Answered step by step

Verified Expert Solution

Question

1 Approved Answer

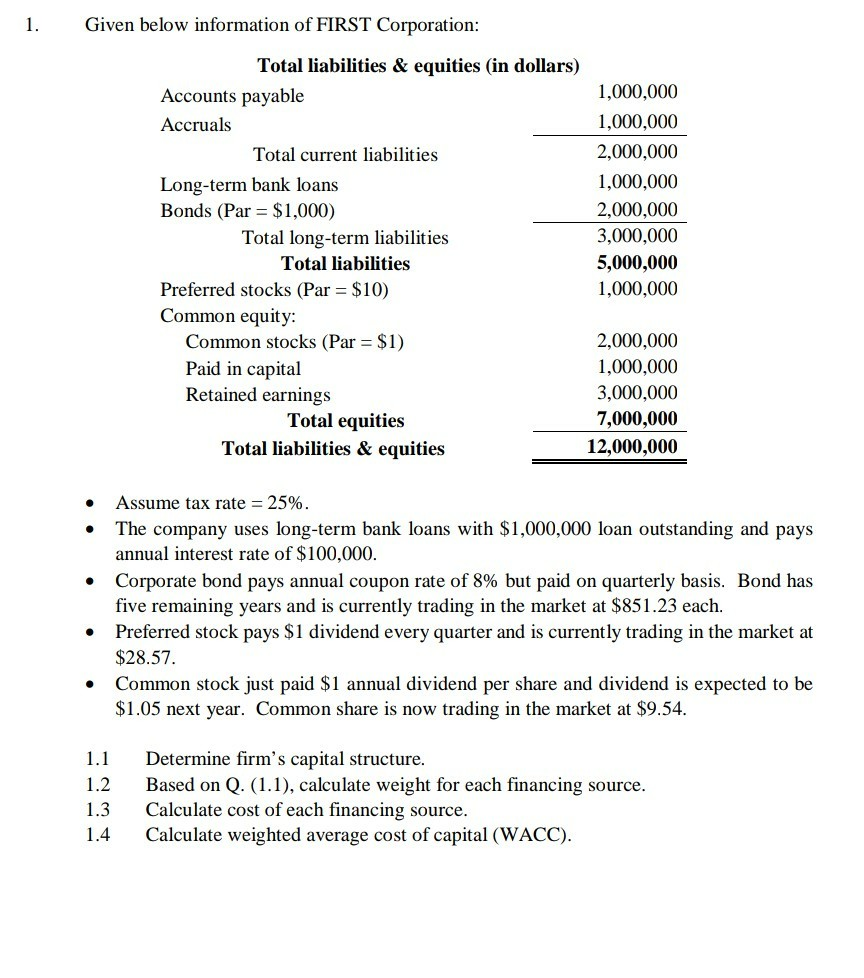

Given below information of FIRST Corporation Total liabilities & equities (in dollars) 1,000,000 1,000,000 2,000,000 1,000,000 2,000,000 3,000,000 5,000,000 1,000,000 Accounts payable Accruals Total current

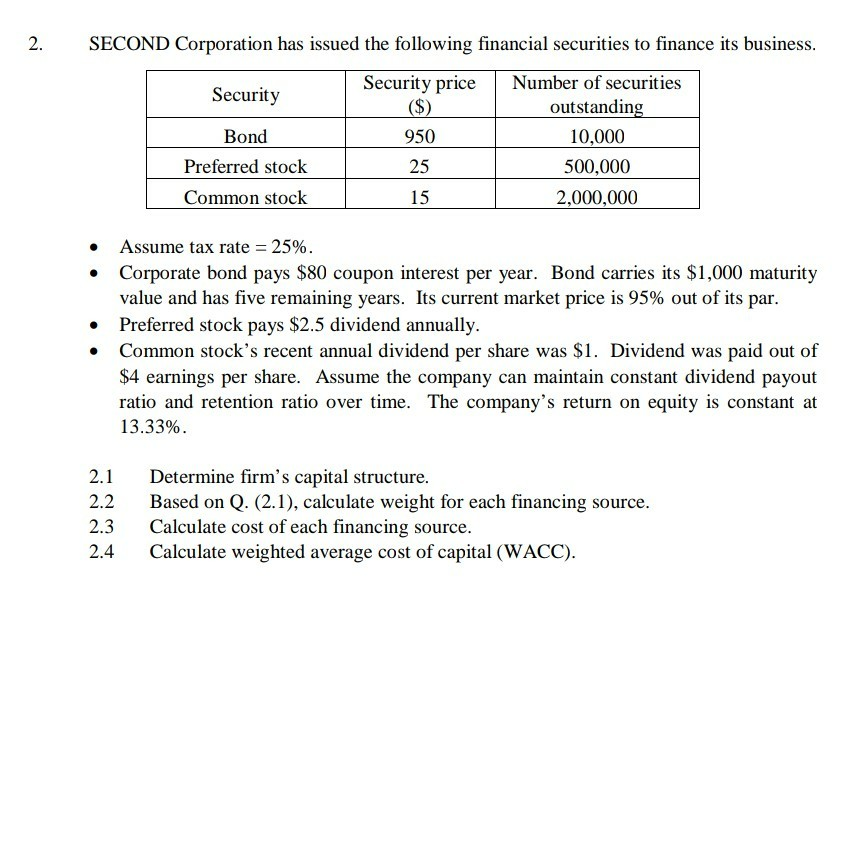

Given below information of FIRST Corporation Total liabilities & equities (in dollars) 1,000,000 1,000,000 2,000,000 1,000,000 2,000,000 3,000,000 5,000,000 1,000,000 Accounts payable Accruals Total current liabilities Long-term bank loans Bonds (Par = $1,000) Total long-term liabilities Total liabilities Preferred stocks (Par $10) Common equity: 2,000,000 1,000,000 3,000,000 7,000,000 12,000,000 Common stocks (Par $1) Paid in capital Retained earnings Total equities Total liabilities & equities Assume tax rate The company uses long-term bank loans with $1,000,000 loan outstanding and pays annual interest rate of $100,000 Corporate bond pays annual coupon rate of 8% but paid on quarterly basis. Bond has five remaining years and is currently trading in the market at $851.23 each Preferred stock pays $1 dividend every quarter and is currently trading in the market at $28.57. Common stock just paid $1 annual dividend per share and dividend is expected to be $1.05 next year. Common share is now trading in the market at $9.54 25% . 1.1 1.2 1.3 1.4 Determine firm's capital structure. Based on Q. (1.1), calculate weight for each financing source Calculate cost of each financing source Calculate weighted average cost of capital (WACC) SECOND Corporation has issued the following financial securities to finance its business Security priceNumber of securities Security Bond Preferred stock Common stock outstanding 10,000 500,000 2,000,000 950 25 15 Assume tax rate-25% Corporate bond pays $80 coupon interest per year. Bond carries its $1,000 maturity value and has five remaining years. Its current market price is 95% out of its par Preferred stock pays $2.5 dividend annually. Common stock's recent annual dividend per share was $1. Dividend was paid out of $4 earnings per share. Assume the company can maintain constant dividend payout ratio and retention ratio over time. The company's return on equity is constant at 13.33% 2.1 2.2 2.3 2.4 Determine firm's capital structure. Based on Q. (2.1), calculate weight for each financing source Calculate cost of each financing source Calculate weighted average cost of capital (WACC)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started