| Given Data |

| Parent Company | Roberts Corporation |

| Purchased Company | Williams Corporation |

| Purchase Price | | |

| Cash | | $726,000 |

| | | |

| Purchased Company Book Value | | $560,000 |

| Purchased Company Fair value | | $726,000 |

| Excess over Book Value | | |

| Equipment | $100,000 | |

| Goodwill | ?? | |

| Total Excess | | ?? |

| Purchased Date | | |

| Purchased % | | |

| Financial December 31,2021 |

| | Roberts | Williams |

| Revenues | ($800,000) | ($500,000) |

| CGS | $500,000 | $300,000 |

| Depr Expense | $100,000 | $60,000 |

| Equity in Income of Williams | ($120,000) | $0 |

| Net Income | ($320,000) | ($140,000) |

| | | |

| RE 1/1/21 | ($1,085,000) | ($320,000) |

| Net Income | ($320,000) | ($140,000) |

| Dividends | $115,000 | $60,000 |

| RE 12/31/2021 | ($1,290,000) | ($400,000) |

| | | |

| Cash | $234,000 | $125,000 |

| Accounts receivable | $365,000 | $172,000 |

| Inventory | $375,000 | $225,000 |

| Investment in Williams Stock | $786,000 | $0 |

| Land | $180,000 | $200,000 |

| Buildings and equipment (net) | $580,000 | $283,000 |

| Total assets | $2,520,000 | $1,005,000 |

| | | |

| Accounts payable | ($110,000) | ($65,000) |

| Notes payable | ($310,000) | ($300,000) |

| Common stock | ($610,000) | ($150,000) |

| Additional paid-in capital | ($200,000) | ($90,000) |

| Retained earnings, 1/1/21 | ($1,290,000) | ($400,000) |

| Total liabilities and stockholders equity | ($2,520,000) | ($1,005,000) |

| | | |

| Finacials 2022 Williams | |

| Net Income | ($180,000) | |

| Dividends | $50,000 | |

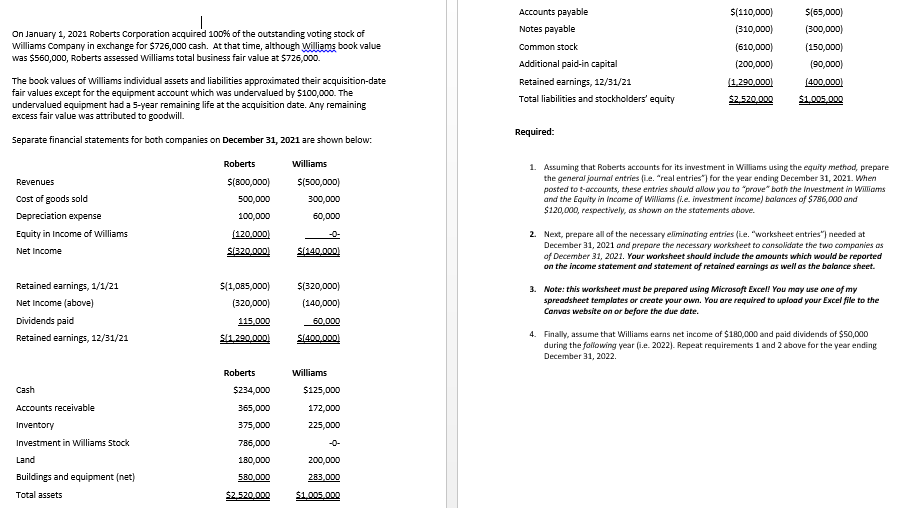

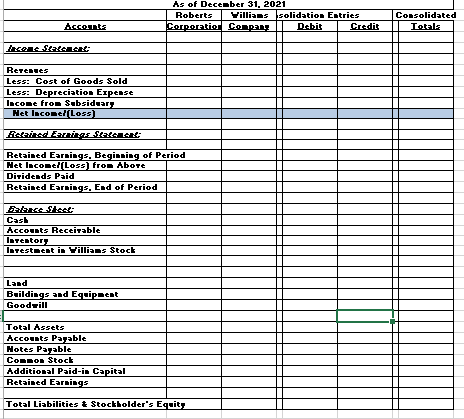

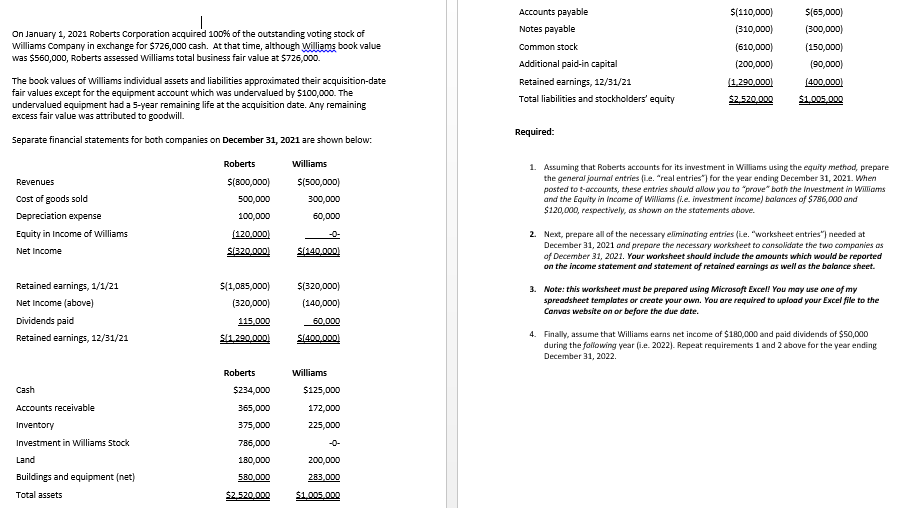

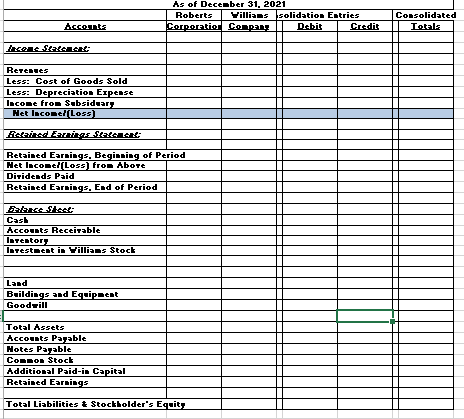

Accounts payable $(110,000) $(65,000) Notes payable (310,000) (300,000) On January 1, 2021 Roberts Corporation acquired 100% of the outstanding voting stock of Williams Company in exchange for $726,000 cash. At that time, although Williams book value was $560,000, Roberts assessed Williams total business fair value at 5726,000. Common stock (610,000) (150,000) Additional paid-in capital (200,000) (90,000) Retained earnings, 12/31/21 1 290.000) (400,000) The book values of Williams individual assets and liabilities approximated their acquisition date fair values except for the equipment account which was undervalued by $100,000. The undervalued equipment had a 5-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. Total liabilities and stockholders' equity $2.520.000 $1.005.000 Required: Separate financial statements for both companies on December 31, 2021 are shown below: Roberts Williams Revenues $(800,000) $(500,000) 1. Assuming that Roberts accounts for its investment in Williams using the equity method, prepare the general