Answered step by step

Verified Expert Solution

Question

1 Approved Answer

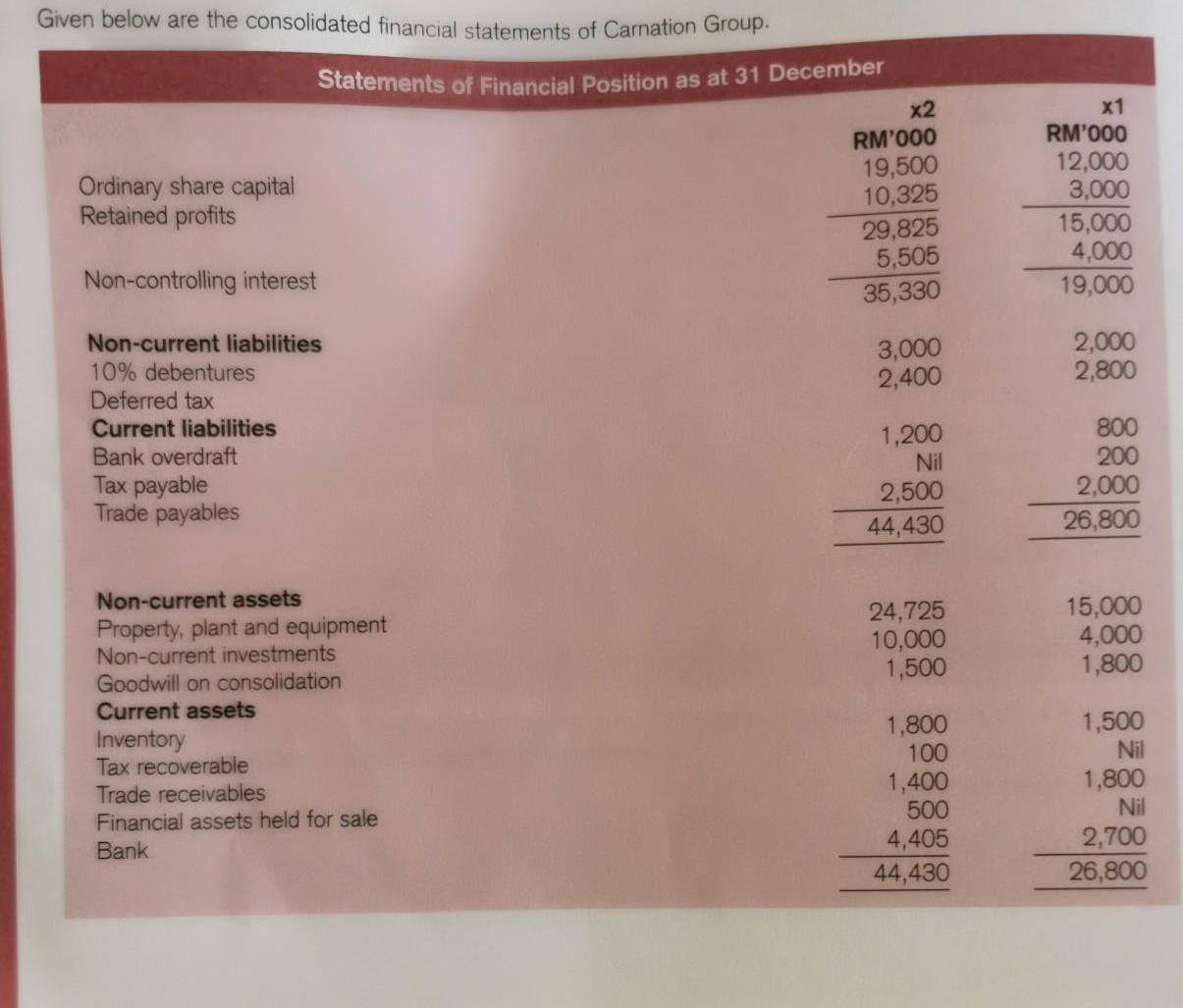

Given below are the consolidated financial statements of Carnation Group. Ordinary share capital Retained profits Statements of Financial Position as at 31 December Non-controlling

