GIVEN INFORMATION:

The Byte of Accounting Corporation (Byte) sells turn-key computer systems to midsize businesses on account. Byte was started by Lauryn on January 1 of last year when she was issued 2,200 shares of stock.

- Perpetual FIFO will be used for the Super Toners.

- The allowance method is used to account for bad debts.

FOR JOURNAL ENTRIES: #15, #26, #27, #38, #39, #40, #44, #45, #46, #48, #49, #50, and #51

I need an answer with the following (for all listed journal entries below):

1) Transaction Name

2) Transaction Debit amount

3) Transaction Credit amount

| Transaction 15: December 19: Byte records the cost of the 6 Super Toners sold using FIFO. The sales order number was 12101. |

| Transaction 26: December 28: Record the cost of the computers that were sold today. |

| Transaction 27: December 28: Byte paid the bill that was previously received and recorded from Computer Parts and Repairs Co with Check # 6007. The invoice number was 43254. |

| Transaction 38: A physical inventory showed that only $526.00 worth of supplies remained on hand as of December 31. |

| Transaction 39: The interest on the note for the Ricoh Color Copier will be paid every six months. Record the December accrued interest on the note payable for the Ricoh purchased on December 1. |

| Transaction 40: Record a journal entry to reflect that one-half month's insurance has expired. |

| Transaction 44: The computer equipment on the Post Closing Trial Balance from last year was purchased last January for $20,000.00. It is being depreciated based upon an estimated useful life of 5.0 years with no salvage value. Calculate the depreciation for one year using the |

| straight-line method of depreciation. |

| Transaction 45: The Ricoh Color Copier, part of the office equipment, is estimated to make 480,000 copies a year, have a useful life of 5 years and a salvage value of $300.00. |

| During December, 8,250 copies were made. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. Calculate the depreciation for one month using the straight-line method of depreciation. |

| Transaction 46: The remaining office equipment, $62,100.00, was purchased last January and has an estimated useful life of 10.0 years with a salvage value of $3,100.00. Calculate the depreciation for one year using the straight-line method of depreciation. |

| Transaction 47: A review of Byte's payroll records show that unpaid salaries in the amount of $1,200.00 are owed by Byte for three days, December 28 - 31. (Ignore payroll taxes at this time.) |

| Transaction 48: Byte's CPA indicated that the Allowance for Doubtful Accounts should be increased by 5.00% of the ending balance of the Accounts Receivable account. |

| Trans 49: Byte's income taxes are to be computed @ rate of 25% of net income before taxes. |

| [IMPORTANT NOTE: Since the income taxes are a percent of the net income, you will want to prepare the Income Statement through the Net Income Before Tax line.] |

| Transaction 50: Close the revenue account |

| Transaction 51: Close the expense accounts |

| Transaction 52: Close the dividend account |

| A. Prepare the Post Closing Trial Balance |

| B. Complete the Ratio Analysis --> Current Ratio; Receivable Turnover; Average Collection Period; Inventory Turnover; Average Days in Inventory; Gross Profit Rate; Profit Margin; Earnings per share (EPS) |

