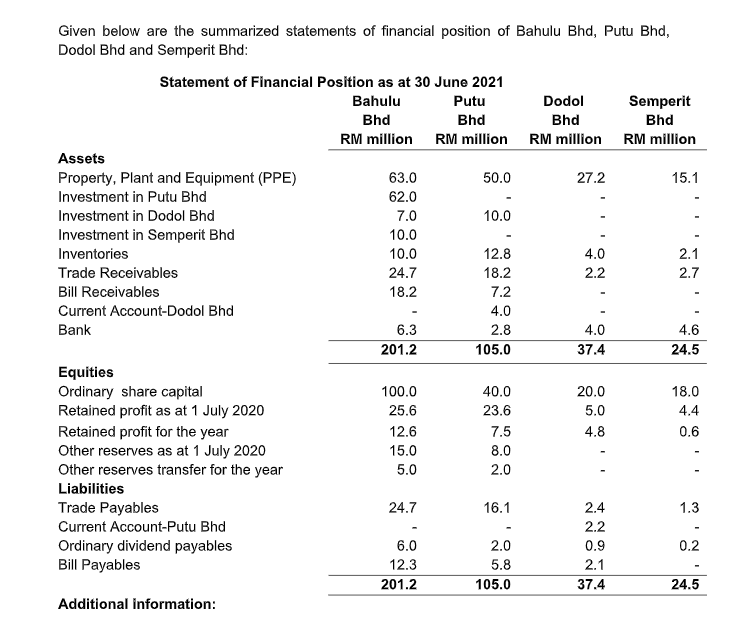

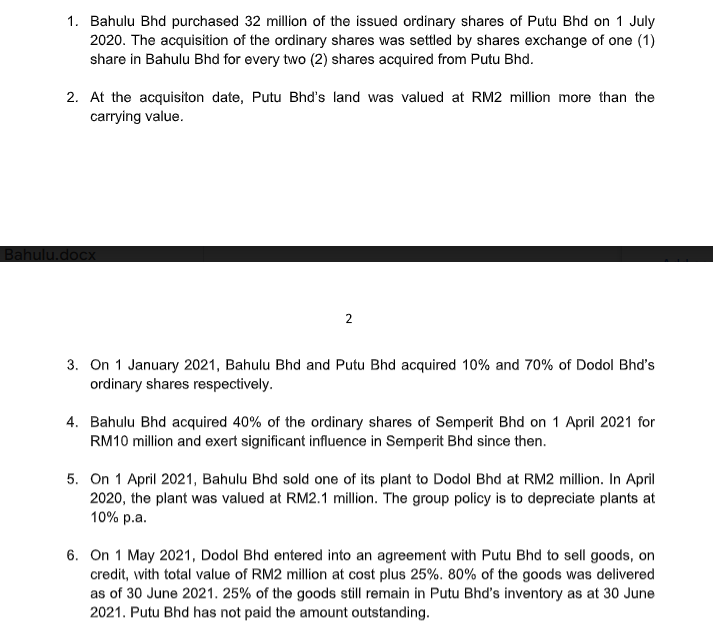

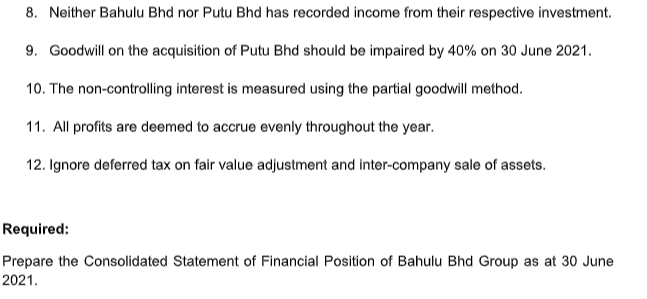

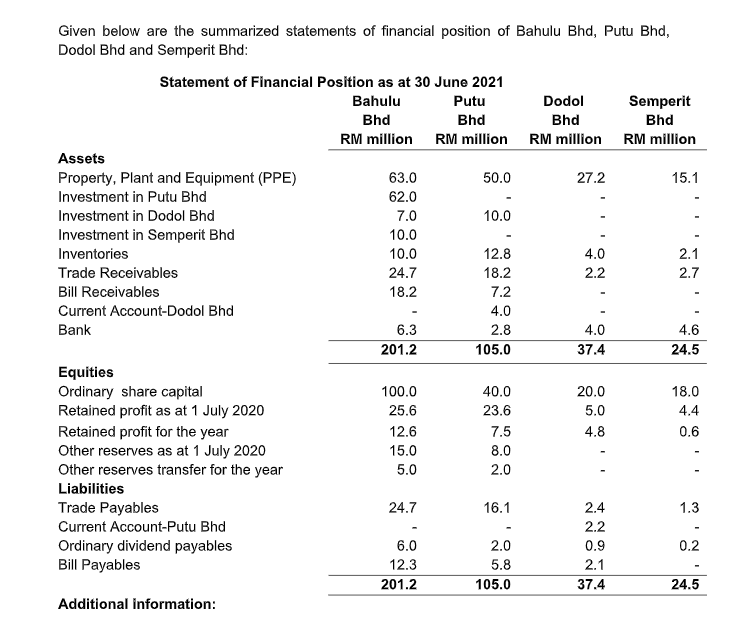

Given below are the summarized statements of financial position of Bahulu Bhd, Putu Bhd, Dodol Bhd and Semperit Bhd: Statement of Financial Position as at 30 June 2021 Bahulu Putu Dodol Semperit Bhd Bhd Bhd Bhd RM million RM million RM million RM million Assets Property, Plant and Equipment (PPE) 63.0 50.0 27.2 15.1 Investment in Putu Bhd 62.0 Investment in Dodol Bhd 7.0 10.0 10.0 Investment in Semperit Bhd Inventories 10.0 12.8 4.0 2.1 Trade Receivables 24.7 18.2 2.2 2.7 Bill Receivables 18.2 7.2 Current Account-Dodol Bhd 4.0 Bank 2.8 4.0 4.6 105.0 37.4 24.5 Equities Ordinary share capital 40.0 20.0 18.0 Retained profit as at 1 July 2020 23.6 5.0 4.4 Retained profit for the year 7.5 4.8 0.6 8.0 Other reserves as at 1 July 2020 Other reserves transfer for the year Liabilities 2.0 Trade Payables 16.1 2.4 1.3 Current Account-Putu Bhd 2.2 2.0 0.9 0.2 Ordinary dividend payables Bill Payables 5.8 2.1 105.0 37.4 24.5 Additional information: 6.3 201.2 100.0 25.6 12.6 15.0 5.0 24.7 6.0 12.3 201.2 1. Bahulu Bhd purchased 32 million of the issued ordinary shares of Putu Bhd on 1 July 2020. The acquisition of the ordinary shares was settled by shares exchange of one (1) share in Bahulu Bhd for every two (2) shares acquired from Putu Bhd. 2. At the acquisiton date, Putu Bhd's land was valued at RM2 million more than the carrying value. 2 3. On 1 January 2021, Bahulu Bhd and Putu Bhd acquired 10% and 70% of Dodol Bhd's ordinary shares respectively. 