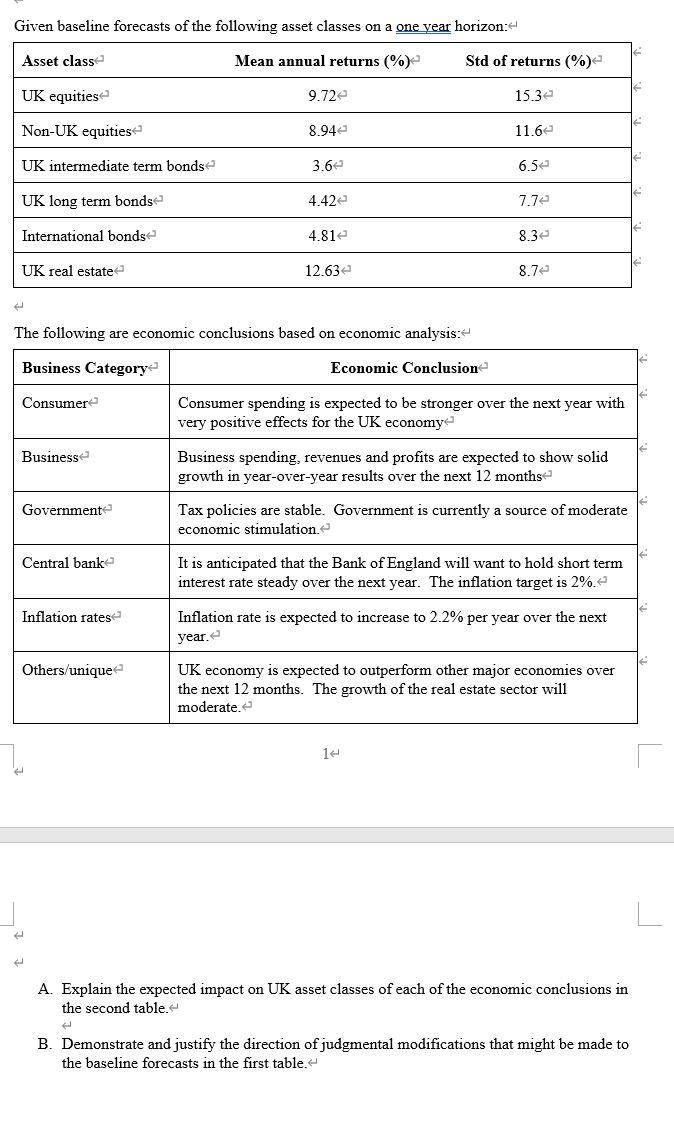

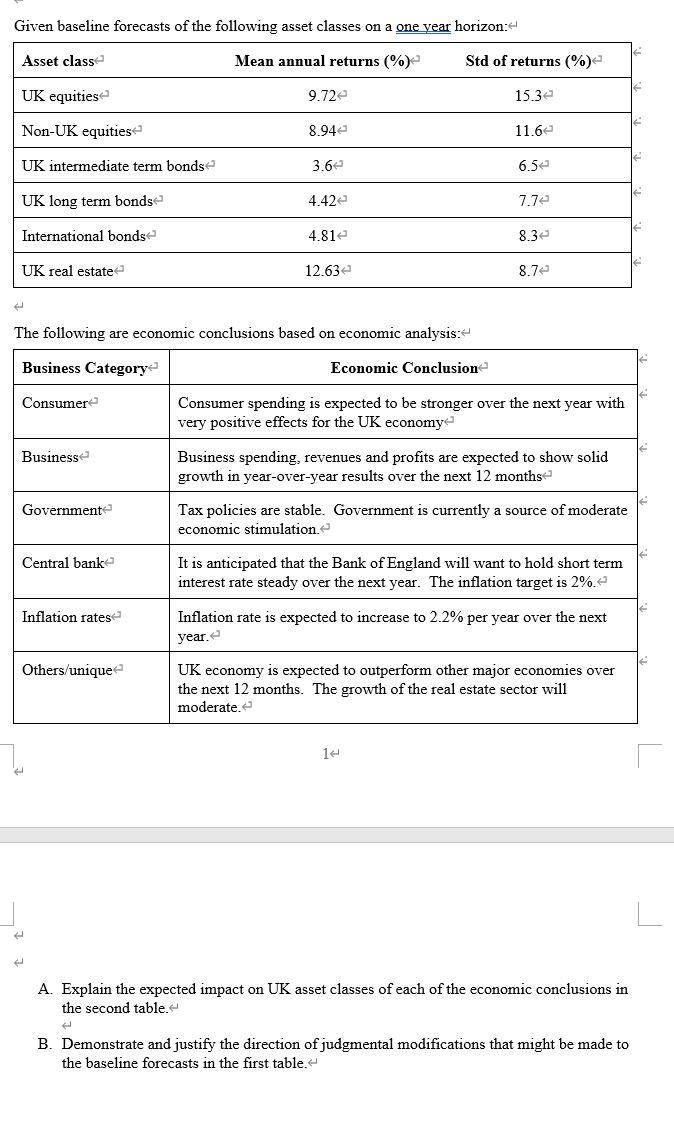

Given baseline forecasts of the following asset classes on a one year horizon: Asset class Mean annual returns (%) Std of returns (%) UK equities 9.72 15.30 Non-UK equities 8.94 11.6 UK intermediate term bonds 3.6 6.54 UK long term bonds- 4.42 7.72 International bonds 4.81 8.32 UK real estate 12.632 8.74 The following are economic conclusions based on economic analysis: Business Category Economic Conclusion Consumere Consumer spending is expected to be stronger over the next year with very positive effects for the UK economy Business spending, revenues and profits are expected to show solid growth in year-over-year results over the next 12 months Business Government Tax policies are stable. Government is currently a source of moderate economic stimulation Central banke It is anticipated that the Bank of England will want to hold short term interest rate steady over the next year. The inflation target is 2%. Inflation ratese Inflation rate is expected to increase to 2.2% per year over the next year. Others/unique UK economy is expected to outperform other major economies over the next 12 months. The growth of the real estate sector will moderate, e 14 A. Explain the expected impact on UK asset classes of each of the economic conclusions in the second table. B. Demonstrate and justify the direction of judgmental modifications that might be made to the baseline forecasts in the first table. Given baseline forecasts of the following asset classes on a one year horizon: Asset class Mean annual returns (%) Std of returns (%) UK equities 9.72 15.30 Non-UK equities 8.94 11.6 UK intermediate term bonds 3.6 6.54 UK long term bonds- 4.42 7.72 International bonds 4.81 8.32 UK real estate 12.632 8.74 The following are economic conclusions based on economic analysis: Business Category Economic Conclusion Consumere Consumer spending is expected to be stronger over the next year with very positive effects for the UK economy Business spending, revenues and profits are expected to show solid growth in year-over-year results over the next 12 months Business Government Tax policies are stable. Government is currently a source of moderate economic stimulation Central banke It is anticipated that the Bank of England will want to hold short term interest rate steady over the next year. The inflation target is 2%. Inflation ratese Inflation rate is expected to increase to 2.2% per year over the next year. Others/unique UK economy is expected to outperform other major economies over the next 12 months. The growth of the real estate sector will moderate, e 14 A. Explain the expected impact on UK asset classes of each of the economic conclusions in the second table. B. Demonstrate and justify the direction of judgmental modifications that might be made to the baseline forecasts in the first table