journal entries fi.e. "real entries for the year ending December 31, 2021. When posted to t-accounts, these entries should allow you to prove both the investment in Williams and the Equity in Income of Williams (ie. investment income) balances of $786,000 and $120,000, respectively, as shown on the statements above. Cost of goods sold 500,000 300,000 Depreciation expense 100,000 60,000 Equity in Income of Williams (120,000) Net Income S1320.000) S1140.000) 2. Next, prepare all of the necessary eliminating entries (ie. "worksheet entries") needed at December 31, 2021 and prepare the necessary worksheet to consolidate the two companies as of December 31, 2021. Your worksheet should include the amounts which would be reported on the income statement and statement of retained earnings as well as the balance sheet. Retained earnings, 1/1/21 $(1,085,000) $(320,000) Net Income (above) (320,000) (140,000) 3. Note: this worksheet must be prepared using Microsoft Excell You may use one of my spreadsheet templates or create your own. You are required to upload your Excel file to the Canvas website on or before the due date. Dividends paid 115.000 60.000 Retained earnings, 12/31/21 $11.200.000 S1400,000) 4. Finally, assume that Williams earns net income of $180,000 and paid dividends of $50,000 during the following year (i.e. 2022). Repeat requirements 1 and 2 above for the year ending December 31, 2022 Roberts Williams Cash $234,000 $125,000 Accounts receivable 365,000 172,000 Inventory 375,000 225,000 Investment in Williams Stock 785,000 Land 180,000 200,000 Buildings and equipment (net) 580,000 283.000 Total assets $2.520.000 $1.005.000 As of Deceaber 31, 2021 Roberts Yilliams solidation Entries Corporation Company Debit Credit Consolidated Totals Accomt 10 Salon Reserves Less: Cost of Goods Sold Less: Depreciation Expense Income from Subsiduary Het lacobel (Loss) Assited Ezings Stalcica: Retained Earnings, Beginning of Period Het lacomel(Loss) from Above Dividends Paid Retained Earnings, End of Period Max Skes Cash Accounts Receivable I reator? latestacat in Yilliams Stock Land Buildings and Equipment Goodwill Total Assets Accounts Payable Hotes Payable Connon Stock Additional Paid-in Capital Retained Earnings Total Liabilities & Stockholder's Equity Accounts payable $(110,000) $(65,000) Notes payable (310,000) (300,000) On January 1, 2021 Roberts Corporation acquired 100% of the outstanding voting stock of Williams Company in exchange for $726,000 cash. At that time, although Williams book value was $560,000, Roberts assessed Williams total business fair value at 5726,000. Common stock (610,000) (150,000) Additional paid-in capital (200,000) (90,000) Retained earnings, 12/31/21 1 290.000) (400,000) The book values of Williams individual assets and liabilities