4. Bahulu Bhd acquired 40% of the ordinary shares of Semperit Bhd on 1 April 2021 for RM10 million and exert significant influence in Semperit Bhd since then. 5. On 1 April 2021, Bahulu Bhd sold one of its plant to Dodol Bhd at RM2 million. In April 2020, the plant was valued at RM2.1 million. The group policy is to depreciate plants at 10% p.a. 6. On 1 May 2021, Dodol Bhd entered into an agreement with Putu Bhd to sell goods, on credit, with total value of RM2 million at cost plus 25%. 80% of the goods was delivered as of 30 June 2021. 25% of the goods still remain in Putu Bhd's inventory as at 30 June 2021. Putu Bhd has not paid the amount outstanding. Bahulu.docx 8. Neither Bahulu Bhd nor Putu Bhd has recorded income from their respective investment. 9. Goodwill on the acquisition of Putu Bhd should be impaired by 40% on 30 June 2021. 10. The non-controlling interest is measured using the partial goodwill method. 11. All profits are deemed to accrue evenly throughout the year. 12. Ignore deferred tax on fair value adjustment and inter-company sale of assets. Required: Prepare the Consolidated Statement of Financial Position of Bahulu Bhd Group as at 30 June 2021. Given below are the summarized statements of financial position of Bahulu Bhd, Putu Bhd, Dodol Bhd and Semperit Bhd: Statement of Financial Position as at 30 June 2021 Bahulu Putu Dodol Semperit Bhd Bhd Bhd Bhd RM million RM million RM million RM million Assets Property, Plant and Equipment (PPE) 63.0 50.0 27.2 15.1 Investment in Putu Bhd 62.0 Investment in Dodol Bhd 7.0 10.0 10.0 Investment in Semperit Bhd Inventories 10.0 12.8 4.0 2.1 Trade Receivables 24.7 18.2 2.2 2.7 Bill Receivables 18.2 7.2 Current Account-Dodol Bhd 4.0 Bank 2.8 4.0 4.6 105.0 37.4 24.5 Equities Ordinary share capital 40.0 20.0 18.0 Retained profit as at 1 July 2020 23.6 5.0 4.4 Retained profit for the year 7.5 4.8 0.6 8.0 Other reserves as at 1 July 2020 Other reserves transfer for the year Liabilities 2.0 Trade Payables 16.1 2.4 1.3 Current