| |

| |

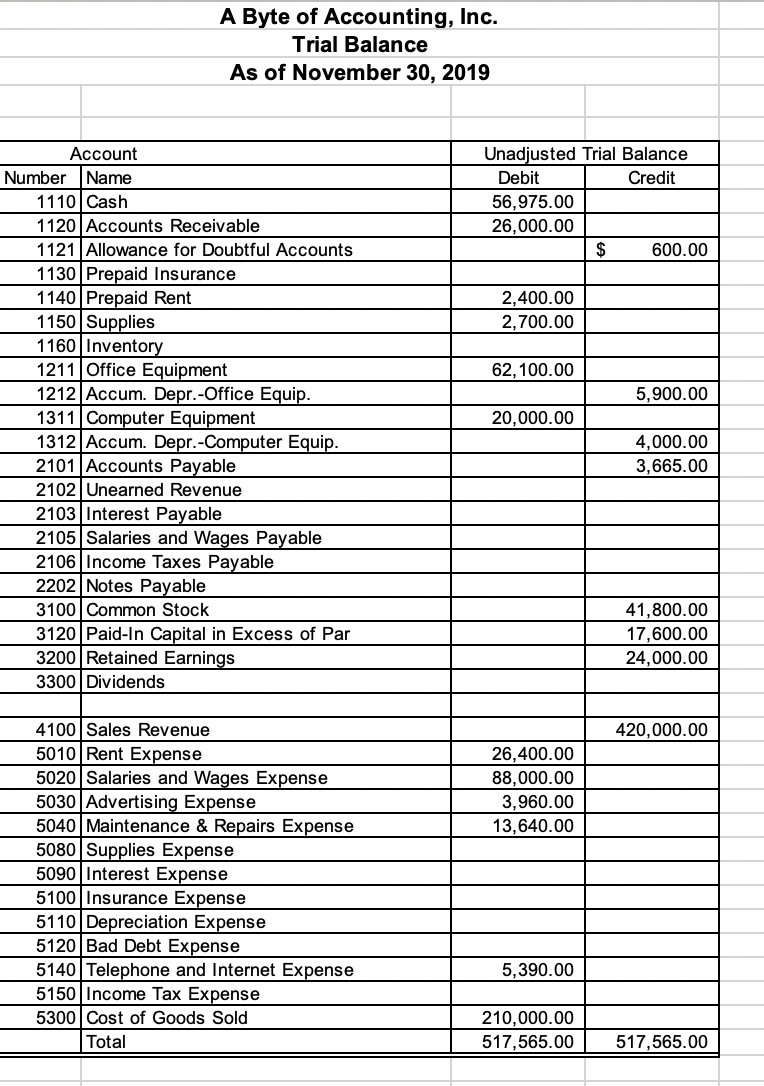

For Journal Entries #50 and #51 use the following trial balance:

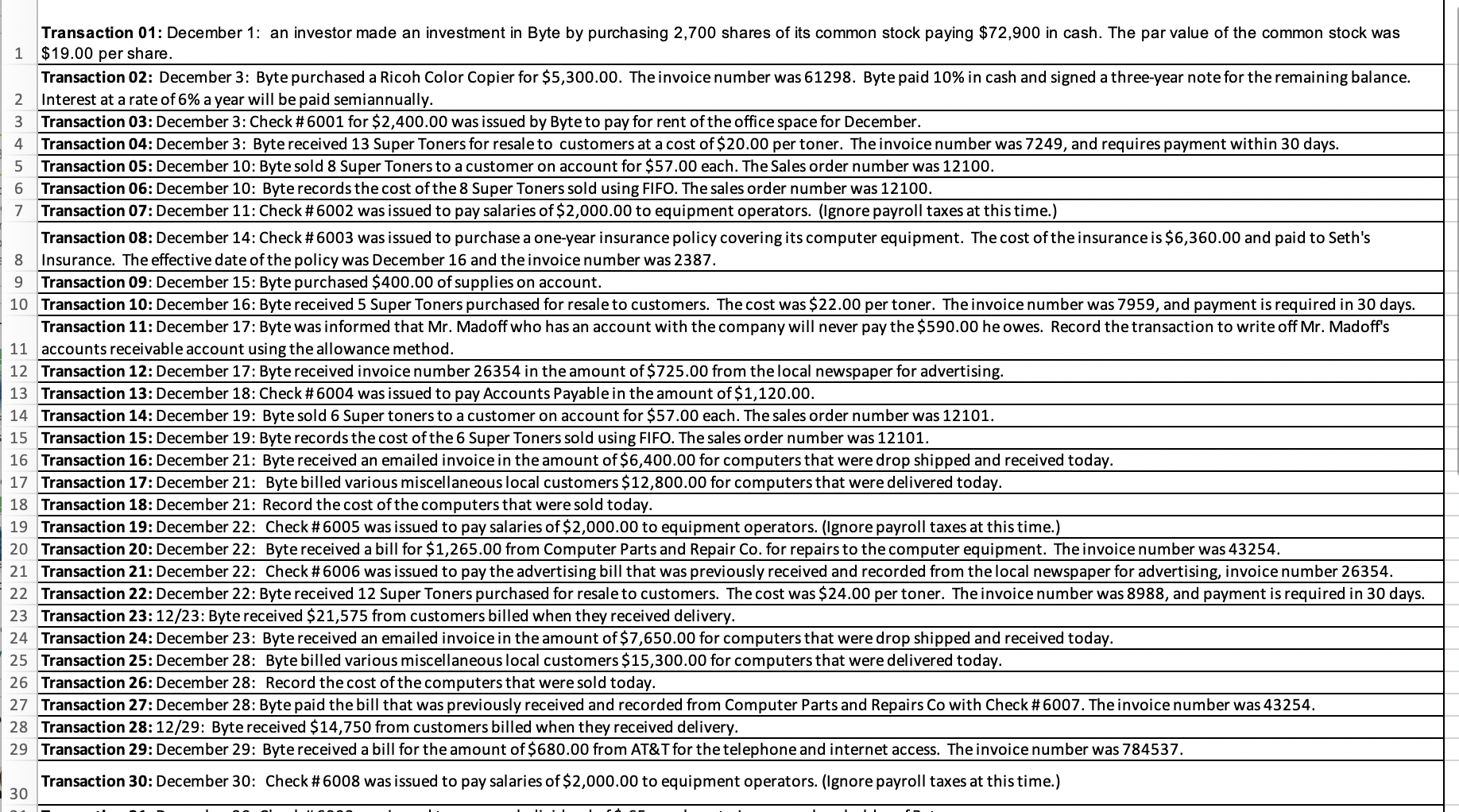

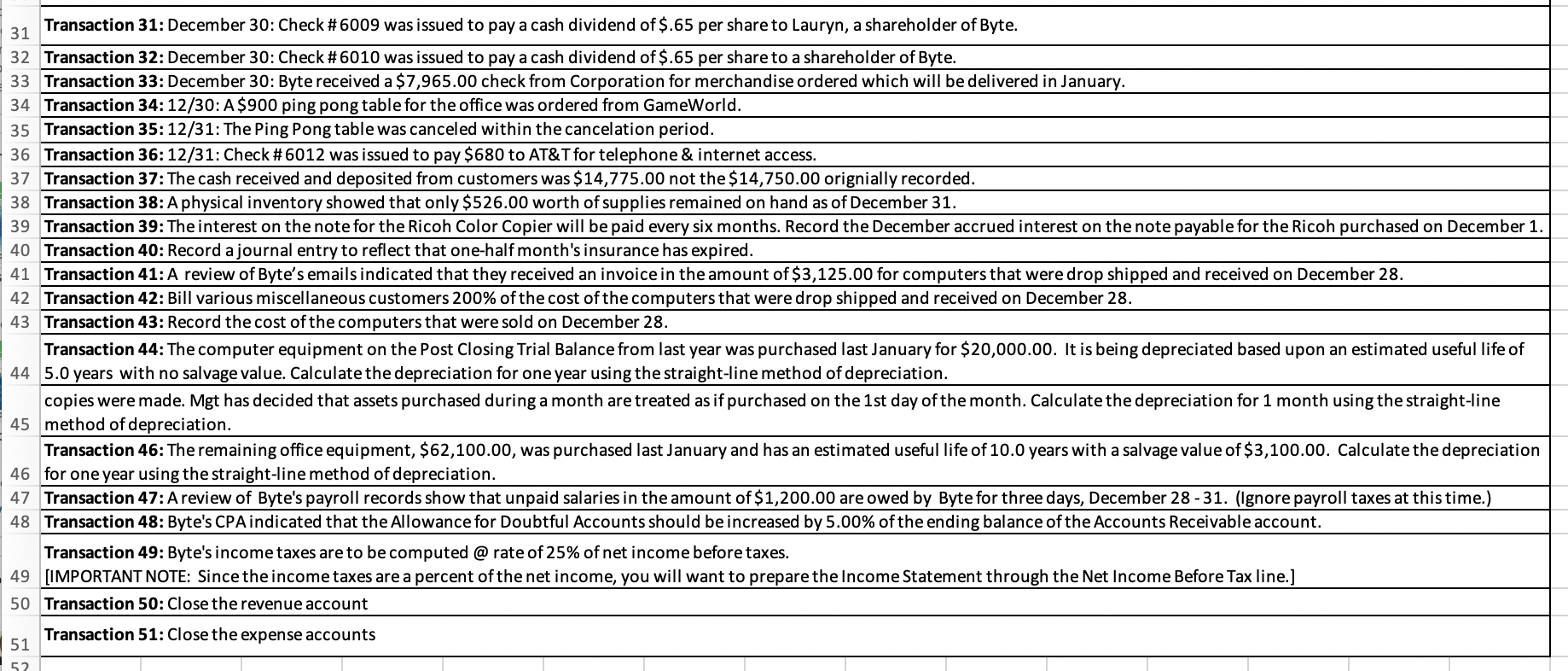

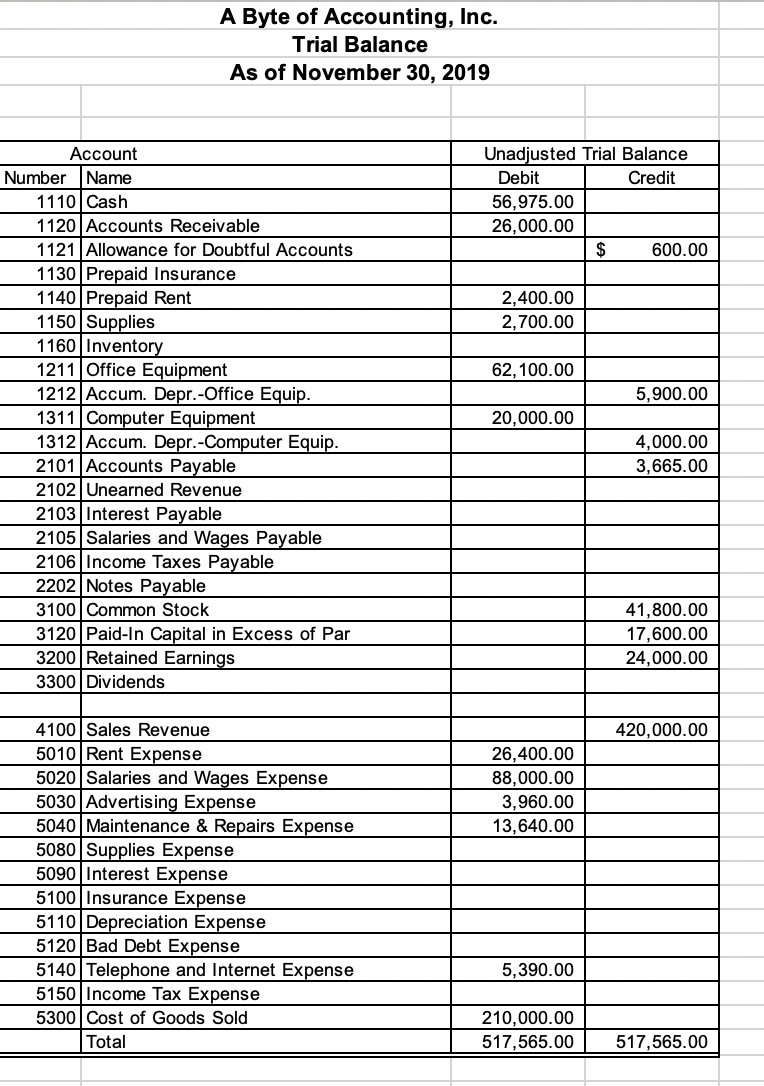

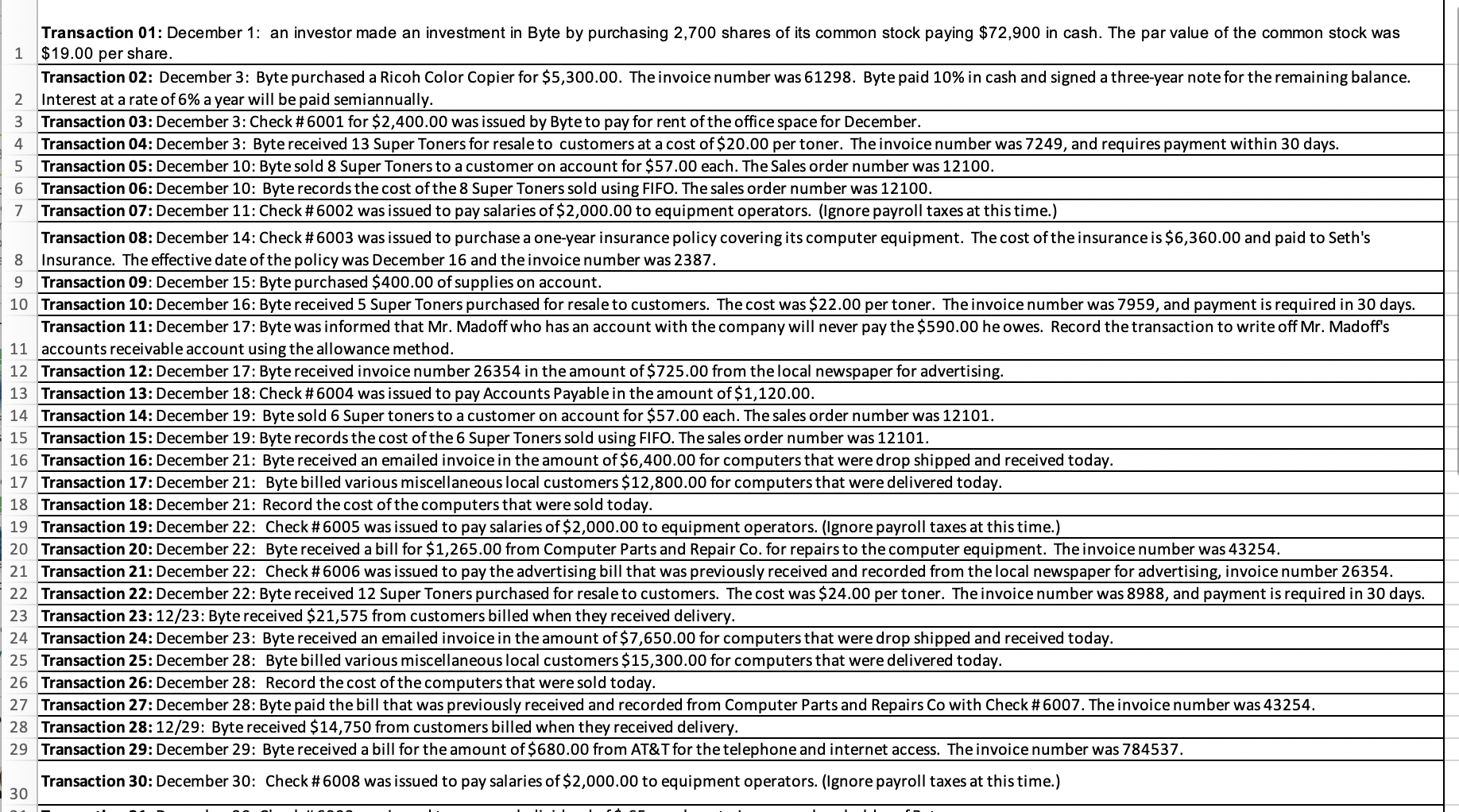

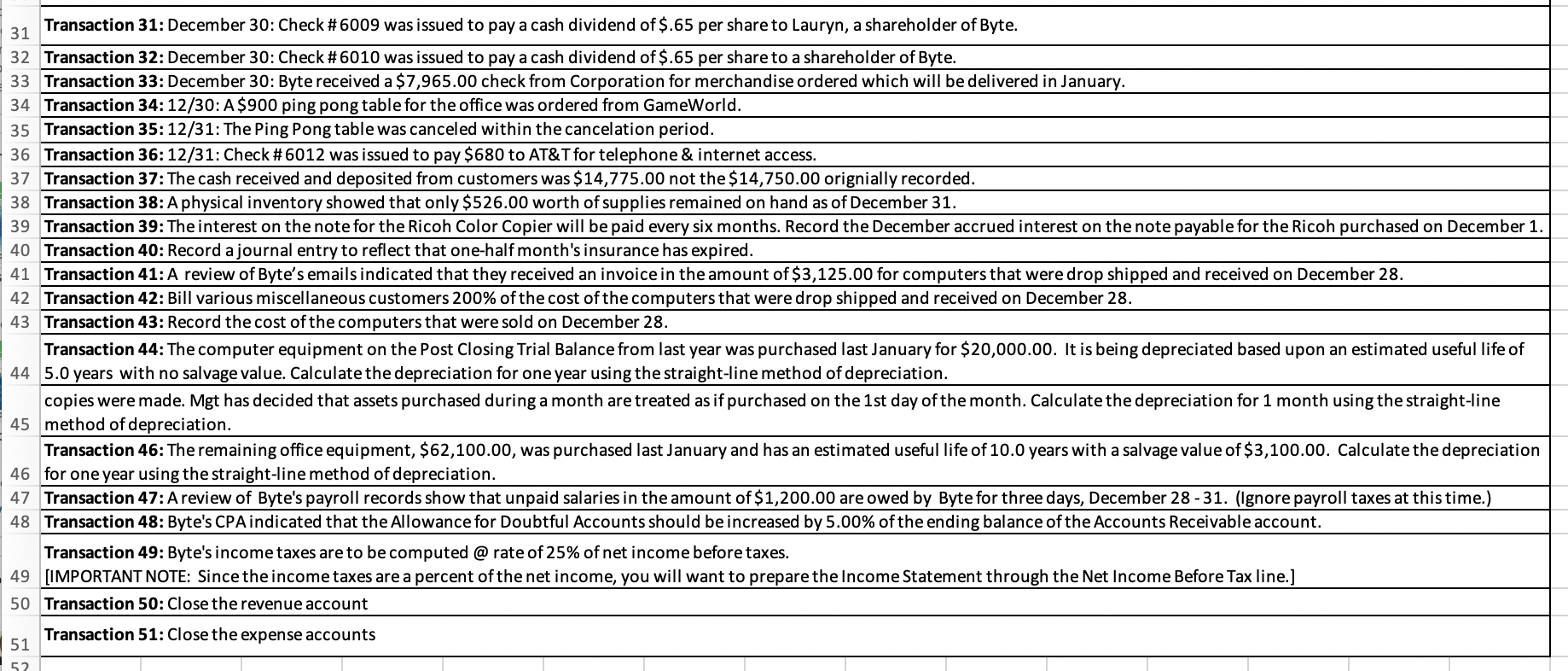

Transaction 01: December 1: an investor made an investment in Byte by purchasing 2,700 shares of its common stock paying $72,900 in cash. The par value of the common stock was 1 $19.00 per share. Transaction 02: December 3: Byte purchased a Ricoh Color Copier for $5,300.00. The invoice number was 61298. Byte paid 10% in cash and signed a three-year note for the remaining balance. 2 Interest at a rate of 6% a year will be paid semiannually. 3 Transaction 03: December 3: Check #6001 for $2,400.00 was issued by Byte to pay for rent of the office space for December. 4 Transaction 04: December 3: Byte received 13 Super Toners for resale to customers at a cost of $20.00 per toner. The invoice number was 7249, and requires payment within 30 days. 5 Transaction 05: December 10: Byte sold 8 Super Toners to a customer on account for $57.00 each. The Sales order number was 12100. 6 Transaction 06: December 10: Byte records the cost of the 8 Super Toners sold using FIFO. The sales order number was 12100. 7 Transaction 07: December 11: Check #6002 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) Transaction 08: December 14: Check #6003 was issued to purchase a one-year insurance policy covering its computer equipment. The cost of the insurance is $6,360.00 and paid to Seth's 8 Insurance. The effective date of the policy was December 16 and the invoice number was 2387. 9 Transaction 09: December 15: Byte purchased $400.00 of supplies on account. 10 Transaction 10: December 16: Byte received 5 Super Toners purchased for resale to customers. The cost was $22.00 per toner. The invoice number was 7959, and payment is required in 30 days. Transaction 11: December 17: Byte was informed that Mr. Madoff who has an account with the company will never pay the $590.00 he owes. Record the transaction to write off Mr. Madoff's 11 accounts receivable account using the allowance method. 12 Transaction 12: December 17: Byte received invoice number 26354 in the amount of $725.00 from the local newspaper for advertising. 13 Transaction 13: December 18: Check #6004 was issued to pay Accounts Payable in the amount of $1,120.00. 14 Transaction 14: December 19: Byte sold 6 Super toners to a customer on account for $57.00 each. The sales order number was 12101. 15 Transaction 15: December 19: Byte records the cost of the 6 Super Toners sold using FIFO. The sales order number was 12101. 16 Transaction 16: December 21: Byte received an emailed invoice in the amount of $6,400.00 for computers that were drop shipped and received today. 17 Transaction 17: December 21: Byte billed various miscellaneous local customers $12,800.00 for computers that were delivered today. 18 Transaction 18: December 21: Record the cost of the computers that were sold today. 