approximated their acquisition date fair values except for the equipment account which was undervalued by $100,000. The undervalued equipment had a 5-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. Total liabilities and stockholders' equity $2.520.000 $1.005.000 Required: Separate financial statements for both companies on December 31, 2021 are shown below: Roberts Williams Revenues $(800,000) $(500,000) 1. Assuming that Roberts accounts for its investment in Williams using the equity method, prepare the general journal entries fi.e. "real entries for the year ending December 31, 2021. When posted to t-accounts, these entries should allow you to prove both the investment in Williams and the Equity in Income of Williams (ie. investment income) balances of $786,000 and $120,000, respectively, as shown on the statements above. Cost of goods sold 500,000 300,000 Depreciation expense 100,000 60,000 Equity in Income of Williams (120,000) Net Income S1320.000) S1140.000) 2. Next, prepare all of the necessary eliminating entries (ie. "worksheet entries") needed at December 31, 2021 and prepare the necessary worksheet to consolidate the two companies as of December 31, 2021. Your worksheet should include the amounts which would be reported on the income statement and statement of retained earnings as well as the balance sheet. Retained earnings, 1/1/21 $(1,085,000) $(320,000) Net Income (above) (320,000) (140,000) 3. Note: this worksheet must be prepared using Microsoft Excell You may use one of my spreadsheet templates or create your own. You are required to upload your Excel file to the Canvas website on or before the due date. Dividends paid 115.000 60.000 Retained earnings, 12/31/21 $11.200.000 S1400,000) 4. Finally, assume that Williams earns net income of $180,000 and paid dividends of $50,000 during the following year (i.e. 2022). Repeat requirements 1 and 2 above for the year ending December 31, 2022 Roberts Williams Cash $234,000 $125,000 Accounts receivable 365,000 172,000 Inventory 375,000 225,000 Investment in Williams Stock 785,000 Land 180,000 200,000 Buildings and equipment (net) 580,000 283.000 Total assets $2.520.000 $1.005.000 As of Deceaber 31, 2021 Roberts Yilliams solidation Entries Corporation Company Debit Credit Consolidated Totals Accomt 10 Salon Reserves Less: Cost of Goods Sold Less: Depreciation Expense Income from Subsiduary Het lacobel (Loss) Assited Ezings Stalcica: Retained Earnings, Beginning of Period Het lacomel(Loss) from Above Dividends Paid Retained Earnings, End of Period Max Skes Cash Accounts Receivable I reator? latestacat in Yilliams Stock Land Buildings and Equipment Goodwill Total Assets Accounts Payable Hotes Payable Connon Stock Additional Paid-in Capital Retained Earnings Total Liabilities & Stockholder's Equity