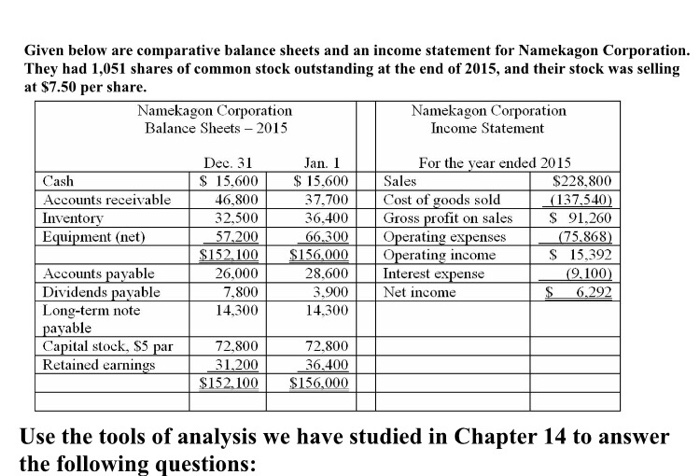

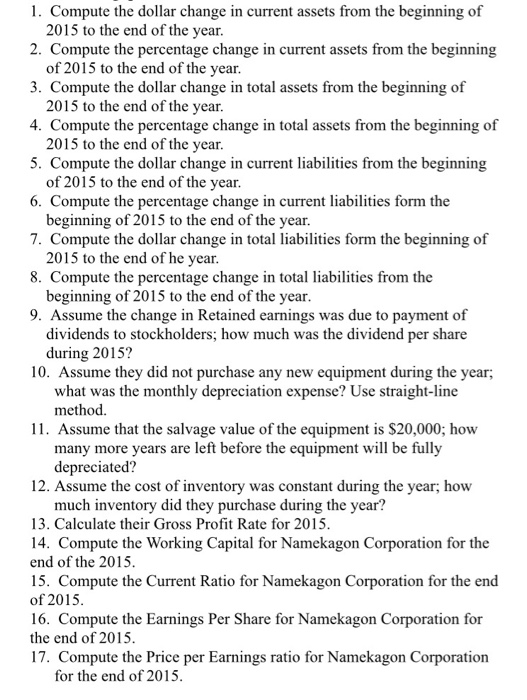

Given below are comparative balance sheets and an income statement for Namekagon Corporation They had 1,051 shares of common stock outstanding at the end of 2015, and their stock was selling at $7.50 per share. Namekagon Corporation Balance Sheets 2015 Namekagon Corporation Income Statement Dec. 31 S 15,600 15.600 Sales an For the vear ended 2015 as Accounts receivable Inventory 46,800 32.500 57,200 $152 100 26,000 7,800 14,300 37,700 36.400 66.300 S156,000 28,600 Cost of goods sold Gross profit on sales Operating expenses Operating income Interest expense $228,800 137,540 S 91,260 75.868 S 15.392 Equipment (net) Accounts payable Dividends payable 9,100 6292 3,900Net income Long-term note 14.300 avable Capital stock, S5 par Retained earnings 72.800 36.400 $152 100156,000 72,800 31.200 Use the tools of analysis we have studied in Chapter 14 to answeir the following questions: 1. Compute the dollar change in current assets from the beginning of 2015 to the end of the year 2. Compute the percentage change in current assets from the beginning of 2015 to the end of the year 3. Compute the dollar change in total assets from the beginning of 2015 to the end of the year 4. Compute the percentage change in total assets from the beginning of 2015 to the end of the year 5. Compute the dollar change in current liabilities from the beginning of 2015 to the end of the year 6. Compute the percentage change in current liabilities form the beginning of 2015 to the end of the year. 7. Compute the dollar change in total liabilities form the beginning of 2015 to the end of he year. 8. Compute the percentage change in total liabilities from the beginning of 2015 to the end of the year 9. Assume the change in Retained earnings was due to payment of dividends to stockholders; how much was the dividend per share during 2015? 10. Assume they did not purchase any new equipment during the year; what was the monthly depreciation expense? Use straight-line method. 11. Assume that the salvage value of the equipment is $20,000; how many more years are left before the equipment will be fully depreciated? 12. Assume the cost of inventory was constant during the year; how much inventory did they purchase during the year? 13. Calculate their Gross Profit Rate for 2015 14. Compute the Working Capital for Namekagon Corporation for the end of the 2015 15. Compute the Current Ratio for Namekagon Corporation for the end of 2015 16. Compute the Earnings Per Share for Namekagon Corporation for the end of 2015 17. Compute the Price per Earnings ratio for Namekagon Corporation for the end of 2015