Answered step by step

Verified Expert Solution

Question

1 Approved Answer

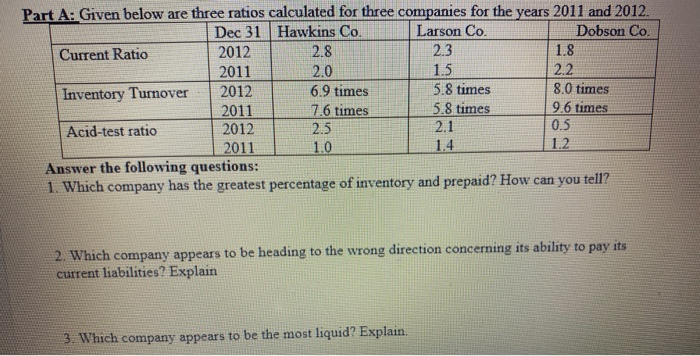

Given below are three ratios calculated for three companies for the years 2011 and 2012. Dobson Co. Larson Co. Hawkins Co. Dec 31 1.8 2.2

Given below are three ratios calculated for three companies for the years 2011 and 2012.

Dobson Co.

Larson Co.

Hawkins Co.

Dec 31

1.8

2.2

2.3

1.5

2.8

2.0

2012

2011

Current Ratio

8.0 times

9.6 times

5.8 times

5.8 times

6.9 times

7.6 times

2012

2011

Inventory Turnover

0.5

1.2

2.1

1.4

2.5

1.0

2012

2011

Acid-test ratio

Answer the following questions:

1. Which company has the greatest percentage of inventory and prepaid? How can you tell?

2. Which company appears to be heading to the wrong direction concerning its ability to pay its current liabilities? Explain

3. Which company appears to be the most liquid? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started