19 Transaction 19: December 22: Check #6005 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) 20 Transaction 20: December 22: Byte received a bill for $1,265.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invoice number was 43254. 21 Transaction 21: December 22: Check #6006 was issued to pay the advertising bill that was previously received and recorded from the local newspaper for advertising, invoice number 26354. 22 Transaction 22: December 22: Byte received 12 Super Toners purchased for resale to customers. The cost was $24.00 per toner. The invoice number was 8988, and payment is required in 30 days. 23 Transaction 23: 12/23: Byte received $21,575 from customers billed when they received delivery. 24 Transaction 24: December 23: Byte received an emailed invoice in the amount of $7,650.00 for computers that were drop shipped and received today. 25 Transaction 25: December 28: Byte billed various miscellaneous local customers $15,300.00 for computers that were delivered today. 26 Transaction 26: December 28: Record the cost of the computers that were sold today. 27 Transaction 27: December 28: Byte paid the bill that was previously received and recorded from Computer Parts and Repairs Co with Check #6007. The invoice number was 43254. 28 Transaction 28: 12/29: Byte received $14,750 from customers billed when they received delivery. 29 Transaction 29: December 29: Byte received a bill for the amount of $680.00 from AT&T for the telephone and internet access. The invoice number was 784537. Transaction 30: December 30: Check#6008 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) 30 Innnn 31 Transaction 31: December 30: Check #6009 was issued to pay a cash dividend of $.65 per share to Lauryn, a shareholder of Byte. 32 Transaction 32: December 30: Check #6010 was issued to pay a cash dividend of $.65 per share to a shareholder of Byte. 33 Transaction 33: December 30: Byte received a $7,965.00 check from Corporation for merchandise ordered which will be delivered in January. 34 Transaction 34: 12/30: A $900 ping pong table for the office was ordered from GameWorld. 35 Transaction 35: 12/31: The Ping Pong table was canceled within the cancelation period. 36 Transaction 36:12/31: Check #6012 was issued to pay $680 to AT&T for telephone & internet access. 37 Transaction 37: The cash received and deposited from customers was $14,775.00 not the $14,750.00 orignially recorded. 38 Transaction 38: A physical inventory showed that only $526.00 worth of supplies remained on hand as of December 31. 39 Transaction 39: The interest on the note for the Ricoh Color Copier will be paid every six months. Record the December accrued interest on the note payable for the Ricoh purchased on December 1. 40 Transaction 40: Record a journal entry to reflect that one-half month's insurance has expired. 