Given :

Calculate :

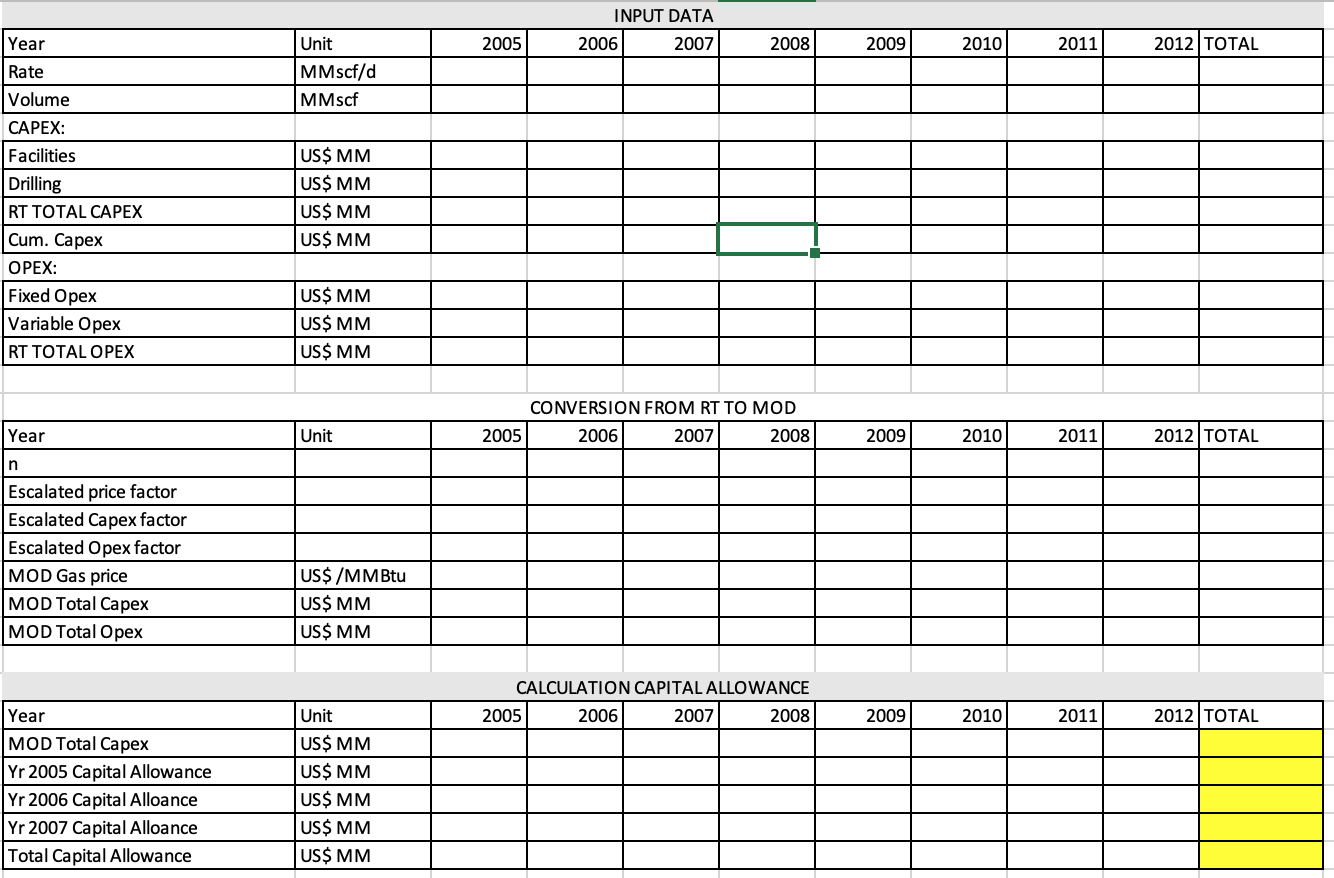

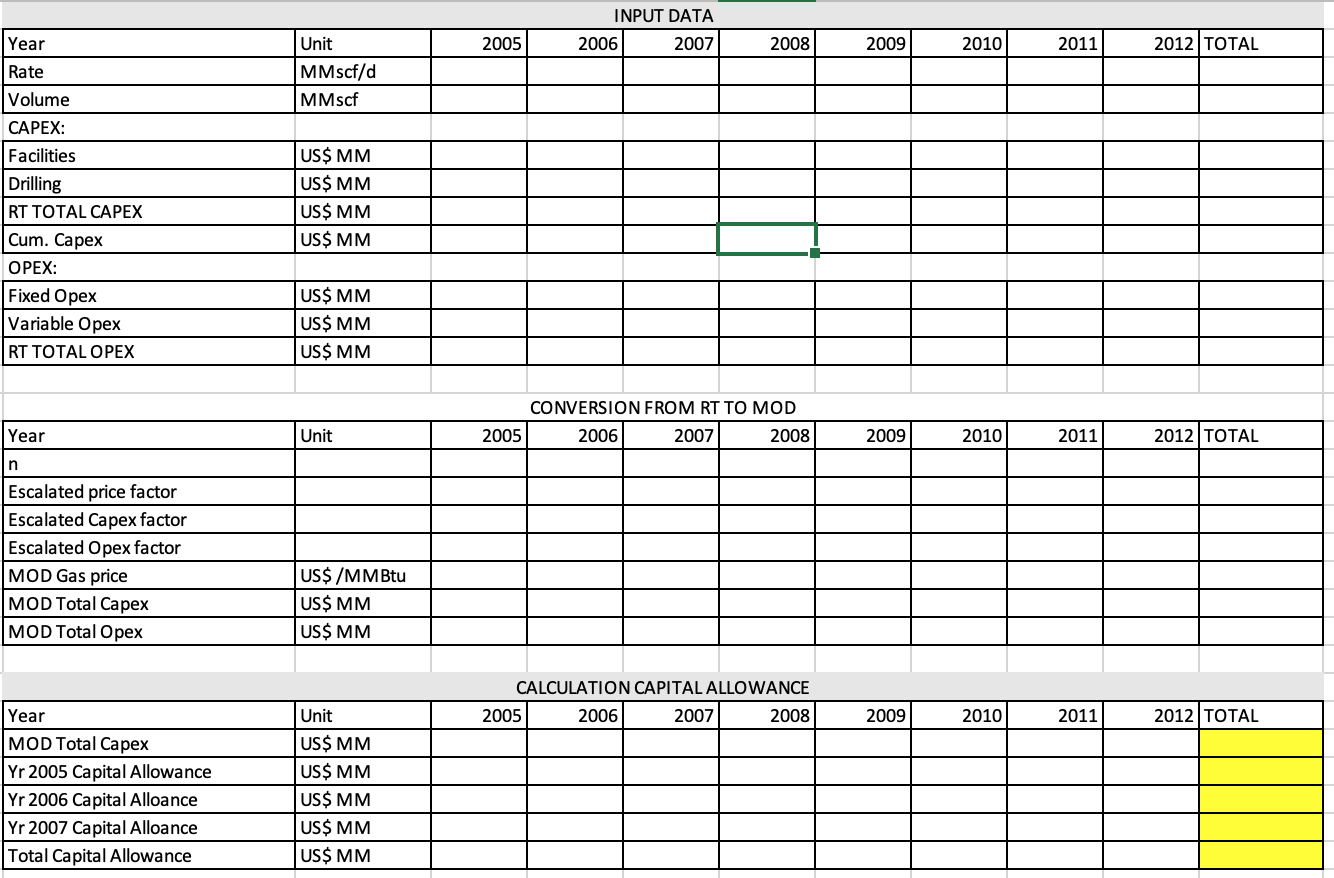

Royalty: 10% for production equal or below 50 Mboe/d 15% for production exceeding 50 Mboe/d 20% for production exceeding 100 Mboe/d Cost Recovery: Ceiling cost of 60% of Gross production Excess cost Oil/Gas is shared in the proportion as Profit oil/gas Profit Oil/Gas: 30% to contractor, 70% to SPC Petroleum tax: 30% of taxable income Capital allowance: 25% on all capital expediture GAS PRICE, USS Gas price escalation Cost escalation Hurdle rate, IRR 2.3 per MMBTU 2.5% per annum 3% per annum 15% for all development projects Project: - located in Block VIII, central Syria - Development of As-Sifar Gas Field of UR 440 Bscf A new 60 km gas pipeline from As-Sifar gas field to Homs will be built by government as stated in PSC). Agreement: - PSC - 5-year exploration period, 10-year development and production period. Work completed: - 6000 km 2D seismic - 2 exploration wells and 1 appraisal well SPC's offer to you (the contractor): - Working interest 100% (appoint as PS contractor) Field development assumptions: Development will begin in 2005 first gas production in 2006 Gas sales peak rate of 210 MMscf/d, sustainable at 70% of EUR through phased well production Production will decline at 25% per annum thereafter Gas heating value of 1000 Btu/scf Reservoir infor: Gas-intially in-place (GIP) 623 Bscf RF: 70% Development will include gas production facilities at As-Sifar field, and drilling 10 wells. The capital expenditure, total = USS 300 MM: Production facilities USS 200 MM Wellsite USS 10 MM Infrastructure US$ 30 MM Development Drilling USS 60 MM Ist yr will spend 30% of CAPEX for production facilities, wellsite and infrastructure 2nd yr will spend the balance CAPEX from production facilities, wellsite and infrastructure 2nd yr will also spend 90% of total drilling cost 3rd yr