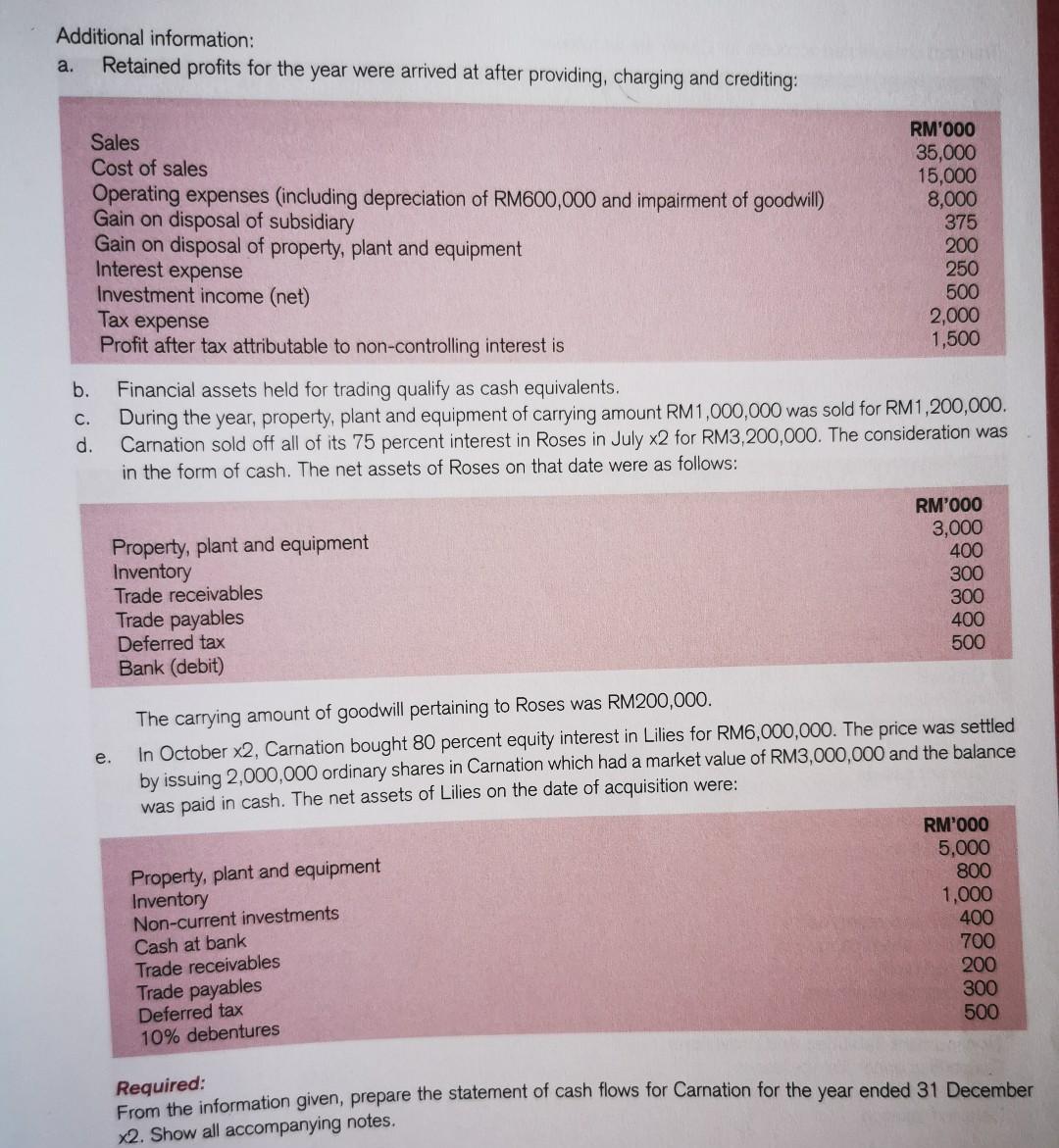

Given below are the consolidated financial statements of Carnation Group. Ordinary share capital Retained profits Statements of Financial Position as at 31 December Non-controlling interest Non-current liabilities 10% debentures Deferred tax Current liabilities Bank overdraft Tax payable Trade payables Non-current assets Property, plant and equipment Non-current investments Goodwill on consolidation Current assets Inventory Tax recoverable Trade receivables Financial assets held for sale Bank x2 RM'000 19,500 10,325 29,825 5,505 35,330 3,000 2,400 1,200 Nil 2,500 44,430 24,725 10,000 1,500 1,800 100 1,400 500 4,405 44,430 x1 RM'000 12,000 3,000 15,000 4,000 19,000 2,000 2,800 800 200 2,000 26,800 15,000 4,000 1,800 1,500 Nil 1,800 Nil 2,700 26,800 Additional information: a. Retained profits for the year were arrived at after providing, charging and crediting: Sales Cost of sales b. C. Operating expenses (including depreciation of RM600,000 and impairment of goodwill) Gain on disposal of subsidiary Gain on disposal of property, plant and equipment Interest expense Investment income (net) d. Tax expense Profit after tax attributable to non-controlling interest is Property, plant and equipment Inventory e. Financial assets held for trading qualify as cash equivalents. During the year, property, plant and equipment of carrying amount RM 1,000,000 was sold for RM1,200,000. Carnation sold off all of its 75 percent interest in Roses in July x2 for RM3,200,000. The consideration was in the form of cash. The net assets of Roses on that date were as follows: Trade receivables Trade payables Deferred tax Bank (debit) RM'000 35,000 15,000 8,000 375 200 250 500 Property, plant and equipment Inventory 2,000 1,500 Non-current investments Cash at bank Trade receivables Trade payables Deferred tax 10% debentures The carrying amount of goodwill pertaining to Roses was RM200,000. In October x2, Carnation bought 80 percent equity interest in Lilies for RM6,000,000. The price was settled by issuing 2,000,000 ordinary shares in Carnation which had a market value of RM3,000,000 and the balance was paid in cash. The net assets of Lilies on the date of acquisition were: RM'000 3,000 400 300 300 400 500 RM'000 5,000 800 1,000 400 700 200 300 500 Required: 2013 From the information given, prepare the statement of cash flows for Carnation for the year ended 31 December x2. Show all accompanying notes.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows For the Year Ended 31 December x2 Notes RM000 Cash flows from operating acti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started