41 Transaction 41: A review of Byte's emails indicated that they received an invoice in the amount of $3,125.00 for computers that were drop shipped and received on December 28. 42 Transaction 42: Bill various miscellaneous customers 200% of the cost of the computers that were drop shipped and received on December 28. 43 Transaction 43: Record the cost of the computers that were sold on December 28. Transaction 44: The computer equipment on the Post Closing Trial Balance from last year was purchased last January for $20,000.00. It is being depreciated based upon an estimated useful life of 44 5.0 years with no salvage value. Calculate the depreciation for one year using the straight-line method of depreciation. copies were made. Mgt has decided that assets purchased during a month are treated as if purchased on the 1st day of the month. Calculate the depreciation for 1 month using the straight-line 45 method of depreciation. Transaction 46: The remaining office equipment, $62,100.00, was purchased last January and has an estimated useful life of 10.0 years with a salvage value of $3,100.00. Calculate the depreciation 46 for one year using the straight-line method of depreciation. 47 Transaction 47: A review of Byte's payroll records show that unpaid salaries in the amount of $1,200.00 are owed by Byte for three days, December 28 -31. (Ignore payroll taxes at this time.) 48 Transaction 48: Byte's CPA indicated that the Allowance for Doubtful Accounts should be increased by 5.00% of the ending balance of the Accounts Receivable account. Transaction 49: Byte's income taxes are to be computed @ rate of 25% of net income before taxes. 49 [IMPORTANT NOTE: Since the income taxes are a percent of the net income, you will want to prepare the Income Statement through the Net Income Before Tax line.] 50 Transaction 50: Close the revenue account Transaction 51: Close the expense accounts 51 52 A Byte of Accounting, Inc. Trial Balance As of November 30, 2019 Unadjusted Trial Balance Debit Credit 56,975.00 26,000.00 $ 600.00 2,400.00 2,700.00 62,100.00 5,900.00 Account Number Name 1110 Cash 1120 Accounts Receivable 1121 Allowance for Doubtful Accounts 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Supplies 1160 Inventory 1211 Office Equipment 1212 Accum. Depr.-Office Equip. 1311 Computer Equipment 1312 Accum. Depr.-Computer Equip. 2101 | Accounts Payable 2102 Unearned Revenue 2103 Interest Payable 2105 Salaries and Wages Payable 2106 Income Taxes Payable 2202 Notes Payable 3100 Common Stock 3120 Paid-In Capital in Excess of Par 3200 Retained Earnings 3300 Dividends 20,000.00 4,000.00 3,665.00 41,800.00 17,600.00 24,000.00 420,000.00 26,400.00 88,000.00 3,960.00 13,640.00 4100 Sales Revenue 5010 Rent Expense 5020 Salaries and Wages Expense 5030 Advertising Expense 5040 Maintenance & Repairs Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Bad Debt Expense 5140 Telephone and Internet Expense 5150 Income Tax Expense 5300 Cost of Goods Sold Total 5,390.00 210,000.00 517,565.00 517,565.00 Transaction 01: December 1: an investor made an investment in Byte by purchasing 2,700 shares of its common stock paying $72,900 in cash. The par value of the common stock was 1 $19.00 per share. Transaction 02: December 3: Byte purchased a Ricoh Color Copier for $5,300.00. The invoice number was 61298. Byte paid 10% in cash and signed a three-year note for the remaining balance. 