will incur the balance of devt drilling cost Total annual operating expenses is estimated at 4% of cumulative capex per year. A gas pipeline from As-Sifar field to Homs (60km) is estimated around US$ 15 MM, will be built by the government. Contractor has to pay tariff of US$ 0.20/Mscf for using the pipeline. INPUT DATA 2006 2007 Year 2005 2008 2009 2010 2011 2012 TOTAL Rate Unit MMscf/d MMscf Volume CAPEX: Facilities Drilling RT TOTAL CAPEX Cum. Capex OPEX: Fixed Opex Variable Opex RT TOTAL OPEX US$ MM US$ MM US$ MM US$ MM US$ MM US$ MM US$ MM CONVERSION FROM RT TO MOD 2006 2007 2008 Year Unit 2005 2009 2010 2011 2012 TOTAL n Escalated price factor Escalated Capex factor Escalated Opex factor MOD Gas price MOD Total Capex MOD Total Opex US$ /M MBtu US$ MM US$ MM CALCULATION CAPITAL ALLOWANCE 2005 2006 2007 2008 2009 2010 2011 2012 TOTAL Year MOD Total Capex Yr 2005 Capital Allowance Yr 2006 Capital Alloance Yr 2007 Capital Alloance Total Capital Allowance Unit US$ MM US$ MM US$ MM US$ MM US$ MM Royalty: 10% for production equal or below 50 Mboe/d 15% for production exceeding 50 Mboe/d 20% for production exceeding 100 Mboe/d Cost Recovery: Ceiling cost of 60% of Gross production Excess cost Oil/Gas is shared in the proportion as Profit oil/gas Profit Oil/Gas: 30% to contractor, 70% to SPC Petroleum tax: 30% of taxable income Capital allowance: 25% on all capital expediture GAS PRICE, USS Gas price escalation Cost escalation Hurdle rate, IRR 2.3 per MMBTU 2.5% per annum 3% per annum 15% for all development projects Project: - located in Block VIII, central Syria - Development of As-Sifar Gas Field of UR 440 Bscf A new 60 km gas pipeline from As-Sifar gas field to Homs will be built by government as stated in PSC). Agreement: - PSC - 5-year exploration period, 10-year development and production period. Work completed: - 6000 km 2D seismic - 2 exploration wells and 1 appraisal well