Account-Putu Bhd 2.2 2.0 0.9 0.2 Ordinary dividend payables Bill Payables 5.8 2.1 105.0 37.4 24.5 Additional information: 6.3 201.2 100.0 25.6 12.6 15.0 5.0 24.7 6.0 12.3 201.2 1. Bahulu Bhd purchased 32 million of the issued ordinary shares of Putu Bhd on 1 July 2020. The acquisition of the ordinary shares was settled by shares exchange of one (1) share in Bahulu Bhd for every two (2) shares acquired from Putu Bhd. 2. At the acquisiton date, Putu Bhd's land was valued at RM2 million more than the carrying value. 2 3. On 1 January 2021, Bahulu Bhd and Putu Bhd acquired 10% and 70% of Dodol Bhd's ordinary shares respectively. 4. Bahulu Bhd acquired 40% of the ordinary shares of Semperit Bhd on 1 April 2021 for RM10 million and exert significant influence in Semperit Bhd since then. 5. On 1 April 2021, Bahulu Bhd sold one of its plant to Dodol Bhd at RM2 million. In April 2020, the plant was valued at RM2.1 million. The group policy is to depreciate plants at 10% p.a. 6. On 1 May 2021, Dodol Bhd entered into an agreement with Putu Bhd to sell goods, on credit, with total value of RM2 million at cost plus 25%. 80% of the goods was delivered as of 30 June 2021. 25% of the goods still remain in Putu Bhd's inventory as at 30 June 2021. Putu Bhd has not paid the amount outstanding. Bahulu.docx 8. Neither Bahulu Bhd nor Putu Bhd has recorded income from their respective investment. 9. Goodwill on the acquisition of Putu Bhd should be impaired by 40% on 30 June 2021. 10. The non-controlling interest is measured using the partial goodwill method. 11. All profits are deemed to accrue evenly throughout the year. 12. Ignore deferred tax on fair value adjustment and inter-company sale of assets. Required: Prepare the Consolidated Statement of Financial Position of Bahulu Bhd Group as at 30 June 2021