2 Interest at a rate of 6% a year will be paid semiannually. 3 Transaction 03: December 3: Check #6001 for $2,400.00 was issued by Byte to pay for rent of the office space for December. 4 Transaction 04: December 3: Byte received 13 Super Toners for resale to customers at a cost of $20.00 per toner. The invoice number was 7249, and requires payment within 30 days. 5 Transaction 05: December 10: Byte sold 8 Super Toners to a customer on account for $57.00 each. The Sales order number was 12100. 6 Transaction 06: December 10: Byte records the cost of the 8 Super Toners sold using FIFO. The sales order number was 12100. 7 Transaction 07: December 11: Check #6002 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) Transaction 08: December 14: Check #6003 was issued to purchase a one-year insurance policy covering its computer equipment. The cost of the insurance is $6,360.00 and paid to Seth's 8 Insurance. The effective date of the policy was December 16 and the invoice number was 2387. 9 Transaction 09: December 15: Byte purchased $400.00 of supplies on account. 10 Transaction 10: December 16: Byte received 5 Super Toners purchased for resale to customers. The cost was $22.00 per toner. The invoice number was 7959, and payment is required in 30 days. Transaction 11: December 17: Byte was informed that Mr. Madoff who has an account with the company will never pay the $590.00 he owes. Record the transaction to write off Mr. Madoff's 11 accounts receivable account using the allowance method. 12 Transaction 12: December 17: Byte received invoice number 26354 in the amount of $725.00 from the local newspaper for advertising. 13 Transaction 13: December 18: Check #6004 was issued to pay Accounts Payable in the amount of $1,120.00. 14 Transaction 14: December 19: Byte sold 6 Super toners to a customer on account for $57.00 each. The sales order number was 12101. 15 Transaction 15: December 19: Byte records the cost of the 6 Super Toners sold using FIFO. The sales order number was 12101. 16 Transaction 16: December 21: Byte received an emailed invoice in the amount of $6,400.00 for computers that were drop shipped and received today. 17 Transaction 17: December 21: Byte billed various miscellaneous local customers $12,800.00 for computers that were delivered today. 18 Transaction 18: December 21: Record the cost of the computers that were sold today. 