SPC's offer to you (the contractor): - Working interest 100% (appoint as PS contractor) Field development assumptions: Development will begin in 2005 first gas production in 2006 Gas sales peak rate of 210 MMscf/d, sustainable at 70% of EUR through phased well production Production will decline at 25% per annum thereafter Gas heating value of 1000 Btu/scf Reservoir infor: Gas-intially in-place (GIP) 623 Bscf RF: 70% Development will include gas production facilities at As-Sifar field, and drilling 10 wells. The capital expenditure, total = USS 300 MM: Production facilities USS 200 MM Wellsite USS 10 MM Infrastructure US$ 30 MM Development Drilling USS 60 MM Ist yr will spend 30% of CAPEX for production facilities, wellsite and infrastructure 2nd yr will spend the balance CAPEX from production facilities, wellsite and infrastructure 2nd yr will also spend 90% of total drilling cost 3rd yr will incur the balance of devt drilling cost Total annual operating expenses is estimated at 4% of cumulative capex per year. A gas pipeline from As-Sifar field to Homs (60km) is estimated around US$ 15 MM, will be built by the government. Contractor has to pay tariff of US$ 0.20/Mscf for using the pipeline. INPUT DATA 2006 2007 Year 2005 2008 2009 2010 2011 2012 TOTAL Rate Unit MMscf/d MMscf Volume CAPEX: Facilities Drilling RT TOTAL CAPEX Cum. Capex OPEX: Fixed Opex Variable Opex RT TOTAL OPEX US$ MM US$ MM US$ MM US$ MM US$ MM US$ MM US$ MM CONVERSION FROM RT TO MOD 2006 2007 2008 Year Unit 2005 2009 2010 2011 2012 TOTAL n Escalated price factor Escalated Capex factor Escalated Opex factor MOD Gas price MOD Total Capex MOD Total Opex US$ /M MBtu US$ MM US$ MM CALCULATION CAPITAL ALLOWANCE 2005 2006 2007 2008 2009 2010 2011 2012 TOTAL Year MOD Total Capex Yr 2005 Capital Allowance Yr 2006 Capital Alloance Yr 2007 Capital Alloance Total Capital Allowance Unit US$ MM US$ MM US$ MM US$ MM US$ MM