What return did you eam? Retum eamed What return would you suffer next year for your investment to be valued at the original $3,000? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your final answer to 2 decimal places.) Retum eaned