19 Transaction 19: December 22: Check #6005 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) 20 Transaction 20: December 22: Byte received a bill for $1,265.00 from Computer Parts and Repair Co. for repairs to the computer equipment. The invoice number was 43254. 21 Transaction 21: December 22: Check #6006 was issued to pay the advertising bill that was previously received and recorded from the local newspaper for advertising, invoice number 26354. 22 Transaction 22: December 22: Byte received 12 Super Toners purchased for resale to customers. The cost was $24.00 per toner. The invoice number was 8988, and payment is required in 30 days. 23 Transaction 23: 12/23: Byte received $21,575 from customers billed when they received delivery. 24 Transaction 24: December 23: Byte received an emailed invoice in the amount of $7,650.00 for computers that were drop shipped and received today. 25 Transaction 25: December 28: Byte billed various miscellaneous local customers $15,300.00 for computers that were delivered today. 26 Transaction 26: December 28: Record the cost of the computers that were sold today. 27 Transaction 27: December 28: Byte paid the bill that was previously received and recorded from Computer Parts and Repairs Co with Check #6007. The invoice number was 43254. 28 Transaction 28: 12/29: Byte received $14,750 from customers billed when they received delivery. 29 Transaction 29: December 29: Byte received a bill for the amount of $680.00 from AT&T for the telephone and internet access. The invoice number was 784537. Transaction 30: December 30: Check#6008 was issued to pay salaries of $2,000.00 to equipment operators. (Ignore payroll taxes at this time.) 30 Innnn 31 Transaction 31: December 30: Check #6009 was issued to pay a cash dividend of $.65 per share to Lauryn, a shareholder of Byte. 32 Transaction 32: December 30: Check #6010 was issued to pay a cash dividend of $.65 per share to a shareholder of Byte. 33 Transaction 33: December 30: Byte received a $7,965.00 check from Corporation for merchandise ordered which will be delivered in January. 34 Transaction 34: 12/30: A $900 ping pong table for the office was ordered from GameWorld. 35 Transaction 35: 12/31: The Ping Pong table was canceled within the cancelation period. 36 Transaction 36:12/31: Check #6012 was issued to pay $680 to AT&T for telephone & internet access. 37 Transaction 37: The cash received and deposited from customers was $14,775.00 not the $14,750.00 orignially recorded. 38 Transaction 38: A physical inventory showed that only $526.00 worth of supplies remained on hand as of December 31. 39 Transaction 39: The interest on the note for the Ricoh Color Copier will be paid every six months. Record the December accrued interest on the note payable for the Ricoh purchased on December 1. 40 Transaction 40: Record a journal entry to reflect that one-half month's insurance has expired. 41 Transaction 41: A review of Byte's emails indicated that they received an invoice in the amount of $3,125.00 for computers that were drop shipped and received on December 28. 42 Transaction 42: Bill various miscellaneous customers 200% of the cost of the computers that were drop shipped and received on December 28. 43 Transaction 43: Record the cost of the computers that were sold on December 28. Transaction 44: The computer equipment on the Post Closing Trial Balance from last year was purchased last January for $20,000.00. It is being depreciated based upon an estimated useful life of 44 5.0 years with no salvage value. Calculate the depreciation for one year using the straight-line method of depreciation. copies were made. Mgt has decided that assets purchased during a month are treated as if purchased on the 1st day of the month. Calculate the depreciation for 1 month using the straight-line 45 method of depreciation. Transaction 46: The remaining office equipment, $62,100.00, was purchased last January and has an estimated useful life of 10.0 years with a salvage value of $3,100.00. Calculate the depreciation 46 for one year using the straight-line method of depreciation. 47 Transaction 47: A review of Byte's payroll records show that unpaid salaries in the amount of $1,200.00 are owed by Byte for three days, December 28 -31. (Ignore payroll taxes at this time.) 48 Transaction 48: Byte's CPA indicated that the Allowance for Doubtful Accounts should be increased by 5.00% of the ending balance of the Accounts Receivable account. Transaction 49: Byte's income taxes are to be computed @ rate of 25% of net income before taxes. 49 [IMPORTANT NOTE: Since the income taxes are a percent of the net income, you will want to prepare the Income Statement through the Net Income Before Tax line.] 50 Transaction 50: Close the revenue account Transaction 51: Close the expense accounts 51 52 A Byte of Accounting, Inc. Trial Balance As of November 30, 2019 Unadjusted Trial Balance Debit Credit 56,975.00 26,000.00 $ 600.00 2,400.00 2,700.00 62,100.00 5,900.00 Account Number Name 1110 Cash 1120 Accounts Receivable 1121 Allowance for Doubtful Accounts 1130 Prepaid Insurance 1140 Prepaid Rent 1150 Supplies 1160 Inventory 1211 Office Equipment 1212 Accum. Depr.-Office Equip. 1311 Computer Equipment 1312 Accum. Depr.-Computer Equip. 2101 | Accounts Payable 2102 Unearned Revenue 2103 Interest Payable 2105 Salaries and Wages Payable 2106 Income Taxes Payable 2202 Notes Payable 3100 Common Stock 3120 Paid-In Capital in Excess of Par 3200 Retained Earnings 3300 Dividends 20,000.00 4,000.00 3,665.00 41,800.00 17,600.00 24,000.00 420,000.00 26,400.00 88,000.00 3,960.00 13,640.00 4100 Sales Revenue 5010 Rent Expense 5020 Salaries and Wages Expense 5030 Advertising Expense 5040 Maintenance & Repairs Expense 5080 Supplies Expense 5090 Interest Expense 5100 Insurance Expense 5110 Depreciation Expense 5120 Bad Debt Expense 5140 Telephone and Internet Expense 5150 Income Tax Expense 5300 Cost of Goods Sold Total 5,390.00 210,000.00 517,565.00 517,565.00